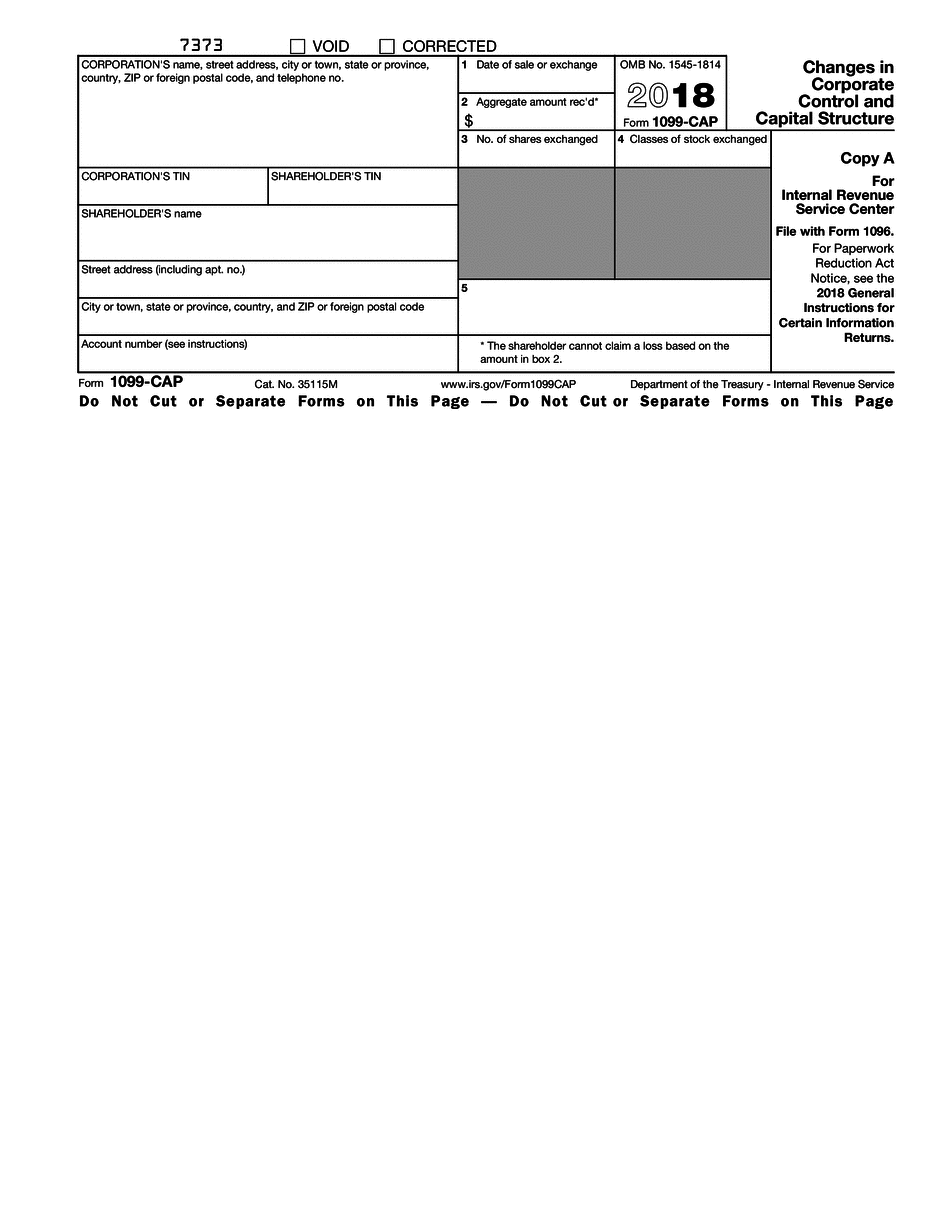

1099 Cap Form 2018

What is the 1099 Cap Form

The 1099 cap form is a tax document used in the United States to report income received by independent contractors and freelancers. This form is essential for both the payer and the payee, as it ensures that all income is accurately reported to the Internal Revenue Service (IRS). The 1099 cap form typically includes details such as the total amount paid to the contractor, the payer's information, and the recipient's taxpayer identification number. Understanding the purpose and requirements of this form is crucial for compliance with tax regulations.

How to use the 1099 Cap Form

Using the 1099 cap form involves several steps to ensure that it is filled out correctly and submitted on time. First, gather all necessary information, including the total payments made to the contractor during the tax year. Next, accurately fill in the form with the payer's and recipient's details. It is important to double-check all entries for accuracy before submission. Once completed, the form must be sent to the IRS and a copy provided to the contractor. Utilizing electronic solutions can streamline this process, making it easier to manage and submit the form securely.

Steps to complete the 1099 Cap Form

Completing the 1099 cap form requires careful attention to detail. Follow these steps:

- Collect all relevant payment records for the contractor.

- Obtain the contractor's taxpayer identification number (TIN) or Social Security number (SSN).

- Fill out the form, ensuring that the payer's and recipient's information is accurate.

- Enter the total amount paid to the contractor in the appropriate box.

- Review the form for any errors or omissions.

- Submit the form to the IRS by the deadline, and provide a copy to the contractor.

Legal use of the 1099 Cap Form

The legal use of the 1099 cap form is governed by IRS regulations. This form must be used to report non-employee compensation to ensure compliance with tax laws. Failure to issue a 1099 cap form when required can result in penalties for the payer. It is essential to understand the legal implications of this form, including the requirement to issue it for any contractor paid $600 or more during the tax year. Proper use of the form helps maintain transparency and accountability in financial transactions.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 cap form are critical to avoid penalties. Generally, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which payments were made. Additionally, a copy must be provided to the contractor by the same date. It is advisable to keep track of these deadlines and plan ahead to ensure timely submission. Missing these dates can lead to fines and complications with tax reporting.

Examples of using the 1099 Cap Form

There are various scenarios where the 1099 cap form is applicable. For instance, if a business hires a freelance graphic designer and pays them a total of $1,200 for services rendered throughout the year, the business must issue a 1099 cap form to report this payment. Similarly, if a company pays an independent consultant $800 for a project, they are also required to provide a 1099 cap form. These examples illustrate the importance of the form in documenting income for tax purposes.

Quick guide on how to complete 1099 cap 2018 2019 form

Accomplish 1099 Cap Form effortlessly on any gadget

Web-based document management has become increasingly favored by companies and individuals alike. It offers a sustainable alternative to conventional printed and signed files, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents swiftly without delays. Manage 1099 Cap Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

Ways to alter and eSign 1099 Cap Form with ease

- Find 1099 Cap Form and click Get Form to begin.

- Use the tools provided to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your requirements in document management in just a few clicks from any device of your choosing. Alter and eSign 1099 Cap Form to ensure exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 cap 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the 1099 cap 2018 2019 form

How to make an eSignature for your 1099 Cap 2018 2019 Form in the online mode

How to create an electronic signature for the 1099 Cap 2018 2019 Form in Google Chrome

How to create an eSignature for putting it on the 1099 Cap 2018 2019 Form in Gmail

How to make an eSignature for the 1099 Cap 2018 2019 Form right from your smart phone

How to generate an eSignature for the 1099 Cap 2018 2019 Form on iOS

How to create an eSignature for the 1099 Cap 2018 2019 Form on Android devices

People also ask

-

What is a 1099 Cap Form and why do I need it?

The 1099 Cap Form is a tax document used to report income earned by independent contractors and freelancers. If you are a business owner working with such individuals, you will need the 1099 Cap Form to ensure compliance with IRS regulations. Utilizing airSlate SignNow makes it easy to create, send, and eSign your 1099 Cap Forms securely.

-

How does airSlate SignNow simplify the process of managing 1099 Cap Forms?

airSlate SignNow offers a user-friendly platform that allows you to quickly prepare and send 1099 Cap Forms for eSignature. With our automated workflows, you can track the status of each document in real-time, ensuring that your forms are completed efficiently. This streamlines your tax reporting process and saves valuable time.

-

Is there a cost associated with using airSlate SignNow for 1099 Cap Forms?

Yes, airSlate SignNow offers various pricing plans tailored to fit businesses of all sizes. Our pricing is competitive and designed to provide great value, especially for handling documents like the 1099 Cap Form. You can choose a plan that best meets your needs and budget.

-

Can I integrate airSlate SignNow with my existing accounting software for 1099 Cap Forms?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to manage your 1099 Cap Forms alongside your financial data. This integration helps maintain accurate records and simplifies the process of tracking contractor payments.

-

What features does airSlate SignNow offer for eSigning 1099 Cap Forms?

airSlate SignNow offers a wide range of features for eSigning 1099 Cap Forms, including customizable templates, secure signing, and document tracking. You can easily add signature fields and ensure that all parties can sign from any device, enhancing the overall efficiency of your document workflow.

-

How secure is airSlate SignNow when handling 1099 Cap Forms?

Security is a top priority for airSlate SignNow. We implement advanced encryption protocols and comply with industry standards to protect your sensitive data, including 1099 Cap Forms. You can rest assured that your documents are safe and secure throughout the signing process.

-

Can I store my completed 1099 Cap Forms in airSlate SignNow?

Yes, airSlate SignNow allows you to securely store all your completed 1099 Cap Forms within the platform. You can easily access, manage, and retrieve your documents whenever needed, ensuring that you have all your necessary forms organized and readily available for tax season.

Get more for 1099 Cap Form

- Ftcc form a 14 revised 03072013 academic agreement review faytechcc

- Scope appointment form

- Application for waiver of distance city of fort pierce form

- Application government guam form

- Liquidation value form

- Form dh 427

- How to sign applicant for amendment to florida birth record form

- Form dh 1322 december 2009 florida department of health

Find out other 1099 Cap Form

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer