Schedule P 541 Form 2011

What is the Schedule P 541 Form

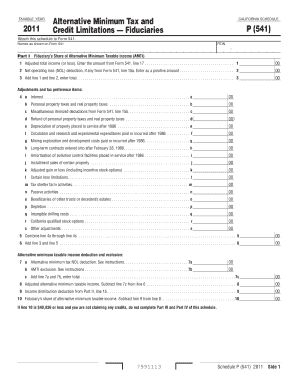

The Schedule P 541 Form is a tax document used by individuals and businesses in the United States to report income and expenses related to partnerships. This form is essential for ensuring accurate tax reporting and compliance with federal and state tax regulations. It helps taxpayers detail their share of partnership income, deductions, and credits, which are then used to calculate their overall tax liability. Understanding the purpose of this form is crucial for anyone involved in a partnership structure.

How to use the Schedule P 541 Form

Using the Schedule P 541 Form involves several key steps that ensure proper completion and submission. First, gather all necessary financial documents, including partnership agreements, income statements, and expense records. Next, accurately fill out the form by entering your share of the partnership's income, deductions, and credits. It's important to follow the instructions provided with the form carefully to avoid errors. Once completed, the form must be submitted along with your tax return to the appropriate tax authority.

Steps to complete the Schedule P 541 Form

Completing the Schedule P 541 Form requires a systematic approach. Start by downloading the form from the IRS website or obtaining it from your tax professional. Follow these steps:

- Enter your personal information, including your name, address, and Social Security number.

- Report your share of the partnership's income, ensuring to include all relevant sources.

- List any deductions you are eligible for, such as business expenses and contributions.

- Calculate your total income and deductions to determine your taxable income.

- Review the form for accuracy before submission.

Legal use of the Schedule P 541 Form

The Schedule P 541 Form must be completed and submitted in accordance with U.S. tax laws to ensure its legal validity. This includes adhering to regulations set forth by the IRS regarding the reporting of partnership income and expenses. Using electronic tools like e-signature solutions can enhance the legal standing of the form, provided they comply with the ESIGN Act and UETA. It's essential to maintain accurate records and documentation to support the information reported on the form.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule P 541 Form are critical for compliance. Typically, the form must be submitted by the due date of your tax return, which is usually April 15 for individual taxpayers. If you are filing for a partnership, the deadline may vary based on the partnership's tax year. It's advisable to check the IRS guidelines for specific dates each tax year, as extensions may also apply under certain circumstances.

Who Issues the Form

The Schedule P 541 Form is issued by the Internal Revenue Service (IRS). The IRS is responsible for providing the necessary forms and guidelines for taxpayers to report their income and expenses accurately. This ensures that all individuals and businesses comply with federal tax laws. Taxpayers can access the form directly from the IRS website or through authorized tax professionals.

Quick guide on how to complete schedule p 541 form

Finish Schedule P 541 Form seamlessly on any gadget

Digital document organization has gained traction among businesses and individuals alike. It presents a fantastic eco-friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate form and securely archive it online. airSlate SignNow supplies you with all the necessary tools to generate, alter, and electronically sign your documents promptly without hindrances. Manage Schedule P 541 Form on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to adjust and electronically sign Schedule P 541 Form without any hassle

- Find Schedule P 541 Form and click on Get Form to begin.

- Employ the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, by email, SMS, or invite link, or download it to your computer.

Forget about absent or lost documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Adjust and electronically sign Schedule P 541 Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule p 541 form

Create this form in 5 minutes!

How to create an eSignature for the schedule p 541 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule P 541 Form?

The Schedule P 541 Form is an important document used for reporting and calculating personal income tax for specific entities in compliance with tax regulations. Understanding this form is essential for businesses as it affects their financial reporting and tax obligations. airSlate SignNow simplifies the process of preparing and submitting the Schedule P 541 Form with its user-friendly eSignature features.

-

How can airSlate SignNow help with the Schedule P 541 Form?

airSlate SignNow allows users to prepare, send, and eSign the Schedule P 541 Form efficiently. With its intuitive interface, you can easily add your documents and collect signatures securely. This streamlines the often complex process of tax filing, making it quick and hassle-free.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans designed to suit different business needs. Whether you're a solo entrepreneur or part of a larger organization, you can choose a plan that allows you to manage documents like the Schedule P 541 Form effectively. Explore our competitive pricing to find the best option for your document management.

-

Is airSlate SignNow compliant with tax regulations for the Schedule P 541 Form?

Yes, airSlate SignNow is compliant with federal and state regulations, ensuring that your eSigned documents, including the Schedule P 541 Form, meet legal standards. Our platform safeguards your data and maintains compliance with eSignature laws, giving you confidence in your tax documentation.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time notifications that enhance document management efficiency for the Schedule P 541 Form. With these tools, you can streamline the signing process and ensure that all parties are kept in the loop, enhancing overall productivity.

-

Can I integrate airSlate SignNow with other software for handling the Schedule P 541 Form?

Absolutely! airSlate SignNow seamlessly integrates with various software applications used in accounting and tax preparation, enabling you to streamline the handling of the Schedule P 541 Form. This integration allows for easy data transfer and enhances collaboration between teams, ensuring a smooth workflow.

-

What are the benefits of using airSlate SignNow for the Schedule P 541 Form?

Using airSlate SignNow for the Schedule P 541 Form provides numerous benefits, including faster turnaround times and reduced paperwork. Our platform enhances the accuracy of your submissions and minimizes errors that can occur with manual processes. This makes airSlate SignNow not only a time-saving solution but also a cost-effective one.

Get more for Schedule P 541 Form

Find out other Schedule P 541 Form

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking