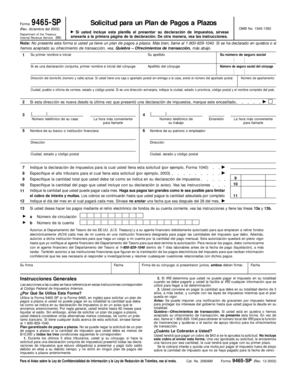

Form 9465 SP Rev Diciembre Del

What is the Form 9465?

The Form 9465, officially known as the Installment Agreement Request, is a tax form used by individuals to request a monthly installment plan for paying federal income tax owed to the IRS. This form is essential for taxpayers who cannot pay their tax liability in full by the due date. By submitting Form 9465, taxpayers can propose a payment plan that allows them to settle their tax debt over time, making it more manageable.

How to use the Form 9465

To use Form 9465 effectively, taxpayers should first determine their eligibility for an installment agreement. This typically includes having a tax liability that can be paid in installments and not having filed for bankruptcy. Once eligibility is confirmed, the form can be filled out with relevant personal and financial information. Taxpayers must specify the amount they can pay each month and provide details about their financial situation. After completing the form, it should be submitted to the IRS along with any required fees.

Steps to complete the Form 9465

Completing Form 9465 involves several key steps:

- Gather necessary information, including your Social Security number, tax return details, and financial information.

- Fill out the form, indicating your proposed monthly payment and the total amount owed.

- Review the form for accuracy, ensuring all information is correct and complete.

- Sign and date the form to validate your request.

- Submit the form to the IRS, either electronically or by mail, depending on your preference.

Legal use of the Form 9465

Form 9465 is legally binding once submitted and accepted by the IRS. By signing the form, taxpayers agree to the terms of the installment agreement, which includes making timely payments as specified. Failure to adhere to the agreement can result in penalties, including the IRS taking collection actions. Therefore, it is crucial for taxpayers to understand their obligations under the agreement and ensure they can meet the proposed payment schedule.

Filing Deadlines / Important Dates

When using Form 9465, it is important to be aware of specific filing deadlines. Generally, the form should be submitted by the tax payment due date to avoid penalties. If a taxpayer is filing for an extension, they should still submit Form 9465 by the original due date of the tax return. Additionally, timely payments must be made according to the terms of the installment agreement to maintain compliance.

Eligibility Criteria

To qualify for an installment agreement using Form 9465, taxpayers must meet certain eligibility criteria. These include:

- Having a tax liability that is not currently being disputed.

- Not being in bankruptcy proceedings.

- Owing less than a specified amount, which can vary based on the IRS guidelines.

- Being able to propose a reasonable monthly payment based on their financial situation.

Form Submission Methods

Form 9465 can be submitted to the IRS through various methods. Taxpayers have the option to file the form electronically using IRS e-file services or submit a paper form by mail. When filing electronically, taxpayers may receive quicker processing times. If submitting by mail, it is advisable to send the form via certified mail to ensure it is received and to keep a record of the submission.

Quick guide on how to complete form 9465

Effortlessly Prepare form 9465 on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the features needed to create, edit, and electronically sign your documents swiftly without delays. Manage form 9465 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The Simplest Method to Edit and Electronically Sign form 9465 with Ease

- Locate form 9465 and click Get Form to begin.

- Make use of the instruments we offer to fill out your form.

- Select important sections of the documents or conceal sensitive content using tools available through airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information thoroughly and then select the Done button to save your modifications.

- Decide how you wish to send your form – via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, the hassle of searching for forms, or errors that require reprinting new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign form 9465 to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 9465

Create this form in 5 minutes!

How to create an eSignature for the form 9465

How to generate an eSignature for the Form 9465 Sp Rev Diciembre Del 2003 online

How to create an electronic signature for the Form 9465 Sp Rev Diciembre Del 2003 in Chrome

How to generate an electronic signature for putting it on the Form 9465 Sp Rev Diciembre Del 2003 in Gmail

How to create an eSignature for the Form 9465 Sp Rev Diciembre Del 2003 from your smartphone

How to make an eSignature for the Form 9465 Sp Rev Diciembre Del 2003 on iOS

How to create an electronic signature for the Form 9465 Sp Rev Diciembre Del 2003 on Android devices

People also ask form 9465

-

What is form 9465 and how can airSlate SignNow help with it?

Form 9465 is the IRS form used to request a monthly installment agreement for tax payments. With airSlate SignNow, you can easily fill, sign, and send your form 9465 electronically, streamlining the process and ensuring your requests are handled efficiently.

-

Is airSlate SignNow compliant with IRS regulations for form 9465?

Yes, airSlate SignNow complies with IRS regulations for submitting forms like the form 9465. Our platform ensures that all documents are securely signed and can be submitted according to IRS guidelines, providing peace of mind for users.

-

What are the pricing options for using airSlate SignNow with form 9465?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features for handling form 9465 submissions, making it a cost-effective solution for both individuals and businesses alike.

-

Can I integrate airSlate SignNow with other applications for managing form 9465?

Absolutely! airSlate SignNow supports integrations with numerous popular applications, allowing you to manage form 9465 alongside your existing tools. This enhances efficiency and streamlines your workflow.

-

What features make airSlate SignNow ideal for submitting form 9465?

airSlate SignNow provides features like eSigning, document storage, and real-time notifications that make submitting form 9465 simple and efficient. These capabilities ensure you can complete your tax agreements quickly and easily.

-

How does airSlate SignNow enhance the eSigning process for form 9465?

airSlate SignNow enhances the eSigning process for form 9465 by providing an intuitive interface and quick access to signing features. This simplicity reduces the time it takes for you to finalize your form 9465 and submit it.

-

Is customer support available for inquiries regarding form 9465 on airSlate SignNow?

Yes, airSlate SignNow offers comprehensive customer support to assist users with inquiries about form 9465. Our support team is dedicated to ensuring you have all the resources you need for a smooth experience.

Get more for form 9465

- Publication 3007 rev 1 form

- Form 1120 w estimated tax for corporations for calendar year or tax year beginning and ending 20 omb no

- Publication 4303 rev 03 a donors guide to car donations form

- Publication 3211 engsp rev 10 form

- 1040a note this booklet does not contain tax forms instructions explore all electronic filing and payment options including file

- Instructions for form 706 d rev october instructions for form 706 d united states additional estate tax return under code

- October for use with form 941 rev

- Instructions for form 1099 h section references are to the internal revenue code unless otherwise noted

Find out other form 9465

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online