01 114 Sales Tax Form 2015

What is the 01 114 Sales Tax Form

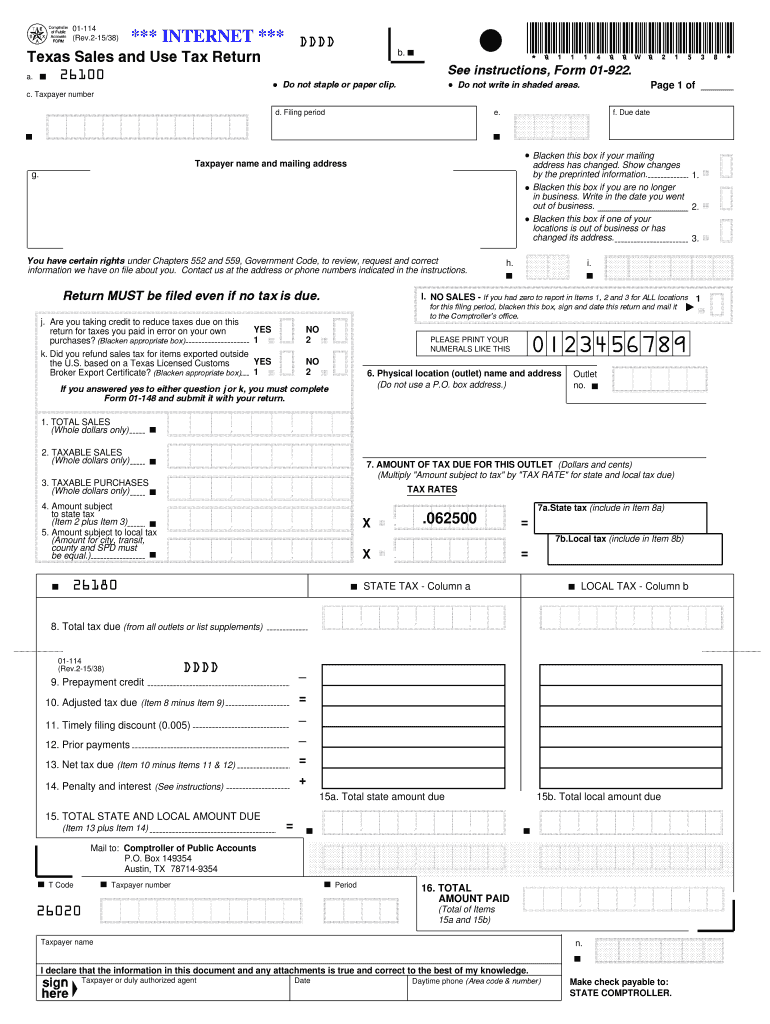

The 01 114 Sales Tax Form is a document used by businesses in the United States to report and remit sales tax to the appropriate state authority. This form is essential for compliance with state tax regulations and is typically required on a periodic basis, such as monthly or quarterly. The form captures vital information regarding sales transactions, including the total sales amount, taxable sales, and the sales tax collected. It ensures that businesses fulfill their tax obligations accurately and on time.

How to use the 01 114 Sales Tax Form

Using the 01 114 Sales Tax Form involves several key steps. First, gather all necessary sales records and documentation for the reporting period. This includes invoices, receipts, and any other relevant financial records. Next, accurately complete the form by entering the total sales, taxable sales, and the amount of sales tax collected. After filling out the form, review it thoroughly for accuracy. Finally, submit the completed form to the appropriate state tax authority by the specified deadline.

Steps to complete the 01 114 Sales Tax Form

Completing the 01 114 Sales Tax Form requires attention to detail. Follow these steps for proper completion:

- Gather sales records for the reporting period.

- Identify total sales and taxable sales amounts.

- Calculate the sales tax collected based on applicable rates.

- Fill in the required fields on the form, ensuring accuracy.

- Double-check all entries for any errors or omissions.

- Submit the form by the deadline via the designated method.

Legal use of the 01 114 Sales Tax Form

The legal use of the 01 114 Sales Tax Form is crucial for businesses to maintain compliance with state tax laws. Filing this form accurately and on time helps avoid penalties and interest charges. It serves as a formal declaration of sales activity and tax collected, which can be audited by state tax authorities. Businesses must ensure that all information reported is truthful and complete to uphold legal standards and protect against potential legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the 01 114 Sales Tax Form vary by state and the frequency of filing required (monthly, quarterly, or annually). It is important for businesses to be aware of these deadlines to avoid late fees and penalties. Typically, forms are due on the last day of the month following the reporting period. For example, a monthly form for January would be due by the end of February. Always check with your state tax authority for specific dates and any changes in the filing schedule.

Form Submission Methods (Online / Mail / In-Person)

The 01 114 Sales Tax Form can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the state tax authority's website.

- Mailing a physical copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Choosing the appropriate submission method can help ensure timely processing and compliance with state requirements.

Quick guide on how to complete 01 114 sales tax 2015 form

Complete 01 114 Sales Tax Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Handle 01 114 Sales Tax Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign 01 114 Sales Tax Form seamlessly

- Locate 01 114 Sales Tax Form and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your needs in document management with just a few clicks from any device of your choice. Modify and eSign 01 114 Sales Tax Form and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 01 114 sales tax 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 01 114 sales tax 2015 form

How to make an electronic signature for the 01 114 Sales Tax 2015 Form online

How to generate an eSignature for the 01 114 Sales Tax 2015 Form in Chrome

How to generate an electronic signature for signing the 01 114 Sales Tax 2015 Form in Gmail

How to make an electronic signature for the 01 114 Sales Tax 2015 Form straight from your mobile device

How to generate an electronic signature for the 01 114 Sales Tax 2015 Form on iOS devices

How to make an eSignature for the 01 114 Sales Tax 2015 Form on Android

People also ask

-

What is the 01 114 Sales Tax Form?

The 01 114 Sales Tax Form is a document used by businesses to report sales tax collected to state authorities. Understanding how to properly complete this form is crucial to ensure compliance with tax regulations. Using airSlate SignNow, you can easily eSign and send your 01 114 Sales Tax Form without any hassle.

-

How does airSlate SignNow streamline the 01 114 Sales Tax Form process?

airSlate SignNow simplifies the process of completing the 01 114 Sales Tax Form by providing an intuitive interface for filling out required fields. Furthermore, you can eSign the document and send it directly to your accountant or state agency, all within the same platform. This saves you time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the 01 114 Sales Tax Form?

airSlate SignNow offers various pricing plans that cater to businesses of all sizes. Each plan includes features to help you manage and eSign documents like the 01 114 Sales Tax Form effectively. You can choose a plan that's right for your needs and budget, ensuring you get the best value for your investment.

-

Can I integrate other applications with airSlate SignNow for the 01 114 Sales Tax Form?

Yes, airSlate SignNow supports integrations with various business applications and tools that can enhance your workflow. You can connect your CRM or accounting software to manage your 01 114 Sales Tax Form and other documents more efficiently. These integrations help streamline data transfer and improve overall productivity.

-

What are the benefits of using airSlate SignNow for the 01 114 Sales Tax Form?

Using airSlate SignNow for your 01 114 Sales Tax Form offers several benefits, including increased efficiency, reduced paper usage, and enhanced security. The platform allows for quick eSigning and sharing capabilities, ensuring that your tax documents are processed faster. Additionally, your forms are securely stored and easily accessible when needed.

-

Is airSlate SignNow compliant with legal standards for the 01 114 Sales Tax Form?

Absolutely! airSlate SignNow complies with all relevant laws and regulations for electronic signatures and document management. When you use our platform for the 01 114 Sales Tax Form, you can be assured that your documents are legally binding and compliant with state requirements.

-

How secure is my data when using airSlate SignNow for the 01 114 Sales Tax Form?

Your data security is a top priority at airSlate SignNow. We employ advanced encryption and security measures to protect all documents, including the 01 114 Sales Tax Form. You can eSign and send your documents with confidence, knowing that your sensitive information is well protected.

Get more for 01 114 Sales Tax Form

- Online term change uwm form

- Form 15 certification and notice of termination of registration under section 12g or suspension of duty to file reports under

- City of redlands rebate form

- 504 plan fillable forms

- Trec fillable lease agreement form

- Notice of abandonment form az

- Sr 13 form

- Ecsu transcript form

Find out other 01 114 Sales Tax Form

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free