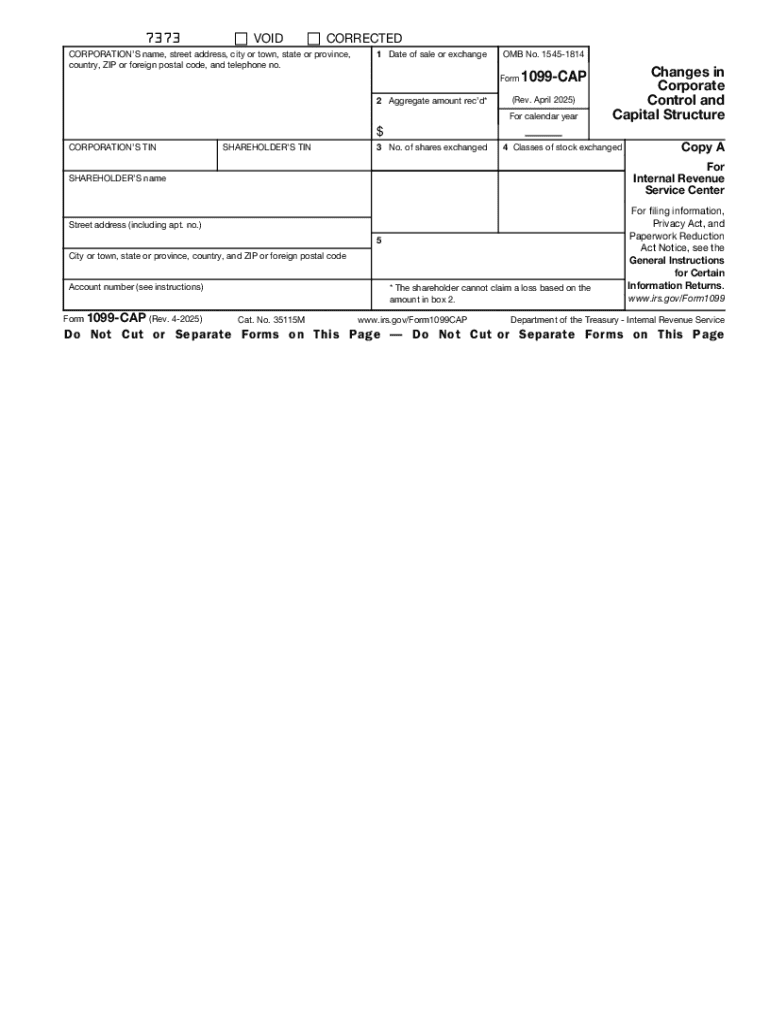

Form 1099 CAP Rev April 2025-2026

What is the Form 1099 CAP Rev April

The Form 1099 CAP Rev April is a tax form used in the United States to report certain types of income received by individuals and businesses. This form is specifically designed for reporting contributions made to a retirement plan or account. It helps the Internal Revenue Service (IRS) track contributions and ensure compliance with tax regulations. The form includes detailed information about the payer, recipient, and the amount contributed, making it essential for accurate tax reporting.

How to use the Form 1099 CAP Rev April

To use the Form 1099 CAP Rev April, individuals or businesses must first gather the necessary information about the contributions made during the tax year. This includes the total amount contributed, the recipient's details, and the payer's information. Once the information is collected, the form should be filled out accurately, ensuring all required fields are completed. After completing the form, it must be submitted to the IRS and provided to the recipient for their records.

Steps to complete the Form 1099 CAP Rev April

Completing the Form 1099 CAP Rev April involves several key steps:

- Gather all relevant information, including payer and recipient details.

- Enter the total amount of contributions made during the tax year.

- Ensure all fields are filled out accurately to avoid penalties.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS and provide a copy to the recipient.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 1099 CAP Rev April. Typically, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which contributions were made. Recipients should also receive their copies by this date to ensure they can accurately report their income on their tax returns. Missing these deadlines can result in penalties and interest charges.

Legal use of the Form 1099 CAP Rev April

The legal use of the Form 1099 CAP Rev April is essential for compliance with U.S. tax laws. This form must be used to report contributions to retirement accounts accurately. Failure to file this form or inaccuracies in reporting can lead to penalties from the IRS. It is important for both payers and recipients to understand their responsibilities regarding this form to avoid legal issues and ensure proper tax reporting.

Who Issues the Form

The Form 1099 CAP Rev April is typically issued by financial institutions, employers, or any entity that makes contributions to retirement accounts on behalf of individuals. These issuers are responsible for accurately reporting the contributions made and providing copies of the form to both the IRS and the recipients. It is essential for these entities to maintain accurate records to ensure compliance with IRS regulations.

Create this form in 5 minutes or less

Find and fill out the correct form 1099 cap rev april

Create this form in 5 minutes!

How to create an eSignature for the form 1099 cap rev april

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1099 CAP Rev April and why is it important?

Form 1099 CAP Rev April is a tax form used to report certain types of income to the IRS. It is crucial for businesses to accurately complete this form to ensure compliance with tax regulations and avoid penalties. Using airSlate SignNow can simplify the process of preparing and eSigning this form.

-

How can airSlate SignNow help with Form 1099 CAP Rev April?

airSlate SignNow provides an intuitive platform for businesses to easily create, send, and eSign Form 1099 CAP Rev April. The solution streamlines the document workflow, ensuring that all necessary signatures are collected efficiently and securely. This helps businesses save time and reduce errors in their tax reporting.

-

What are the pricing options for using airSlate SignNow for Form 1099 CAP Rev April?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of different businesses. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while providing access to features that facilitate the completion of Form 1099 CAP Rev April. Visit our pricing page for detailed information.

-

Are there any integrations available for Form 1099 CAP Rev April with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your ability to manage Form 1099 CAP Rev April. You can connect with popular tools like Google Drive, Salesforce, and more, allowing for a streamlined workflow and easy access to your documents. This integration capability makes it easier to handle your tax documentation.

-

What features does airSlate SignNow offer for managing Form 1099 CAP Rev April?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated reminders to help you manage Form 1099 CAP Rev April effectively. These tools ensure that your documents are completed accurately and on time, reducing the stress associated with tax season. Additionally, you can track the status of your documents in real-time.

-

Can I use airSlate SignNow on mobile devices for Form 1099 CAP Rev April?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to manage Form 1099 CAP Rev April on the go. Whether you are using a smartphone or tablet, you can easily access your documents, send them for eSignature, and track their progress. This flexibility ensures that you can handle your tax documentation anytime, anywhere.

-

What are the benefits of using airSlate SignNow for Form 1099 CAP Rev April?

Using airSlate SignNow for Form 1099 CAP Rev April offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform simplifies the eSigning process, ensuring that your documents are legally binding and securely stored. This not only saves time but also helps you maintain compliance with tax regulations.

Get more for Form 1099 CAP Rev April

- L 115 115 d form

- Drl 115 115 d form 24 new york state unified court

- 115 115 d9 form

- A beurre dehydration shortness of breath emachines 370 954rr form

- Adoption form 27 b

- Get the drl 114 adoption form 27 c adoption affidavit

- Fillable online courts state ny drl 114 adoption form

- Guardianship forms new york state unified court

Find out other Form 1099 CAP Rev April

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation