Form 01 117 Texas 2019

What is the Form 01 117 Texas

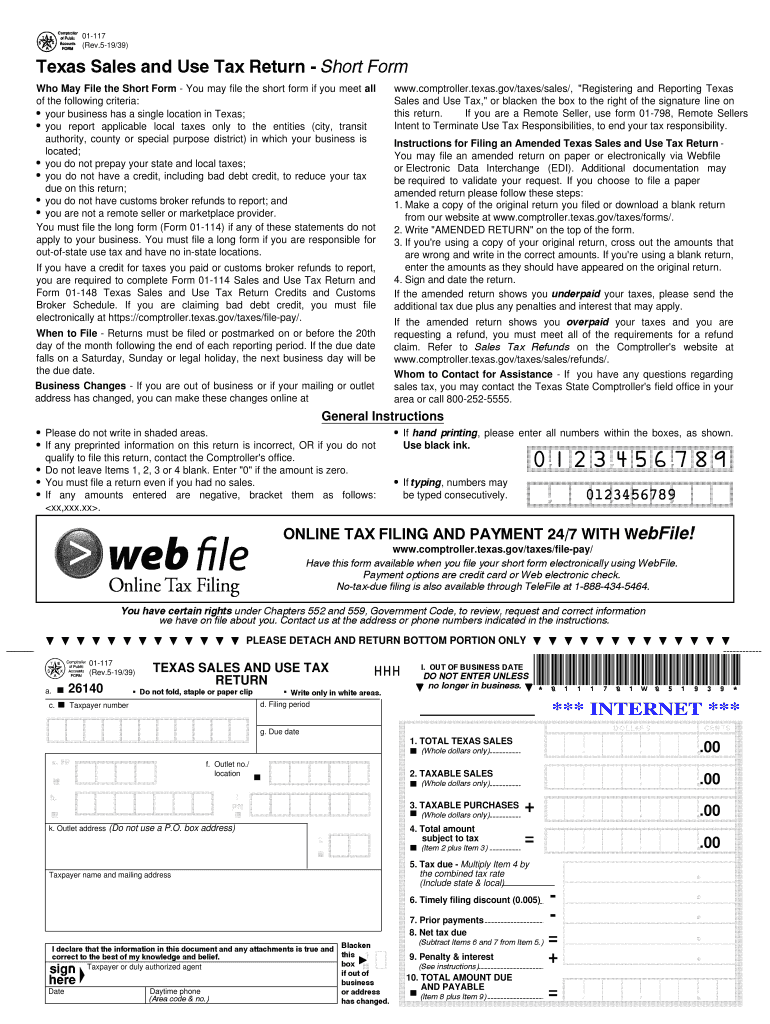

The Texas Form 01 117 is a sales tax exemption certificate used by businesses and individuals in Texas to claim exemption from sales tax on purchases. This form is essential for those who qualify for tax-exempt status under specific circumstances, such as non-profit organizations, government entities, or certain types of sales. Understanding the purpose and application of this form is crucial for ensuring compliance with Texas tax regulations.

How to use the Form 01 117 Texas

To use the Texas Form 01 117 effectively, the individual or business must complete the form accurately, providing all required information, including the purchaser's name, address, and the reason for the exemption. After filling out the form, it should be presented to the seller at the time of purchase. This allows the seller to validate the exemption and avoid charging sales tax on the transaction. It is important to retain a copy of the completed form for record-keeping and compliance purposes.

Steps to complete the Form 01 117 Texas

Completing the Texas Form 01 117 involves several key steps:

- Begin by entering the purchaser's name and address in the designated fields.

- Indicate the reason for the exemption by selecting the appropriate category from the provided options.

- Include the seller's name and address to ensure clarity in the transaction.

- Sign and date the form to certify that the information provided is accurate and truthful.

- Make a copy of the completed form for your records before submitting it to the seller.

Legal use of the Form 01 117 Texas

The legal use of the Texas Form 01 117 is governed by state tax laws. This form must be used only by eligible purchasers who meet the criteria for tax exemption. Misuse of the form, such as providing false information or using it for ineligible purchases, can result in penalties, including fines and back taxes owed. It is essential to understand the legal implications and ensure that the form is used appropriately to maintain compliance with Texas tax regulations.

Key elements of the Form 01 117 Texas

The Texas Form 01 117 includes several key elements that are essential for its validity:

- Purchaser Information: Name and address of the individual or organization claiming the exemption.

- Seller Information: Name and address of the seller where the purchase is being made.

- Reason for Exemption: A clear indication of the category under which the exemption is claimed.

- Signature and Date: The form must be signed and dated by the purchaser to validate the exemption claim.

Who Issues the Form

The Texas Form 01 117 is not issued by a specific agency but is a standardized form provided by the Texas Comptroller of Public Accounts. Businesses and individuals can obtain this form from the Comptroller's official website or through authorized tax professionals. It is important to ensure that the most current version of the form is used to comply with Texas tax regulations.

Quick guide on how to complete located

Effortlessly Prepare Form 01 117 Texas on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Form 01 117 Texas from any device with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The Easiest Method to Alter and eSign Form 01 117 Texas

- Obtain Form 01 117 Texas and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with the specialized tools offered by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized files, tedious form searching, or mistakes necessitating new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 01 117 Texas ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct located

Create this form in 5 minutes!

How to create an eSignature for the located

How to generate an eSignature for your Located in the online mode

How to make an eSignature for the Located in Chrome

How to generate an electronic signature for signing the Located in Gmail

How to generate an eSignature for the Located straight from your mobile device

How to make an electronic signature for the Located on iOS devices

How to make an eSignature for the Located on Android devices

People also ask

-

What is Texas Form 117?

Texas Form 117, also known as the Texas Sales and Use Tax Return, is a document used by businesses to report sales tax collected in the state of Texas. This form must be filed regularly, and airSlate SignNow can help streamline the eSigning process, ensuring your Texas Form 117 is submitted quickly and securely.

-

How can airSlate SignNow assist with Texas Form 117?

AirSlate SignNow simplifies the preparation and signing of Texas Form 117 by providing easy-to-use templates and a secure electronic signature feature. Our solution ensures that your documents are handled efficiently, which saves you time and reduces errors during submission.

-

What are the pricing plans for airSlate SignNow?

AirSlate SignNow offers several competitive pricing plans tailored to accommodate various business sizes and needs. Each plan includes essential features for managing Texas Form 117 and other documents, ensuring you find the right fit for your eSignature requirements.

-

Can I integrate airSlate SignNow with other software for Texas Form 117?

Yes, airSlate SignNow seamlessly integrates with various business applications, including accounting and tax software, enhancing your workflow for Texas Form 117. This integration allows you to manage documents and eSignatures efficiently within your existing systems.

-

What are the benefits of using airSlate SignNow for Texas Form 117?

Using airSlate SignNow for Texas Form 117 ensures faster processing times, reduced paperwork, and enhanced security for your sensitive information. Our platform allows you to send and eSign documents from anywhere, making compliance easier and more accessible for your business.

-

Is it easy to eSign Texas Form 117 using airSlate SignNow?

Absolutely! AirSlate SignNow's user-friendly interface makes it easy for anyone to eSign Texas Form 117 without any hassle. You can quickly access your documents, sign them securely, and send them off in a matter of minutes.

-

Are there any mobile capabilities for handling Texas Form 117 with airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage, eSign, and send your Texas Form 117 on the go. This flexibility ensures that you can complete your document management tasks anytime, anywhere, increasing your efficiency.

Get more for Form 01 117 Texas

Find out other Form 01 117 Texas

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online