Form 9465 2013

What is the Form 9465

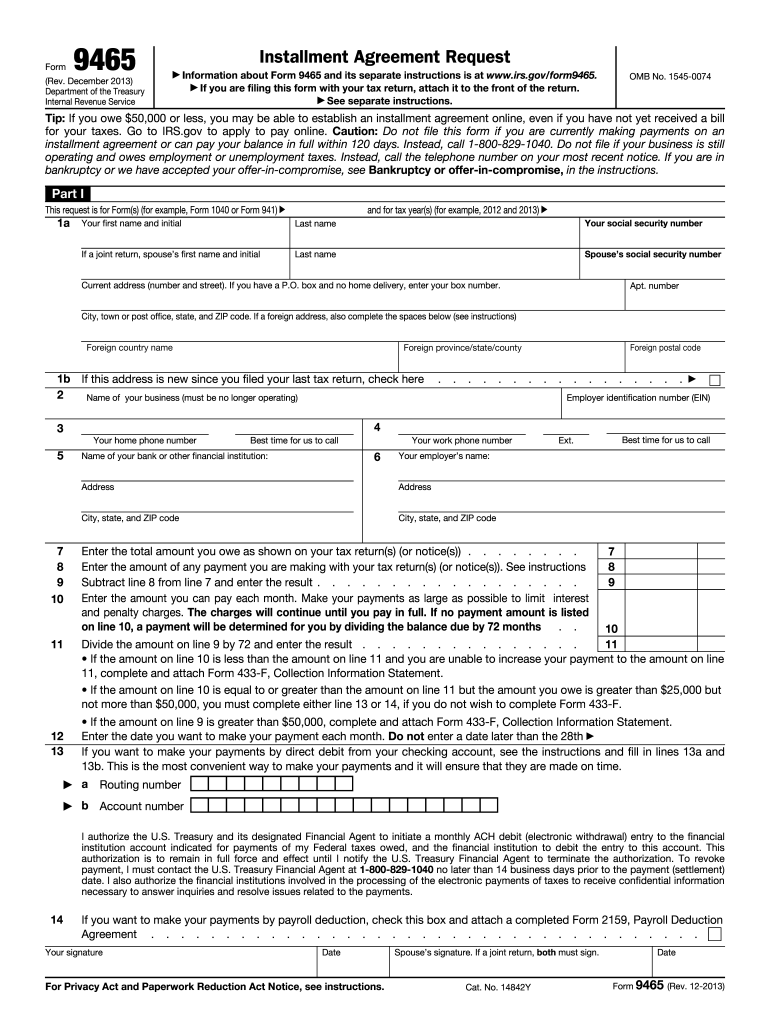

The Form 9465, officially known as the Installment Agreement Request, is a tax form used by individuals to request a monthly payment plan for their federal tax liabilities. This form is particularly useful for taxpayers who cannot pay their tax bill in full by the due date. By submitting Form 9465, taxpayers can propose a payment schedule that allows them to settle their debts over time, thereby avoiding immediate financial strain.

How to use the Form 9465

Using Form 9465 involves a straightforward process. Taxpayers must fill out the form with their personal information, including their name, address, and Social Security number. They also need to provide details about their tax liability and the proposed monthly payment amount. Once completed, the form can be submitted to the IRS, either electronically or by mail, depending on the taxpayer's preference and eligibility.

Steps to complete the Form 9465

Completing Form 9465 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your tax return and details of your financial situation.

- Fill out your personal information at the top of the form.

- Indicate the total amount you owe and your proposed monthly payment.

- Sign and date the form to certify the accuracy of the information provided.

- Submit the form to the IRS using your preferred method.

Legal use of the Form 9465

Form 9465 is legally binding once it is signed and submitted to the IRS. By submitting this form, taxpayers agree to the terms of the installment agreement, which includes making timely payments as proposed. Failure to adhere to the agreement may result in penalties or additional interest on the unpaid balance. It is crucial for taxpayers to understand the legal implications of their agreement and to maintain communication with the IRS if any changes in their financial situation occur.

Eligibility Criteria

To qualify for an installment agreement using Form 9465, taxpayers must meet specific eligibility criteria. Generally, individuals must owe less than $50,000 in combined tax, penalties, and interest. Additionally, they must have filed all required tax returns and cannot be in bankruptcy proceedings. Understanding these criteria is essential to ensure that the request for an installment agreement is approved.

Form Submission Methods

Form 9465 can be submitted to the IRS through various methods. Taxpayers can file the form electronically if they are eligible, which allows for faster processing. Alternatively, the form can be mailed to the appropriate IRS address, depending on the taxpayer's location. In-person submissions are typically not an option for this form. Choosing the right submission method can affect the speed and efficiency of the request process.

Filing Deadlines / Important Dates

It is essential for taxpayers to be aware of filing deadlines associated with Form 9465. The form should be submitted as soon as the taxpayer realizes they cannot pay their tax bill in full. Additionally, if the form is submitted along with a tax return, it must be filed by the tax return due date. Keeping track of these deadlines helps avoid unnecessary penalties and interest charges.

Quick guide on how to complete 2013 form 9465

Complete Form 9465 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle Form 9465 on any device using airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The simplest way to modify and eSign Form 9465 with ease

- Locate Form 9465 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 9465 while ensuring excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form 9465

Create this form in 5 minutes!

How to create an eSignature for the 2013 form 9465

How to generate an electronic signature for the 2013 Form 9465 in the online mode

How to generate an electronic signature for the 2013 Form 9465 in Google Chrome

How to make an eSignature for signing the 2013 Form 9465 in Gmail

How to generate an electronic signature for the 2013 Form 9465 from your mobile device

How to generate an eSignature for the 2013 Form 9465 on iOS

How to make an eSignature for the 2013 Form 9465 on Android OS

People also ask

-

What is Form 9465 and how can airSlate SignNow help with it?

Form 9465 is the Installment Agreement Request form used by taxpayers to request a monthly payment plan for unpaid taxes. With airSlate SignNow, you can easily create, send, and eSign Form 9465, making the process of setting up your payment plan quick and efficient.

-

Are there any costs associated with using airSlate SignNow for Form 9465?

Yes, airSlate SignNow offers a variety of pricing plans tailored to fit different needs. You can choose a plan that allows you to efficiently manage and eSign Form 9465 and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 9465?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure storage for Form 9465. These features streamline the eSigning process and ensure your sensitive tax information remains secure.

-

Can I integrate airSlate SignNow with other software to manage Form 9465?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, including CRM systems and accounting software, which can enhance your workflow when handling Form 9465. This integration helps you manage your documents more effectively.

-

Is it easy to eSign Form 9465 using airSlate SignNow?

Yes, eSigning Form 9465 with airSlate SignNow is simple and user-friendly. The platform allows you to sign documents electronically from any device, ensuring that you can complete your tax payment plans conveniently.

-

How long does it take to process Form 9465 with airSlate SignNow?

Processing time for Form 9465 with airSlate SignNow is signNowly reduced. Once you eSign the document, it can be sent and received by the IRS promptly, allowing you to set up your installment agreement without unnecessary delays.

-

What are the benefits of using airSlate SignNow for tax-related documents like Form 9465?

Using airSlate SignNow for tax documents like Form 9465 provides numerous benefits, including enhanced security, improved efficiency, and the ability to track document status in real-time. These advantages help ensure your tax-related agreements are handled professionally.

Get more for Form 9465

Find out other Form 9465

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple