Texas State Comptroller Sales Tax Form 01 117 2018

What is the Texas State Comptroller Sales Tax Form 01 117

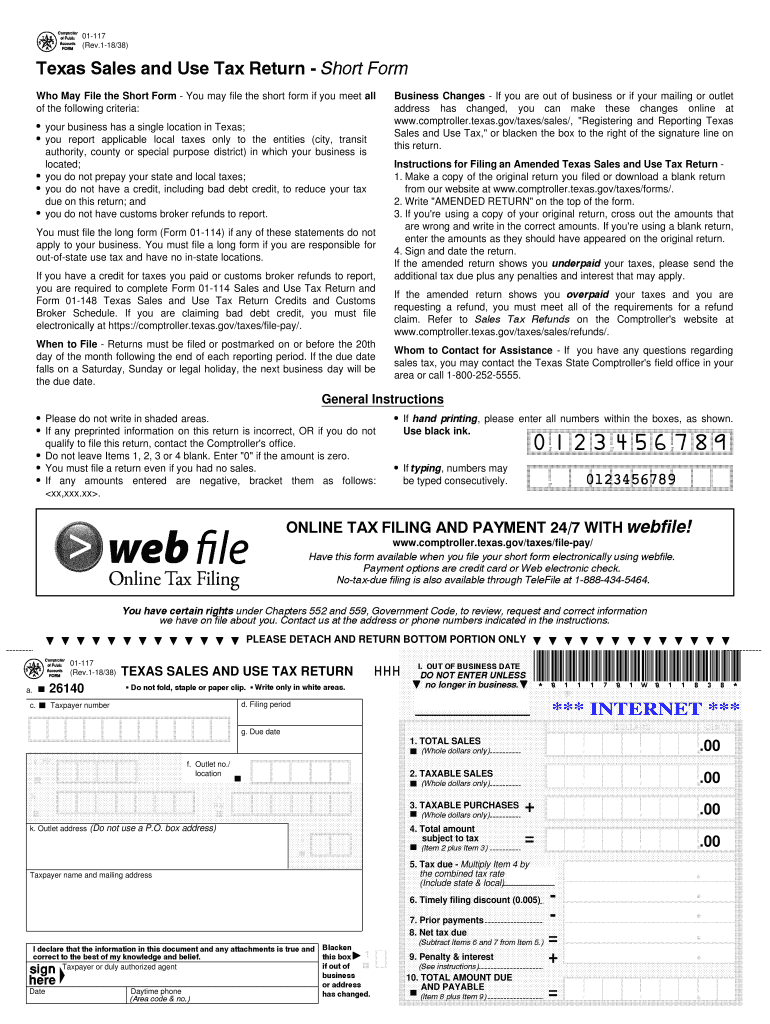

The Texas State Comptroller Sales Tax Form 01 117 is an essential document used to claim sales tax exemptions in Texas. This form is primarily utilized by businesses and individuals who qualify for tax-exempt status under specific circumstances. The form allows eligible entities to purchase goods and services without paying the associated sales tax, thereby reducing overall costs. Understanding the purpose and function of this form is crucial for those seeking to benefit from tax exemptions in Texas.

How to use the Texas State Comptroller Sales Tax Form 01 117

Using the Texas State Comptroller Sales Tax Form 01 117 involves several straightforward steps. First, ensure that you meet the eligibility criteria for tax exemption. Next, complete the form accurately, providing all required information, such as the purchaser's name, address, and the nature of the exempt purchase. Once the form is filled out, it should be presented to the seller at the time of purchase. This process helps ensure that the transaction is recorded as tax-exempt, allowing for compliance with Texas tax regulations.

Steps to complete the Texas State Comptroller Sales Tax Form 01 117

Completing the Texas State Comptroller Sales Tax Form 01 117 requires careful attention to detail. Follow these steps to ensure accuracy:

- Obtain the form from the Texas Comptroller's website or through authorized channels.

- Fill in the purchaser's information, including name, address, and contact details.

- Specify the type of exemption being claimed, such as for resale or for use in manufacturing.

- Provide a description of the items being purchased under the exemption.

- Sign and date the form to certify its accuracy.

After completing the form, retain a copy for your records and present the original to the seller during the transaction.

Legal use of the Texas State Comptroller Sales Tax Form 01 117

The legal use of the Texas State Comptroller Sales Tax Form 01 117 is governed by state tax laws. To ensure compliance, it is important to use the form only for legitimate tax-exempt purchases. Misuse of the form, such as claiming exemptions for non-qualifying purchases, can lead to penalties and fines. It is advisable to familiarize oneself with Texas tax regulations and maintain proper documentation of all exempt transactions to avoid legal complications.

Eligibility Criteria

To qualify for using the Texas State Comptroller Sales Tax Form 01 117, certain eligibility criteria must be met. Generally, the following categories may qualify for sales tax exemptions:

- Resellers who purchase goods for resale.

- Manufacturers who buy materials for production.

- Non-profit organizations that provide exempt services.

- Government entities making purchases for official use.

It is essential to review the specific requirements associated with each category to ensure compliance when claiming exemptions.

Form Submission Methods (Online / Mail / In-Person)

The Texas State Comptroller Sales Tax Form 01 117 can be submitted through various methods, depending on the preferences of the purchaser and seller. Typically, the form is presented in person at the time of purchase. However, some businesses may allow for electronic submission or faxing the completed form for record-keeping purposes. It is important to check with the seller regarding their preferred method of receiving the exemption form to ensure proper processing.

Quick guide on how to complete form 01 117 2018 2019

Your assistance manual on how to prepare your Texas State Comptroller Sales Tax Form 01 117

If you’re wondering how to finalize and submit your Texas State Comptroller Sales Tax Form 01 117, here are a few simple guidelines on how to streamline tax filing.

To begin, you just need to create your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is a user-friendly and powerful document solution that allows you to modify, generate, and complete your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and revisit to adjust information as necessary. Make your tax management easier with advanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to finish your Texas State Comptroller Sales Tax Form 01 117 in no time:

- Create your account and start working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Click Get form to access your Texas State Comptroller Sales Tax Form 01 117 in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that filing on paper may increase error rates and delay refunds. Certainly, before e-filing your taxes, check the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 01 117 2018 2019

FAQs

-

How do I fill out the educational qualification section of the assistant commandant application form in coast guard (01/2019 batch)?

U should be Bachelor of science hieght166 wt 50 and pass ur exams

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the form 01 117 2018 2019

How to create an electronic signature for your Form 01 117 2018 2019 online

How to generate an eSignature for the Form 01 117 2018 2019 in Google Chrome

How to create an electronic signature for putting it on the Form 01 117 2018 2019 in Gmail

How to generate an eSignature for the Form 01 117 2018 2019 from your mobile device

How to make an electronic signature for the Form 01 117 2018 2019 on iOS

How to create an eSignature for the Form 01 117 2018 2019 on Android OS

People also ask

-

What is the Texas State Comptroller Sales Tax Form 01 117?

The Texas State Comptroller Sales Tax Form 01 117 is a document used for reporting and remitting sales and use tax in Texas. By completing this form, businesses can ensure compliance with state tax regulations. Utilizing tools like airSlate SignNow can simplify the process of filling out and submitting the Texas State Comptroller Sales Tax Form 01 117 electronically.

-

How can airSlate SignNow help with the Texas State Comptroller Sales Tax Form 01 117?

airSlate SignNow provides a user-friendly platform for electronically signing and sending the Texas State Comptroller Sales Tax Form 01 117. This streamlined process minimizes the time spent on paperwork and helps ensure that your submissions are accurate and compliant. By leveraging our eSignature capabilities, you can improve efficiency in your tax reporting.

-

Is there a cost to use airSlate SignNow for the Texas State Comptroller Sales Tax Form 01 117?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. We provide a cost-effective solution for managing documents like the Texas State Comptroller Sales Tax Form 01 117, allowing you to choose a plan that fits your needs and budget. Our pricing includes features that enhance collaboration and document management.

-

What features does airSlate SignNow offer for managing the Texas State Comptroller Sales Tax Form 01 117?

With airSlate SignNow, you can easily create, edit, and manage the Texas State Comptroller Sales Tax Form 01 117. Key features include customizable templates, cloud storage, and real-time tracking of document status. These tools help ensure that your forms are completed accurately and submitted on time.

-

Can I integrate airSlate SignNow with my existing software for the Texas State Comptroller Sales Tax Form 01 117?

Yes, airSlate SignNow supports integrations with various software applications to enhance your workflow. You can connect our platform with accounting software and CRM systems to streamline the process of managing the Texas State Comptroller Sales Tax Form 01 117. This integration helps you maintain organized records and improves data accuracy.

-

How does airSlate SignNow ensure the security of the Texas State Comptroller Sales Tax Form 01 117?

airSlate SignNow prioritizes the security of your documents, including the Texas State Comptroller Sales Tax Form 01 117. We implement advanced encryption and secure access controls to protect sensitive information. Our compliance with industry standards ensures that your data remains safe throughout the signing and submission process.

-

What are the benefits of using airSlate SignNow for the Texas State Comptroller Sales Tax Form 01 117?

Using airSlate SignNow for the Texas State Comptroller Sales Tax Form 01 117 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. Our platform allows for quick eSigning and real-time updates, making the tax reporting process smoother. Additionally, our cost-effective solution helps businesses save time and resources.

Get more for Texas State Comptroller Sales Tax Form 01 117

Find out other Texas State Comptroller Sales Tax Form 01 117

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself