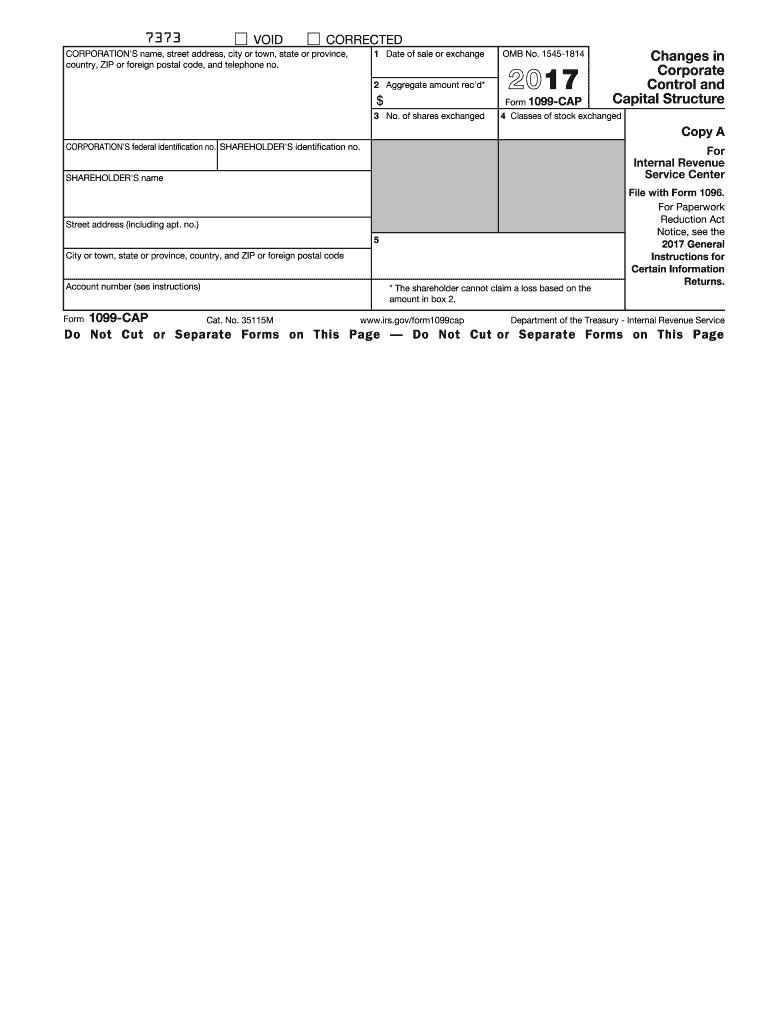

1099 Cap Form 2017

What is the 1099 Cap Form

The 1099 Cap Form is a tax document used in the United States to report certain types of income received by individuals and businesses. This form is particularly relevant for reporting non-employee compensation, which includes payments made to freelancers, independent contractors, and other non-employees. The Internal Revenue Service (IRS) mandates that this form be issued to ensure proper tax reporting and compliance. It helps both the payer and the recipient maintain accurate records of income for tax purposes.

How to use the 1099 Cap Form

Using the 1099 Cap Form involves several straightforward steps. First, gather all necessary information, including the recipient's name, address, and taxpayer identification number (TIN). Next, accurately fill out the form by entering the total amount paid to the recipient during the tax year. It is important to ensure that all information is correct to avoid penalties. Once completed, the form must be sent to the IRS and provided to the recipient by the specified deadlines.

Steps to complete the 1099 Cap Form

Completing the 1099 Cap Form requires careful attention to detail. Follow these steps:

- Obtain the correct version of the form from the IRS website or a tax software program.

- Fill in the payer's information, including name, address, and TIN.

- Enter the recipient's details, ensuring the accuracy of their name, address, and TIN.

- Report the total payments made to the recipient in the appropriate box.

- Review the form for any errors before submission.

- Submit the form to the IRS and provide a copy to the recipient by the deadline.

Legal use of the 1099 Cap Form

The legal use of the 1099 Cap Form is governed by IRS regulations. It serves as an official record of income that must be reported by both the payer and the recipient. Failure to file the form accurately and on time can result in penalties for both parties. To ensure compliance, it is essential to follow IRS guidelines and maintain thorough records of all payments made throughout the year.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Cap Form are crucial for compliance. Generally, the form must be sent to the IRS by January thirty-first of the year following the tax year in which payments were made. Additionally, a copy must be provided to the recipient by the same date. It is important to mark these dates on your calendar to avoid late filing penalties.

Who Issues the Form

The 1099 Cap Form is typically issued by businesses or individuals who have made payments to non-employees. This includes companies hiring freelancers, independent contractors, or any service providers who are not classified as employees. It is the responsibility of the payer to ensure that the form is completed accurately and submitted on time to both the IRS and the recipient.

Quick guide on how to complete 2017 1099 cap form

Effortlessly prepare 1099 Cap Form on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute to conventional printed and signed papers, as you can obtain the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, alter, and eSign your documents quickly without any hold-ups. Manage 1099 Cap Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to edit and eSign 1099 Cap Form effortlessly

- Obtain 1099 Cap Form and click on Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the document or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to confirm your changes.

- Select your method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign 1099 Cap Form to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 1099 cap form

Create this form in 5 minutes!

How to create an eSignature for the 2017 1099 cap form

How to create an eSignature for your 2017 1099 Cap Form online

How to create an electronic signature for the 2017 1099 Cap Form in Chrome

How to generate an eSignature for signing the 2017 1099 Cap Form in Gmail

How to generate an eSignature for the 2017 1099 Cap Form straight from your smartphone

How to make an electronic signature for the 2017 1099 Cap Form on iOS devices

How to create an electronic signature for the 2017 1099 Cap Form on Android devices

People also ask

-

What is a 1099 Cap Form and why do I need it?

The 1099 Cap Form is an essential document used for tax reporting purposes, specifically for reporting payments made to independent contractors. Using airSlate SignNow to manage your 1099 Cap Form ensures that you can eSign and send these important documents quickly and securely, minimizing the risk of errors.

-

How does airSlate SignNow simplify the 1099 Cap Form process?

airSlate SignNow simplifies the 1099 Cap Form process by allowing users to easily create, edit, and eSign documents online. This reduces the need for paper forms and streamlines your workflow, making it more efficient for tracking payments and submissions during tax season.

-

What features does airSlate SignNow offer for handling 1099 Cap Forms?

airSlate SignNow offers features such as custom templates, real-time tracking of document status, and automated reminders to ensure that your 1099 Cap Form is completed and submitted on time. Additionally, the platform allows for secure storage and easy retrieval of signed documents.

-

Is there a pricing plan for using airSlate SignNow for 1099 Cap Forms?

Yes, airSlate SignNow provides several pricing plans to accommodate different business needs, including plans specifically designed for managing tax forms like the 1099 Cap Form. You can choose from various tiers based on features and the number of users, allowing you to find a cost-effective solution.

-

Can I integrate airSlate SignNow with other software for 1099 Cap Form management?

Absolutely! airSlate SignNow integrates seamlessly with many popular software solutions, including accounting and bookkeeping platforms. This integration allows for effortless import and export of data related to your 1099 Cap Form, ensuring better data management and efficiency.

-

What are the benefits of using airSlate SignNow for 1099 Cap Forms?

Using airSlate SignNow for your 1099 Cap Forms offers numerous benefits, including improved security for sensitive tax information, faster processing times, and enhanced collaboration features. These advantages make it a powerful tool for businesses looking to streamline their tax documentation.

-

How secure is airSlate SignNow for managing my 1099 Cap Form?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. Your 1099 Cap Form and other sensitive documents are protected throughout the entire signing process, ensuring that your data remains confidential and secure.

Get more for 1099 Cap Form

- Bvi fishing license application online form

- Oklahoma disablility hunting permit form

- Flathead indian reservation recreation permit form

- Declaration for multi day fishing trip form

- Icg hunting waiver form

- Online permit for deer nebr form

- Application for nebraska master angler form

- Form 7210 clean hydrogen production credit

Find out other 1099 Cap Form

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template