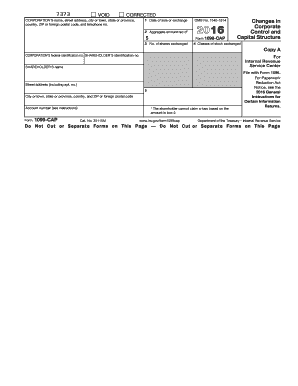

Form 1099 CAP Internal Revenue Service Irs 2016

What is the Form 1099 CAP Internal Revenue Service Irs

The Form 1099 CAP is an important tax document issued by the Internal Revenue Service (IRS) in the United States. It is specifically designed for reporting certain types of income that are not typically reported on traditional wage and salary forms. This form is used primarily by corporations and partnerships to report capital gains distributions made to shareholders or partners. Understanding the purpose of this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Form 1099 CAP Internal Revenue Service Irs

Using the Form 1099 CAP involves several steps to ensure proper completion and submission. First, you need to gather all relevant financial information regarding the capital gains distributions made during the tax year. This includes details about the recipients, the amounts distributed, and any applicable tax withholdings. Once you have this information, you can fill out the form accurately, ensuring that all required fields are completed. After completing the form, it must be submitted to the IRS by the designated deadline, along with copies sent to the recipients.

Steps to complete the Form 1099 CAP Internal Revenue Service Irs

Completing the Form 1099 CAP requires careful attention to detail. Follow these steps for accurate completion:

- Gather all necessary information about the capital gains distributions, including recipient names, addresses, and tax identification numbers.

- Fill out the form, ensuring that each section is completed accurately. This includes reporting the total amount of capital gains distributed.

- Check for accuracy, as errors can lead to penalties or delays in processing.

- Submit the completed form to the IRS by the deadline, typically by the end of February for paper submissions or March for electronic submissions.

- Provide copies of the form to each recipient by the same deadline to ensure compliance.

Legal use of the Form 1099 CAP Internal Revenue Service Irs

The legal use of the Form 1099 CAP is governed by IRS regulations. It is essential for businesses to accurately report capital gains distributions to avoid penalties. The form serves as a record for both the issuer and the recipient, ensuring that income is reported correctly on tax returns. Additionally, compliance with IRS guidelines helps maintain transparency and accountability in financial reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 CAP are critical for compliance. Typically, the form must be submitted to the IRS by February twenty-eight for paper filings and by March thirty-one for electronic submissions. Recipients should also receive their copies by the same deadlines. Staying informed about these dates helps prevent late filing penalties and ensures timely processing of tax documents.

Penalties for Non-Compliance

Failure to comply with the requirements for the Form 1099 CAP can result in significant penalties. The IRS imposes fines for late filings, incorrect information, or failure to provide copies to recipients. The penalties can vary based on the length of the delay and the size of the business. Understanding these potential consequences is essential for businesses to maintain compliance and avoid unnecessary financial burdens.

Quick guide on how to complete 2016 form 1099 cap internal revenue service irs

Complete Form 1099 CAP Internal Revenue Service Irs effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without delays. Manage Form 1099 CAP Internal Revenue Service Irs on any device using airSlate SignNow's Android or iOS apps and enhance any document-related process today.

How to modify and electronically sign Form 1099 CAP Internal Revenue Service Irs with ease

- Locate Form 1099 CAP Internal Revenue Service Irs and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive data with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, monotonous form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 1099 CAP Internal Revenue Service Irs to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 1099 cap internal revenue service irs

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 1099 cap internal revenue service irs

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is Form 1099 CAP Internal Revenue Service Irs?

Form 1099 CAP Internal Revenue Service Irs is used to report the cancellation of debt by a financial institution. This information is essential for taxpayers to understand their tax obligations and potential income. Utilizing airSlate SignNow can streamline the electronic signing and submission of this form, ensuring compliance and efficiency.

-

How does airSlate SignNow help with Form 1099 CAP Internal Revenue Service Irs?

airSlate SignNow offers an intuitive platform for creating, signing, and securely sharing Form 1099 CAP Internal Revenue Service Irs documents. Its easy-to-use interface simplifies the process of gathering signatures and managing documents, making filing more straightforward for businesses. You can save time and minimize errors with this efficient solution.

-

Is airSlate SignNow a cost-effective solution for handling Form 1099 CAP Internal Revenue Service Irs?

Yes, airSlate SignNow provides a cost-effective solution for managing Form 1099 CAP Internal Revenue Service Irs and other documents. By reducing paper usage and streamlining workflow, businesses can lower their operational costs. The pricing plans are transparent and cater to different organizational needs, ensuring affordability.

-

How secure is the information submitted via airSlate SignNow for Form 1099 CAP Internal Revenue Service Irs?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security measures to protect all data submitted, including Form 1099 CAP Internal Revenue Service Irs documents. Our platform ensures compliance with data protection regulations, giving you peace of mind in handling sensitive information.

-

Can I integrate airSlate SignNow with my existing accounting software for Form 1099 CAP Internal Revenue Service Irs?

Absolutely! airSlate SignNow offers seamless integrations with various popular accounting software. This allows for easy transfer of information related to Form 1099 CAP Internal Revenue Service Irs, enhancing your workflow, reducing redundancies, and improving overall efficiency.

-

What features does airSlate SignNow provide for managing Form 1099 CAP Internal Revenue Service Irs?

airSlate SignNow includes features such as customizable templates, automated reminders, and real-time tracking for Form 1099 CAP Internal Revenue Service Irs. These functionalities enhance the document management process, ensuring that you stay organized and compliant while meeting deadlines efficiently.

-

Can I use airSlate SignNow for both sending and eSigning Form 1099 CAP Internal Revenue Service Irs?

Yes, airSlate SignNow is designed for both sending and eSigning Form 1099 CAP Internal Revenue Service Irs documents. This dual functionality allows users to manage their documents entirely within one platform, simplifying the process for businesses of all sizes. eSigning is legally binding and recognized by the IRS, ensuring that your forms are valid.

Get more for Form 1099 CAP Internal Revenue Service Irs

- Co grandparents visitation form

- Affidavit in support of grandparents visitation colorado form

- Parental responsibilities 497300320 form

- Instructions options to enforce orders colorado form

- Filing enforcement form

- Instructions for completing an income assignment based on child support andor maintenance orders colorado form

- Income assignment colorado form

- Advance notice sample form

Find out other Form 1099 CAP Internal Revenue Service Irs

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online