Texas Sales Tax Short Form 2019-2026

What is the Texas Sales Tax Short Form

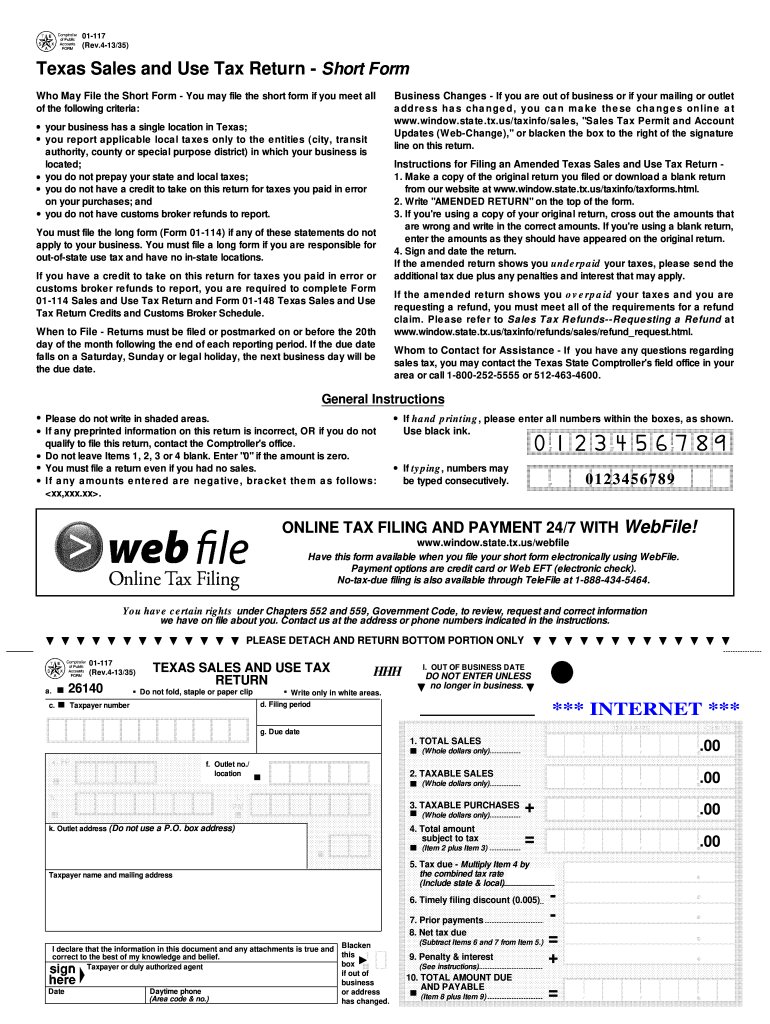

The Texas Sales Tax Short Form, also known as Form 01-117, is a simplified document used by businesses to report and remit sales and use tax to the Texas Comptroller. This form is specifically designed for smaller businesses or those with straightforward tax situations, allowing for easier compliance with state tax laws. It captures essential information regarding taxable sales, exemptions, and the total amount due. Understanding this form is crucial for maintaining compliance and avoiding potential penalties.

How to use the Texas Sales Tax Short Form

To effectively use the Texas Sales Tax Short Form, businesses should first gather all necessary sales records and documentation. This includes invoices, receipts, and any relevant exemption certificates. Once the necessary information is collected, complete the form by accurately entering total sales, exempt sales, and the tax amount owed. After filling out the form, review it for accuracy before submission to ensure compliance with Texas tax regulations.

Steps to complete the Texas Sales Tax Short Form

Completing the Texas Sales Tax Short Form involves several key steps:

- Gather all sales records, including taxable and exempt sales.

- Fill in your business information, including name, address, and taxpayer ID.

- Report total sales and any exempt sales in the designated sections.

- Calculate the total tax due based on the applicable sales tax rate.

- Sign and date the form to certify its accuracy.

Once completed, the form can be submitted online, by mail, or in person to the Texas Comptroller's office.

Legal use of the Texas Sales Tax Short Form

The Texas Sales Tax Short Form is legally binding when completed and submitted according to state regulations. It must be signed by an authorized representative of the business. Compliance with the Texas sales and use tax laws is essential to avoid penalties and interest on unpaid taxes. The form must be filed by the specified deadlines to ensure timely reporting and payment.

Filing Deadlines / Important Dates

Filing deadlines for the Texas Sales Tax Short Form vary depending on the business's reporting frequency. Most businesses are required to file monthly or quarterly, with specific due dates outlined by the Texas Comptroller. It is important to stay informed about these deadlines to avoid late fees and penalties. Regularly checking the Texas Comptroller's website can provide updates on any changes to filing schedules.

Required Documents

When completing the Texas Sales Tax Short Form, businesses should have several documents on hand:

- Sales records, including invoices and receipts.

- Exemption certificates for any exempt sales.

- Previous tax returns, if applicable, for reference.

- Any correspondence from the Texas Comptroller regarding tax obligations.

Having these documents readily available can streamline the form completion process and ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The Texas Sales Tax Short Form can be submitted through various methods:

- Online: Businesses can file electronically through the Texas Comptroller's online portal for quick processing.

- Mail: The completed form can be printed and mailed directly to the Texas Comptroller's office.

- In-Person: Businesses may also deliver the form in person at designated Comptroller locations.

Choosing the appropriate submission method can depend on the business's preferences and urgency of processing.

Quick guide on how to complete texas sales tax short form 2013

Complete Texas Sales Tax Short Form effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Handle Texas Sales Tax Short Form on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to edit and electronically sign Texas Sales Tax Short Form with ease

- Find Texas Sales Tax Short Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the features that airSlate SignNow provides for this purpose.

- Create your electronic signature with the Sign tool, which takes just moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to finalize your changes.

- Select your preferred method of sharing your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or errors necessitating the reprinting of new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Edit and electronically sign Texas Sales Tax Short Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct texas sales tax short form 2013

Create this form in 5 minutes!

How to create an eSignature for the texas sales tax short form 2013

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is Texas sales use tax?

Texas sales use tax refers to the tax imposed on the sale, use, or consumption of tangible personal property and certain services within Texas. Understanding this tax is crucial for businesses operating in the state, as compliance is necessary to avoid penalties and ensure smooth operations.

-

How can airSlate SignNow help me manage Texas sales use tax documentation?

airSlate SignNow provides an efficient way to handle documents related to Texas sales use tax. You can easily eSign tax-related documents, making the process quicker and more secure while ensuring that all necessary paperwork is accurately managed and accessible.

-

What features does airSlate SignNow offer for Texas sales use tax compliance?

airSlate SignNow offers features like customizable templates, secure eSignature capabilities, and automated workflows that streamline the preparation of documents related to Texas sales use tax compliance. These tools help ensure that your business remains compliant while reducing the time spent on paperwork.

-

Is airSlate SignNow cost-effective for small businesses handling Texas sales use tax?

Yes, airSlate SignNow is a cost-effective solution for small businesses managing Texas sales use tax. With flexible pricing plans, businesses can choose options that fit their budget while benefiting from features that simplify tax documentation and compliance.

-

Can I integrate airSlate SignNow with my existing accounting software for Texas sales use tax management?

Absolutely! airSlate SignNow offers seamless integrations with various accounting platforms, allowing for better management of Texas sales use tax. This integration ensures that your financial records remain synchronized and up-to-date, ultimately enhancing efficiency.

-

What benefits does airSlate SignNow provide for Texas sales use tax eSignatures?

Using airSlate SignNow for Texas sales use tax eSignatures provides multiple benefits, including legally binding signatures, enhanced document security, and expedited processing times. This means you can complete tax-related transactions faster and with greater peace of mind.

-

How does airSlate SignNow ensure the security of Texas sales use tax documents?

airSlate SignNow employs advanced security measures, including encryption and access controls, to ensure the safety of Texas sales use tax documents. This commitment to security helps protect sensitive tax information and builds trust with your clients and partners.

Get more for Texas Sales Tax Short Form

Find out other Texas Sales Tax Short Form

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document