California Schedule P 541 2024-2026

What is the California Schedule P 541

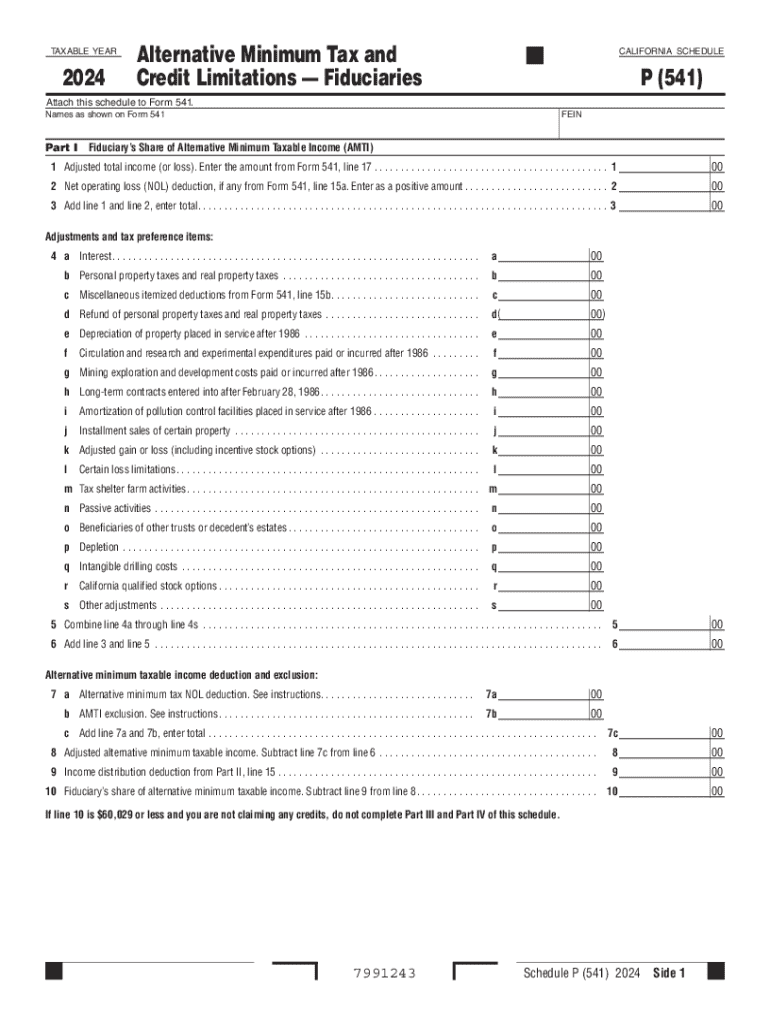

The California Schedule P (541) is a tax form specifically designed for fiduciaries, such as estate executors or trustees, to report income, deductions, and credits on behalf of estates and trusts. This form is essential for ensuring compliance with California tax laws and is used to calculate the taxable income of the estate or trust. The Schedule P (541) allows fiduciaries to report various types of income, including interest, dividends, and capital gains, while also detailing any applicable deductions. Understanding this form is crucial for fiduciaries to fulfill their tax obligations accurately.

How to use the California Schedule P 541

Using the California Schedule P (541) involves several key steps. First, fiduciaries must gather all necessary financial documents related to the estate or trust, including income statements and records of expenses. Next, they should carefully fill out the form, ensuring that all income sources are reported accurately and that deductions are applied correctly. It is important to follow the instructions provided with the form to avoid errors. Once completed, the Schedule P (541) must be submitted along with the California fiduciary income tax return, Form 541, to the California Franchise Tax Board by the specified deadline.

Steps to complete the California Schedule P 541

Completing the California Schedule P (541) requires a systematic approach. Start by collecting all relevant financial information, including income from various sources and any deductible expenses. Follow these steps:

- Begin with the identification section, entering the name and taxpayer identification number of the estate or trust.

- Report all income types, including interest, dividends, and capital gains, in the appropriate sections.

- Detail any deductions, such as administrative expenses or distributions to beneficiaries.

- Calculate the total taxable income by subtracting the total deductions from the total income.

- Review the form thoroughly for accuracy before submission.

Legal use of the California Schedule P 541

The California Schedule P (541) is legally required for fiduciaries managing estates and trusts that generate taxable income. Proper completion and submission of this form ensure compliance with California tax laws, helping to avoid potential penalties for non-compliance. Fiduciaries must understand the legal implications of the information reported, as inaccuracies can lead to audits or legal challenges. It is advisable for fiduciaries to consult with tax professionals to navigate the complexities of tax reporting for estates and trusts.

Filing Deadlines / Important Dates

Filing deadlines for the California Schedule P (541) align with the overall tax deadlines for fiduciaries. Typically, the form must be submitted by the fifteenth day of the fourth month following the close of the taxable year. For estates and trusts operating on a calendar year, this means the deadline is April 15. It is essential to keep track of these dates to avoid late filing penalties. Additionally, extensions may be available, but they must be requested in a timely manner to ensure compliance.

Who Issues the Form

The California Schedule P (541) is issued by the California Franchise Tax Board (FTB). The FTB is responsible for administering California's income tax laws and ensures that fiduciaries comply with tax reporting requirements. The form can be obtained directly from the FTB's website or through authorized tax preparation software. It is important for fiduciaries to use the most current version of the form to ensure compliance with any updates to tax laws.

Create this form in 5 minutes or less

Find and fill out the correct california schedule p 541

Create this form in 5 minutes!

How to create an eSignature for the california schedule p 541

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California Schedule P 541?

California Schedule P 541 is a tax form used by partnerships to report income, deductions, and credits. It is essential for ensuring compliance with California tax regulations. Understanding this form is crucial for businesses operating in California.

-

How can airSlate SignNow help with California Schedule P 541?

airSlate SignNow simplifies the process of preparing and signing California Schedule P 541 by providing an intuitive platform for document management. Users can easily create, send, and eSign their tax documents, ensuring accuracy and compliance. This streamlines the workflow for businesses during tax season.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger enterprises. Each plan provides access to essential features for managing documents, including those related to California Schedule P 541. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking of document status. These features are particularly beneficial for managing California Schedule P 541 and other tax-related documents. The platform enhances efficiency and reduces the risk of errors.

-

Is airSlate SignNow compliant with California tax regulations?

Yes, airSlate SignNow is designed to comply with California tax regulations, including those related to California Schedule P 541. The platform ensures that all documents are securely stored and can be easily accessed for audits or reviews. This compliance helps businesses maintain their credibility with tax authorities.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, including accounting and tax preparation tools. This allows for seamless data transfer and management of California Schedule P 541 and other documents. Integrating with your existing systems enhances productivity and reduces manual entry.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including California Schedule P 541, provides numerous benefits such as increased efficiency, reduced turnaround time, and enhanced security. The platform allows for easy collaboration among team members and ensures that all documents are signed and stored securely. This leads to a smoother tax filing process.

Get more for California Schedule P 541

Find out other California Schedule P 541

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online