Security Deposit Settlement Statement Form

What is the security deposit settlement statement?

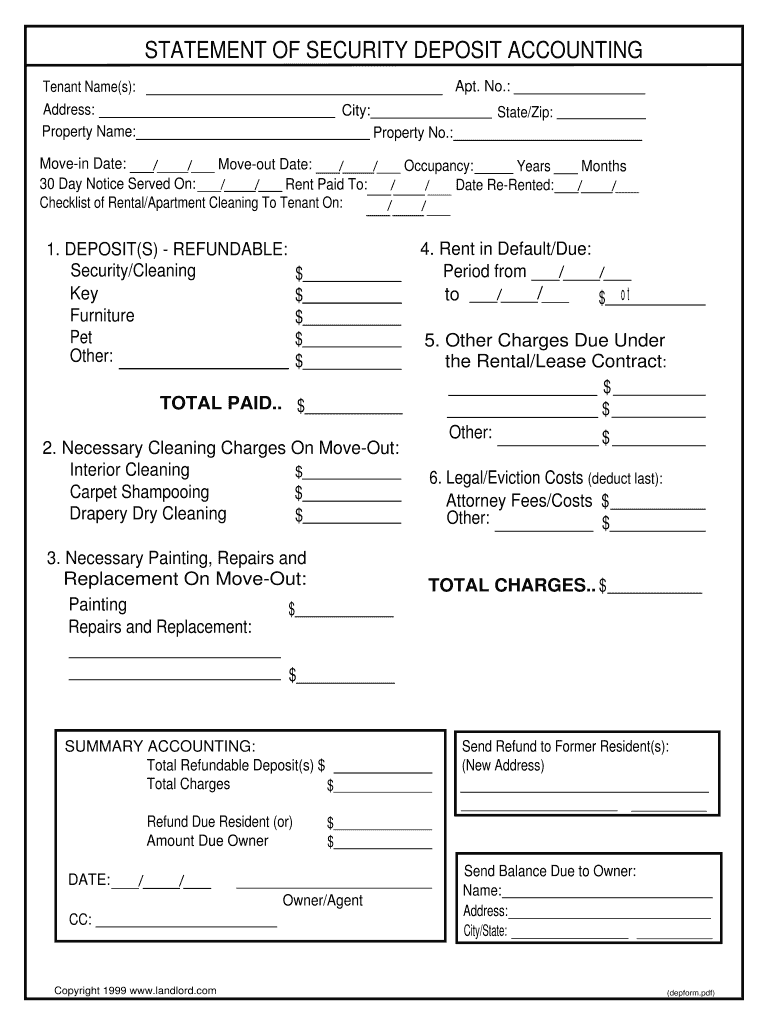

The security deposit settlement statement is a crucial document that outlines the financial details related to the return of a tenant's security deposit. This statement typically includes information such as the total amount of the deposit, any deductions made for damages or unpaid rent, and the final amount returned to the tenant. It serves as a formal record that both landlords and tenants can refer to, ensuring transparency in the settlement process. Understanding this document is essential for both parties to avoid disputes and maintain a clear financial history.

Key elements of the security deposit settlement statement

When reviewing a security deposit settlement statement, several key elements should be highlighted:

- Deposit Amount: The total amount initially collected as a security deposit.

- Deductions: A detailed list of any deductions made from the deposit, including costs for repairs, cleaning, or unpaid rent.

- Final Amount: The total amount returned to the tenant after all deductions have been applied.

- Date of Settlement: The date on which the statement is issued and the settlement is finalized.

- Landlord's Information: Contact details and signature of the landlord or property manager.

These components ensure that both parties have a clear understanding of the financial transactions that have taken place regarding the security deposit.

Steps to complete the security deposit settlement statement

Completing a security deposit settlement statement involves several steps to ensure accuracy and compliance with legal requirements:

- Gather Information: Collect all relevant details, including the original deposit amount, any receipts for repairs or cleaning, and the tenant's forwarding address.

- Calculate Deductions: Review any damages or unpaid rent and calculate the total deductions that will be taken from the deposit.

- Fill Out the Statement: Use a security deposit accounting form to document the deposit amount, deductions, and final return amount clearly.

- Review for Accuracy: Double-check all figures and details to ensure everything is correct before finalizing the document.

- Provide a Copy to the Tenant: Send the completed statement to the tenant, along with any remaining funds, to maintain transparency.

Following these steps helps both landlords and tenants to have a clear understanding of the financial aspects related to the security deposit.

Legal use of the security deposit settlement statement

The security deposit settlement statement must adhere to specific legal standards to be considered valid. In the United States, many states have laws governing how security deposits should be handled, including requirements for documentation and timelines for returning deposits. It is essential for landlords to familiarize themselves with these laws to ensure compliance. A properly completed settlement statement can protect landlords from potential disputes and provide tenants with a clear understanding of any deductions made from their deposit.

How to use the security deposit settlement statement

The security deposit settlement statement is used primarily to document the return of a tenant's security deposit. It serves as proof of the financial transaction between the landlord and tenant. Landlords should provide this statement after the tenant vacates the property, detailing any deductions taken from the deposit. Tenants can use the statement to verify that they received the correct amount and to understand any charges applied. This document can also be useful in case of disputes, as it provides a formal record of the settlement process.

State-specific rules for the security deposit settlement statement

Each state in the U.S. has its own regulations regarding security deposits, including how they must be documented and returned. For instance, some states require landlords to provide a detailed itemization of deductions, while others have specific timelines for returning deposits. It is important for landlords to research the laws applicable in their state to ensure that their security deposit settlement statements comply with local regulations. Understanding these rules can help prevent legal issues and ensure a smooth transition for both landlords and tenants.

Quick guide on how to complete statement security deposit accounting form

The simplest method to locate and endorse Security Deposit Settlement Statement

Across the scope of your complete organization, ineffective workflows related to document approval can consume signNow working hours. Signing documents such as Security Deposit Settlement Statement is an integral aspect of operations across all sectors, which is why the effectiveness of each contract's progression has a substantial impact on the firm’s overall productivity. With airSlate SignNow, endorsing your Security Deposit Settlement Statement is as straightforward and quick as possible. This platform provides you with the latest version of nearly any form. Even better, you can sign it immediately without needing to install additional software on your device or print anything out as physical copies.

Steps to obtain and endorse your Security Deposit Settlement Statement

- Browse our repository by category or use the search bar to locate the document you require.

- View the form preview by clicking Learn more to ensure it is the correct one.

- Select Get form to begin modifying without delay.

- Fill in your form and input any necessary details using the toolbar.

- Once completed, click the Sign feature to endorse your Security Deposit Settlement Statement.

- Pick the signature method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to complete your edits and proceed to document-sharing options as needed.

With airSlate SignNow, you have everything required to manage your documents efficiently. You can discover, complete, amend, and even share your Security Deposit Settlement Statement all within one tab seamlessly. Optimize your workflows by employing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Do I need to fill out a financial statement form if I get a full tuition waiver and RA/TA?

If that is necessary, the university or the faculty will inform you of that. These things can vary from university to university. Your best option would be to check your university website, financial services office or the Bursar office in your university.

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How much money can be deposited in a bank account?

You can deposit as much as you can dream of. Your bank will love you directly proportionate to the amount of money you store with them. Additionally, the more money you put in, the more meaningful those abysmal interest rates may seem. Instead of pennies in interest, you can earn whole dollars.However, your deposits are only insured in the US up to $250,000. And interest rates are garbage.You would probably do much better with your money to invest it in a vehicle of another type. For instance, if you love the bank you will get a better interest rate by locking it into a CD. The money is tied into that CD for the duration you select, but it is better interest. Moving up from there you also could invest into a High Yield Money Market account at the same bank. This may result in higher interest depending on the amount of money deposited into this account.Going a step up from there, invest in mutual funds, stocks, bonds, all that fun stuff. Better returns on average, but increased risk. At this point you would do well to speak to an investment firm to get some advice.All of this assumes it is money you already have. If you are earning this money then capitalize on maxing out your 401K with employer matching if available. Then max out your Health Savings Account if that is available. These both provide the benefit of un-taxed dollars.For further reading you should check out Personal Finance • r/personalfinance

-

Is it fishy if a company wants you to fill out the direct deposit form before you receive any paper work about being hired?

Hi, To give a little more context, if you are worried about completing a direct deposit form, which should be for receiving remuneration of your wages, then request a your employment contract and tell them you will complete the direct deposit form after the employment has been received. Always be open and honest with a potential em0ployer and set parameters for your employment relationship from the get go. you would like to follow procedures. Every Employer will respect you more for that. I do not think it is fishy but a little odd

-

How to trade US stock market from India?

Yes, an Indian can invest in US equity market. Follow the below process:1. Open a trading account to invest in International Capital MarketsTo facilitate you to do the same, an Indian stock broker enters into a tie-up with a foreign broking partner who has the license to act as an intermediary and execute the trades on your behalf in the foreign markets.The Indian stock broker will act as an introducing intermediary between you and the foreign broking house. The Indian stock broker will also help you in getting your account opened and completing the formalities of Know Your Customer (KYC) applicable for that country.You just need to fill an application form and provide your identity proof such as passport or PAN card and residential address proof such as Voters ID card or latest bank statement as the documents required to open an account.Once your necessary details are registered, you will be provided the bank account details of the foreign broker to which funds are to be transferred. You will also get the contact details of the account executive who will take care of your account in case you require any kind of assistance.2. Funds Transfer – Pay-In/Pay-Out ProcessAs per the remittance norms of the Reserve Bank of India (RBI), an Indian citizen can remit a maximum of USD 2,00,000 in a financial year, from any of the authorised banks in India, including for investments in international capital markets.The foreign brokers accept funds originating from your bank account only and will reject any third party fund transfer. Also, they do not accept bankers drafts, cheques or cash depositsIt takes around 24 to 48 hours to remit money from your bank account to your trading account with the foreign broker and around 48 to 72 hours from your trading account to your bank account.Once your account is opened and funds are transferred, you will be provided a client Login ID and password to have an immediate access to the foreign brokers trading platform to buy and sell shares of the listed foreign companies. All dealings like trading, delivery of shares/funds etc. will be done directly with the foreign broker without any involvement of the Indian stock broker.3. Demat AccountUnlike here in the domestic markets, where your bought shares get transferred into your demat account in T+2 days, when you buy shares in the foreign markets the shares remain in a pool account with the brokers custodian but start reflecting in your trading account immediately after buying.Unlike with most Indian brokers, margin trading and short selling will not be allowed with a foreign broker. You will be able to buy shares only when there is sufficient cash in your account and sell shares only when you already hold them.You can have the access to all your transactions, account history and ledger balance on the trading platform. You will also get the contract notes for your executed trades in your mailbox.4. Brokers in India providing this serviceOnly a few Indian broking companies like Kotak Securities, ICICI Direct, India Infoline, Reliance Money and Religare, are offering these trading services to Indian investors.As your overseas investments will be made in some foreign currency, your investment gain or loss will also be linked to the movement of that currency. So, if you invest in some stocks in USD and USD appreciates in value, then it would add to your gains or lower your losses. e.g. Suppose you paid Rs. 50 per USD at the time of investment and liquidate your investment when the USD appreciates to Rs. 55, you will get back Rs. 55 per USD.The process of transacting in equity markets overseas is not that complicated if you are aware about the global dynamics.Hope this is useful :)

Create this form in 5 minutes!

How to create an eSignature for the statement security deposit accounting form

How to make an eSignature for your Statement Security Deposit Accounting Form online

How to generate an electronic signature for the Statement Security Deposit Accounting Form in Google Chrome

How to make an eSignature for signing the Statement Security Deposit Accounting Form in Gmail

How to make an electronic signature for the Statement Security Deposit Accounting Form straight from your smartphone

How to generate an eSignature for the Statement Security Deposit Accounting Form on iOS devices

How to create an electronic signature for the Statement Security Deposit Accounting Form on Android OS

People also ask

-

What is a Security Deposit Settlement Statement?

A Security Deposit Settlement Statement is a detailed document that outlines the financial transactions related to a security deposit during a rental agreement. It provides a clear breakdown of the initial deposit, any deductions for damages or unpaid rent, and the final amount returned to the tenant. This statement ensures transparency and protects the interests of both landlords and tenants.

-

How can airSlate SignNow help with Security Deposit Settlement Statements?

airSlate SignNow streamlines the creation and signing of Security Deposit Settlement Statements by providing an intuitive platform for document management. With features such as eSigning and secure storage, it enhances the efficiency of processing these statements, making it easier for landlords and tenants to finalize their agreements. This means less time spent on paperwork and more focus on what matters.

-

Is there a cost associated with using airSlate SignNow for Security Deposit Settlement Statements?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Users can choose from affordable subscription options that grant access to features for creating and managing Security Deposit Settlement Statements and other documents. You can start with a free trial to explore the functionality before committing to a plan.

-

What features does airSlate SignNow offer for managing Security Deposit Settlement Statements?

airSlate SignNow includes features such as customizable templates for Security Deposit Settlement Statements, electronic signatures, and real-time status tracking. These tools simplify the document process, ensuring that all parties can easily review and sign the statement securely. Additionally, integrations with other platforms enhance its versatility.

-

Are Security Deposit Settlement Statements legally binding when signed through airSlate SignNow?

Yes, Security Deposit Settlement Statements signed through airSlate SignNow are legally binding, provided they comply with local laws and regulations. The platform adheres to electronic signature laws, ensuring that your agreements hold up in court. This gives both landlords and tenants peace of mind regarding their signed documents.

-

Can I customize my Security Deposit Settlement Statement template in airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize their Security Deposit Settlement Statement templates to meet specific requirements. You can modify fields, add branding elements, and ensure the statement aligns with your business practices, making the document both professional and tailored to your needs.

-

What integrations does airSlate SignNow offer for handling Security Deposit Settlement Statements?

airSlate SignNow integrates seamlessly with various business tools like Google Drive, Dropbox, and CRM systems. This connectivity allows you to manage your Security Deposit Settlement Statements more efficiently by accessing documents from multiple platforms and streamlining your workflow. You can easily pull in data and send documents for signature without switching applications.

Get more for Security Deposit Settlement Statement

Find out other Security Deposit Settlement Statement

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself