Form 9465 2017

What is the Form 9465

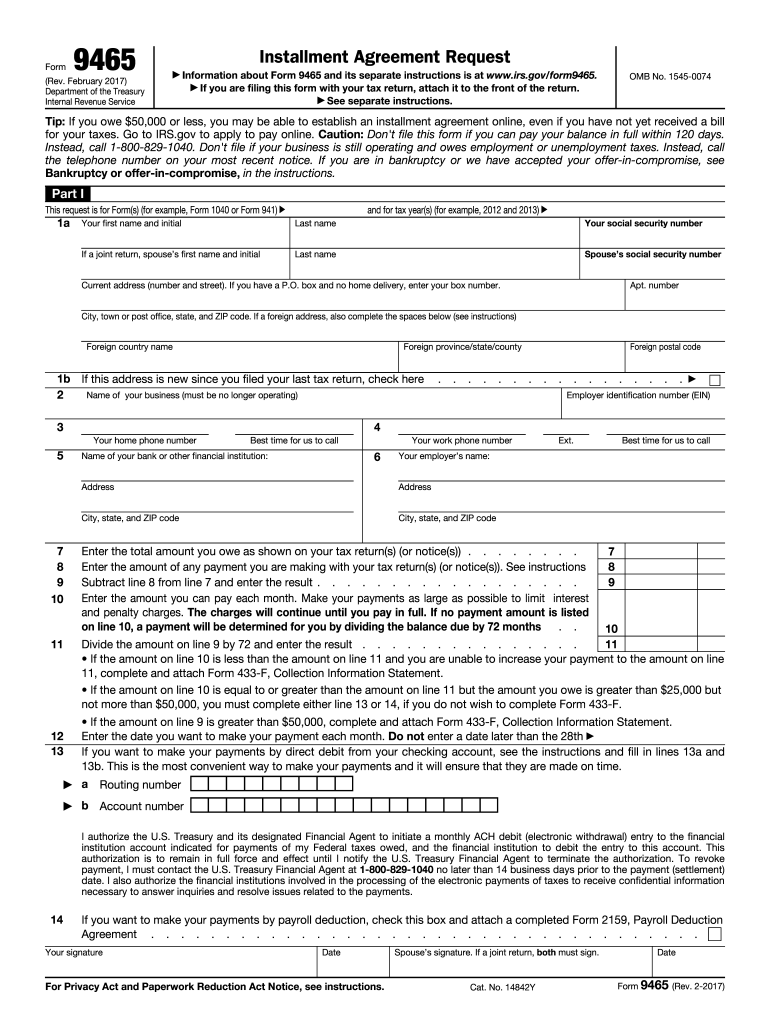

The Form 9465, officially known as the Installment Agreement Request, is a tax form used by individuals in the United States to request a monthly installment plan for paying their federal income tax liabilities. This form is particularly useful for taxpayers who cannot pay their tax bill in full by the due date. By submitting Form 9465, taxpayers can propose a payment plan that allows them to pay their taxes over time, making it easier to manage their financial obligations.

How to use the Form 9465

Using Form 9465 involves a few straightforward steps. Taxpayers must first complete the form by providing essential information, such as their name, address, Social Security number, and the amount owed. It is important to indicate the proposed monthly payment amount and the preferred payment date. After filling out the form, taxpayers can submit it to the IRS either electronically or by mail, depending on their preference. If approved, the IRS will send a confirmation of the installment agreement.

Steps to complete the Form 9465

Completing Form 9465 requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Clearly state the total amount of tax you owe and the proposed monthly payment you can afford.

- Select your preferred payment date each month.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the IRS, either electronically through the IRS website or via mail.

Eligibility Criteria

To qualify for an installment agreement using Form 9465, taxpayers must meet specific criteria. Generally, individuals must owe $50,000 or less in combined tax, penalties, and interest. Additionally, taxpayers should be current with their filing requirements and not have a history of defaulting on previous installment agreements. If the amount owed exceeds this threshold, taxpayers may need to explore other options or negotiate directly with the IRS.

Form Submission Methods

Taxpayers can submit Form 9465 through multiple methods, making it accessible for various preferences. The form can be filed electronically using the IRS e-file system, which is often the quickest method. Alternatively, taxpayers can print the completed form and mail it to the appropriate IRS address based on their state of residence. In some cases, individuals may also submit the form in person at their local IRS office.

Legal use of the Form 9465

Form 9465 is legally binding once it is accepted by the IRS, creating a formal agreement between the taxpayer and the government regarding the payment plan. It is essential for taxpayers to adhere to the terms outlined in the agreement to avoid penalties or further collection actions. The IRS provides guidelines on maintaining compliance, and taxpayers should keep records of payments made under the installment agreement for their records.

Quick guide on how to complete 2017 form 9465

Complete Form 9465 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Form 9465 on any device using airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

How to modify and electronically sign Form 9465 effortlessly

- Find Form 9465 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you prefer to submit your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 9465 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 form 9465

Create this form in 5 minutes!

How to create an eSignature for the 2017 form 9465

How to generate an electronic signature for your 2017 Form 9465 in the online mode

How to make an electronic signature for your 2017 Form 9465 in Chrome

How to create an eSignature for signing the 2017 Form 9465 in Gmail

How to create an eSignature for the 2017 Form 9465 right from your smartphone

How to create an electronic signature for the 2017 Form 9465 on iOS

How to create an eSignature for the 2017 Form 9465 on Android OS

People also ask

-

What is Form 9465 and how can airSlate SignNow help with it?

Form 9465 is the Installment Agreement Request form used by taxpayers to request a monthly payment plan for unpaid taxes. With airSlate SignNow, you can easily create, send, and eSign Form 9465, making the process of setting up your payment plan quick and efficient.

-

Are there any costs associated with using airSlate SignNow for Form 9465?

Yes, airSlate SignNow offers a variety of pricing plans tailored to fit different needs. You can choose a plan that allows you to efficiently manage and eSign Form 9465 and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 9465?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure storage for Form 9465. These features streamline the eSigning process and ensure your sensitive tax information remains secure.

-

Can I integrate airSlate SignNow with other software to manage Form 9465?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, including CRM systems and accounting software, which can enhance your workflow when handling Form 9465. This integration helps you manage your documents more effectively.

-

Is it easy to eSign Form 9465 using airSlate SignNow?

Yes, eSigning Form 9465 with airSlate SignNow is simple and user-friendly. The platform allows you to sign documents electronically from any device, ensuring that you can complete your tax payment plans conveniently.

-

How long does it take to process Form 9465 with airSlate SignNow?

Processing time for Form 9465 with airSlate SignNow is signNowly reduced. Once you eSign the document, it can be sent and received by the IRS promptly, allowing you to set up your installment agreement without unnecessary delays.

-

What are the benefits of using airSlate SignNow for tax-related documents like Form 9465?

Using airSlate SignNow for tax documents like Form 9465 provides numerous benefits, including enhanced security, improved efficiency, and the ability to track document status in real-time. These advantages help ensure your tax-related agreements are handled professionally.

Get more for Form 9465

Find out other Form 9465

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template