Ifta Fuel Tax Report Supplement Form 2019-2026

What is the IFTA Fuel Tax Report Supplement Form

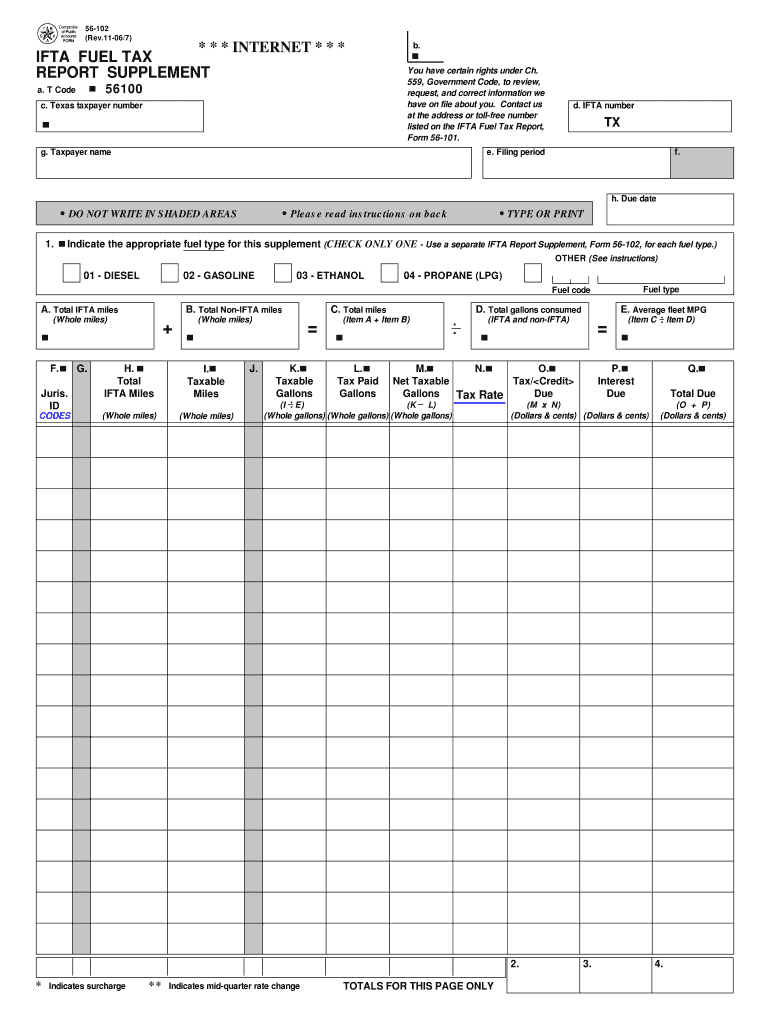

The IFTA Fuel Tax Report Supplement Form is a crucial document for interstate motor carriers operating in the United States. It is designed to facilitate the reporting of fuel use and mileage across different jurisdictions. This form helps ensure compliance with the International Fuel Tax Agreement (IFTA), which simplifies the reporting process for fuel taxes. By consolidating fuel tax reporting into a single form, carriers can streamline their obligations and avoid the complexities of filing separate reports for each state or province they operate in.

Steps to complete the IFTA Fuel Tax Report Supplement Form

Completing the IFTA Fuel Tax Report Supplement Form involves several key steps:

- Gather necessary information: Collect data on fuel purchases, mileage traveled in each jurisdiction, and any other relevant details.

- Fill out the form: Enter the collected data into the appropriate sections of the form, ensuring accuracy to avoid penalties.

- Calculate taxes owed: Use the provided formulas to determine the total fuel tax liability based on the mileage and fuel consumption.

- Review the form: Double-check all entries for accuracy and completeness before submission.

- Submit the form: Follow the preferred submission method, whether online, by mail, or in person, to ensure timely filing.

Key elements of the IFTA Fuel Tax Report Supplement Form

The IFTA Fuel Tax Report Supplement Form includes several key elements that must be accurately completed:

- Carrier Information: Details about the business, including name, address, and IFTA account number.

- Fuel Usage: A breakdown of fuel purchased and consumed in each jurisdiction.

- Mileage Reporting: Total miles traveled in each state or province during the reporting period.

- Tax Calculation: A section for calculating the total fuel tax owed based on the reported data.

- Signature: A declaration that the information provided is accurate, requiring the signature of an authorized representative.

Form Submission Methods (Online / Mail / In-Person)

The IFTA Fuel Tax Report Supplement Form can be submitted through various methods, depending on the preferences of the carrier and the regulations of the respective state:

- Online: Many states offer an online submission option, allowing for quick and efficient filing.

- Mail: Carriers can print the completed form and send it via postal service to the appropriate state agency.

- In-Person: Some jurisdictions allow for in-person submissions at designated offices, providing an opportunity for immediate confirmation of receipt.

Penalties for Non-Compliance

Failing to comply with IFTA reporting requirements can result in significant penalties for carriers. These may include:

- Fines: Monetary penalties imposed for late or inaccurate filings.

- Interest Charges: Accrued interest on unpaid fuel taxes can increase the overall liability.

- License Suspension: Repeated non-compliance may lead to the suspension of the carrier's IFTA license, affecting their ability to operate legally.

Legal use of the IFTA Fuel Tax Report Supplement Form

The legal use of the IFTA Fuel Tax Report Supplement Form is governed by the International Fuel Tax Agreement, which outlines the obligations of carriers regarding fuel tax reporting. To ensure compliance, carriers must:

- Accurately report fuel usage: All fuel purchases and mileage must be documented and reported truthfully.

- Maintain records: Carriers are required to keep supporting documentation for a specified period, typically four years.

- File on time: Adhering to filing deadlines is essential to avoid penalties and maintain good standing with state authorities.

Quick guide on how to complete ifta fuel tax report supplement 2007 form

Complete Ifta Fuel Tax Report Supplement Form seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents promptly without delays. Handle Ifta Fuel Tax Report Supplement Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

How to edit and eSign Ifta Fuel Tax Report Supplement Form effortlessly

- Locate Ifta Fuel Tax Report Supplement Form and click Get Form to begin.

- Use the tools we offer to complete your form.

- Select relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you prefer to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in a few clicks from any device you choose. Edit and eSign Ifta Fuel Tax Report Supplement Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ifta fuel tax report supplement 2007 form

Create this form in 5 minutes!

How to create an eSignature for the ifta fuel tax report supplement 2007 form

The way to generate an eSignature for a PDF file in the online mode

The way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What is an IFTA report example?

An IFTA report example is a standardized document used by interstate motor carriers to report fuel taxes. It provides detailed insights into the amount of fuel purchased and miles driven in each jurisdiction. Understanding an IFTA report example can help you ensure compliance with tax regulations and simplify filing processes.

-

How can airSlate SignNow assist with filing IFTA reports?

airSlate SignNow streamlines the IFTA reporting process by allowing users to eSign and send documents quickly. You can create an IFTA report example using our templates, ensuring all necessary information is captured efficiently. This saves time and reduces the chances of errors in your filing.

-

Is there a cost associated with using airSlate SignNow for IFTA reports?

Yes, airSlate SignNow offers cost-effective pricing plans tailored to different business needs. You can choose a plan that suits your volume of IFTA report examples and overall document management requirements. Our pricing is transparent, with no hidden fees, making it accessible for all businesses.

-

What features does airSlate SignNow provide for creating IFTA reports?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning which are ideal for creating IFTA reports. You can easily generate an IFTA report example tailored to your specific organizational needs. Additionally, the platform ensures compliance with industry standards.

-

Can I integrate airSlate SignNow with existing reporting systems?

Absolutely! airSlate SignNow offers seamless integrations with various reporting and accounting software. This means you can easily pull data into your IFTA report example without duplication of effort, enhancing accuracy and saving time during the filing process.

-

What are the benefits of using airSlate SignNow for IFTA reporting?

Using airSlate SignNow for IFTA reporting streamlines the entire process, reducing paperwork and improving efficiency. The platform enables quick updates to your IFTA report example, ensures secure document handling, and helps maintain compliance with regulations. It ultimately leads to enhanced productivity and reduced stress during filing seasons.

-

How does eSigning enhance the IFTA reporting process?

eSigning with airSlate SignNow allows for quick approval and document finalization, making the IFTA reporting process faster. By using an IFTA report example, signers can complete their signatures from anywhere, reducing delays caused by physical document handling. This feature enhances convenience and efficiency, ensuring timely submissions.

Get more for Ifta Fuel Tax Report Supplement Form

- Addition rule of probability worksheet answers pdf form

- Standard celeration chart template excel form

- Sirius benefits reviews form

- Submission fitness assessment form

- Nm acknoledgement of paterinty pdf form

- Subcontractor information form

- Apush leq rubric form

- D market value property nsclic policygovt sec form

Find out other Ifta Fuel Tax Report Supplement Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation