Application for Homestead 2 Etax Dor Ga Form

What is the Application for Homestead 2 eTax DOR GA?

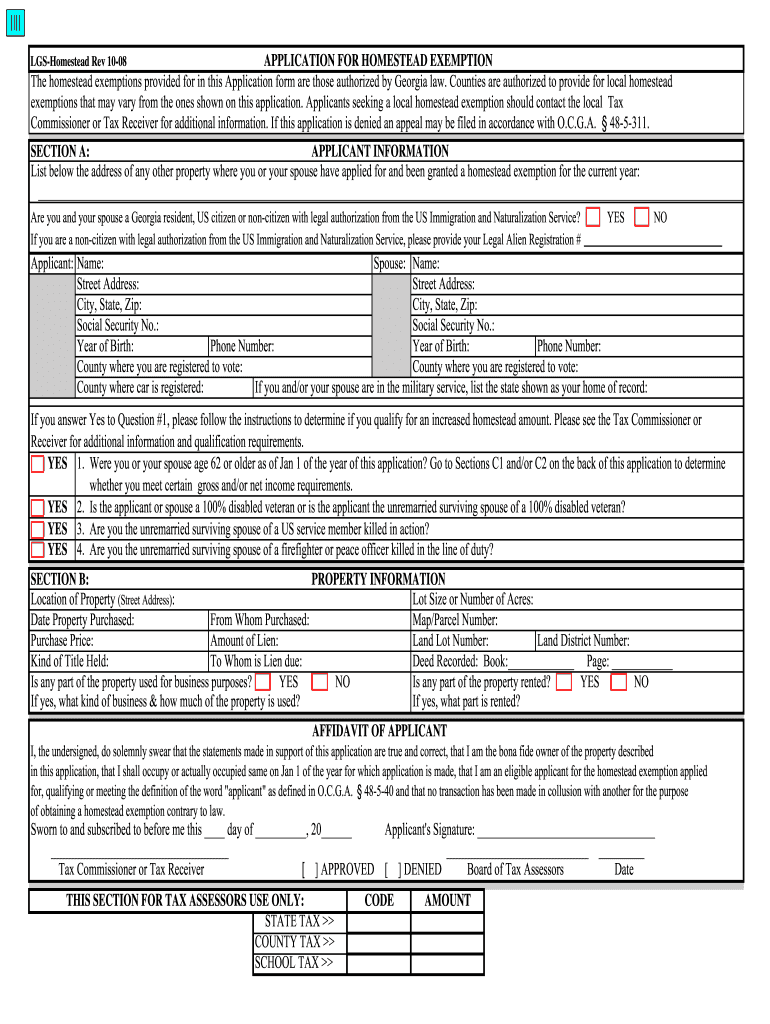

The Application for Homestead 2 eTax DOR GA is a crucial form for homeowners in Georgia seeking to apply for a homestead exemption. This exemption can significantly reduce property taxes for eligible homeowners by providing a reduction in the assessed value of their property. Understanding the specifics of this application is essential for maximizing tax benefits. The form is specifically designed for those who meet the eligibility criteria, including primary residency requirements and income limitations.

Eligibility Criteria for the Homestead Exemption

To qualify for the Georgia tax homestead exemption, applicants must meet several key eligibility criteria. Homeowners must occupy the property as their primary residence as of January first of the tax year. Additionally, applicants should not have a gross income exceeding the limits set by the state, which may vary annually. Certain categories of homeowners, such as seniors or disabled individuals, may also have additional exemptions available, enhancing their potential tax savings.

Steps to Complete the Application for Homestead 2 eTax DOR GA

Filling out the Application for Homestead 2 eTax DOR GA involves several straightforward steps. First, gather all necessary documentation, including proof of residency and income statements. Next, complete the application form, ensuring that all information is accurate and complete. After filling out the form, submit it to the appropriate county tax office. It is advisable to check with local authorities for any specific submission guidelines or additional requirements.

Required Documents for Submission

When applying for the homestead exemption, certain documents are typically required to support your application. These may include:

- Proof of residency, such as a utility bill or lease agreement.

- Income verification documents, including tax returns or pay stubs.

- A copy of the property deed or mortgage statement.

Ensuring that all required documents are included with your application can facilitate a smoother approval process.

Form Submission Methods

The Application for Homestead 2 eTax DOR GA can be submitted through various methods. Homeowners may choose to submit their application online through the Georgia Department of Revenue's eTax system, which offers a convenient digital option. Alternatively, applications can be mailed directly to the county tax office or submitted in person. Each method has its advantages, and homeowners should select the one that best fits their needs.

Key Elements of the Homestead Exemption Application

The Application for Homestead 2 eTax DOR GA includes several key elements that must be completed accurately. These elements typically consist of:

- Personal information, including the homeowner's name and address.

- Details about the property, such as the parcel number and description.

- Income information to determine eligibility for the exemption.

Completing these sections thoroughly is essential for ensuring that the application is processed without delays.

Quick guide on how to complete application for homestead 2 etax dor ga

Handle Application For Homestead 2 Etax Dor Ga effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Application For Homestead 2 Etax Dor Ga on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to modify and electronically sign Application For Homestead 2 Etax Dor Ga with ease

- Find Application For Homestead 2 Etax Dor Ga and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow portions of your documents or obscure sensitive data with features that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced papers, exhausting form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Application For Homestead 2 Etax Dor Ga and ensure outstanding communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out an NDA 2 application form?

visit Welcome to UPSC | UPSCclick on apply online option their and select the ndaII option.Its in 2 parts, Fill part 1 and theirafter 2nd as guided on the website their.

Create this form in 5 minutes!

How to create an eSignature for the application for homestead 2 etax dor ga

How to create an electronic signature for the Application For Homestead 2 Etax Dor Ga online

How to make an electronic signature for the Application For Homestead 2 Etax Dor Ga in Google Chrome

How to generate an eSignature for putting it on the Application For Homestead 2 Etax Dor Ga in Gmail

How to make an eSignature for the Application For Homestead 2 Etax Dor Ga from your mobile device

How to generate an electronic signature for the Application For Homestead 2 Etax Dor Ga on iOS

How to create an eSignature for the Application For Homestead 2 Etax Dor Ga on Android OS

People also ask

-

What is the Georgia tax homestead exemption?

The Georgia tax homestead exemption is a benefit that reduces the amount of property tax owed by homeowners in Georgia. By qualifying for this exemption, homeowners can save signNowly on their property taxes, providing essential financial relief.

-

Who is eligible for the Georgia tax homestead exemption?

To be eligible for the Georgia tax homestead exemption, you must be a legal resident of Georgia and occupy the property as your primary residence. Additionally, there may be age, disability, or income qualifications that could apply depending on the specific exemption type.

-

How can I apply for the Georgia tax homestead exemption?

Applying for the Georgia tax homestead exemption is a straightforward process. Homeowners need to fill out an application form, which can typically be found on local county government websites, and submit it along with any required documentation before the deadline.

-

What documents are required for the Georgia tax homestead exemption application?

To apply for the Georgia tax homestead exemption, you may need to provide proof of residency, such as a utility bill or driver's license, along with the completed application form. Each county may have specific requirements, so it's advisable to check with local authorities.

-

When is the application deadline for the Georgia tax homestead exemption?

The application deadline for the Georgia tax homestead exemption varies by county but generally falls on April 1st for most areas. It's important to check your local county's guidelines to ensure your application is submitted on time.

-

Can I use airSlate SignNow to complete my Georgia tax homestead exemption documents?

Yes, you can use airSlate SignNow to eSign and send your Georgia tax homestead exemption documents securely. Our platform provides an easy-to-use solution to ensure your applications are completed and submitted without hassle, saving you time.

-

What benefits does the Georgia tax homestead exemption provide?

The Georgia tax homestead exemption offers substantial property tax savings for homeowners, which can improve financial stability. Additionally, qualifying for this exemption may enhance the overall affordability of owning a home in Georgia.

Get more for Application For Homestead 2 Etax Dor Ga

- Colorado department of transportation pre approved product evaluation request ampamp coloradodot form

- Evn subscription agreement form

- Dude dude dav30862 connects enrollment form pap

- M175matmesp1engtz1xx form

- Student counselling form jasmine education group jeg nsw edu

- Ffa silviculture contractor award nomination formdocx floridaforest

- Parent consent for voluntary field tripexcursion and emergency medical authorization fresnou form

- Wps medicare snf pps mds 3 form

Find out other Application For Homestead 2 Etax Dor Ga

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe