F8917 Form 2016

What is the F8917 Form

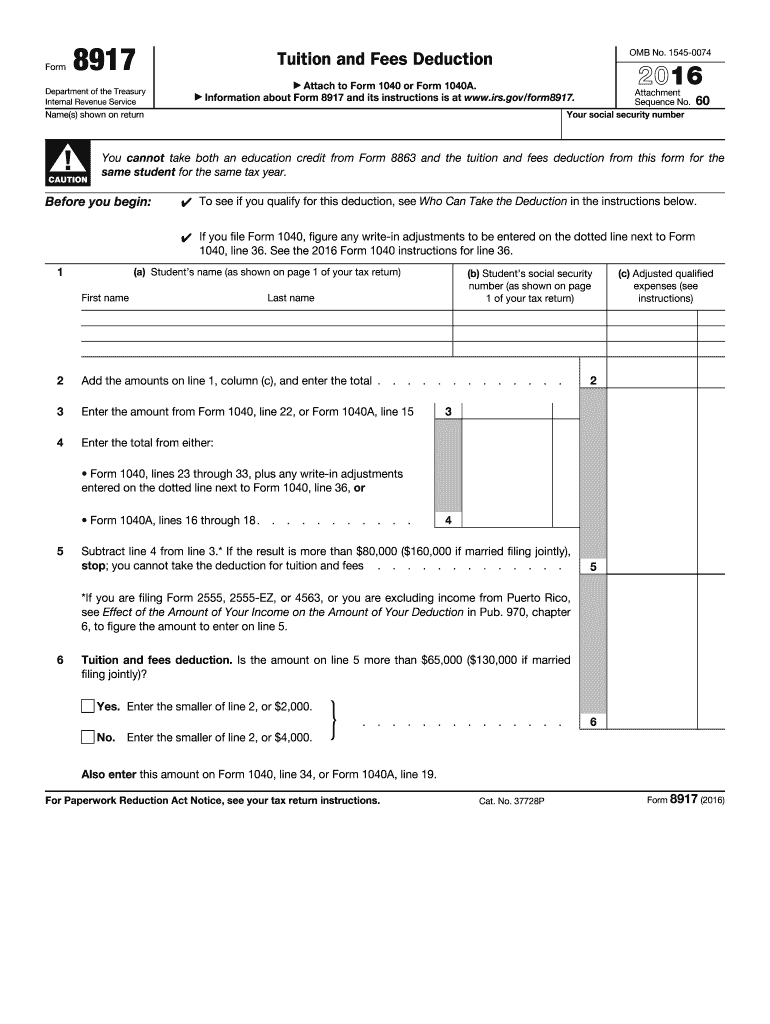

The F8917 Form is a specific tax form used by businesses and individuals in the United States for reporting certain financial information to the Internal Revenue Service (IRS). This form is often utilized to document various tax-related details, ensuring compliance with federal regulations. Understanding the purpose of the F8917 Form is essential for accurate tax reporting and maintaining good standing with the IRS.

How to use the F8917 Form

Using the F8917 Form involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents and records that pertain to the reporting period. Next, fill out the form by entering the required information in the designated fields. It is crucial to double-check all entries for accuracy before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference and the IRS guidelines.

Steps to complete the F8917 Form

Completing the F8917 Form involves a systematic approach:

- Gather relevant financial documents, including income statements and expense reports.

- Access the F8917 Form either through the IRS website or a tax preparation software.

- Fill in your personal and business information as required.

- Provide detailed financial information, ensuring all figures are accurate and complete.

- Review the form for any errors or omissions.

- Submit the completed form to the IRS, either electronically or by mail.

Legal use of the F8917 Form

The F8917 Form is legally binding when filled out and submitted according to IRS regulations. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or legal repercussions. Utilizing a reliable electronic signature solution can enhance the form's legality and security, ensuring compliance with federal eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the F8917 Form typically align with the annual tax filing dates established by the IRS. It is essential to be aware of these dates to avoid late penalties. Generally, individual taxpayers must file their forms by April 15, while businesses may have different deadlines depending on their structure. Keeping track of these important dates helps ensure timely compliance with tax obligations.

Form Submission Methods (Online / Mail / In-Person)

The F8917 Form can be submitted through various methods. Taxpayers have the option to file online using IRS-approved e-filing software, which can streamline the process and reduce errors. Alternatively, the form can be printed and mailed to the appropriate IRS address. In-person submissions are less common but may be available at certain IRS offices for those who prefer direct interaction.

Who Issues the Form

The F8917 Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers have the necessary resources to comply with federal tax laws.

Quick guide on how to complete f8917 2016 form

Effortlessly Complete F8917 Form on Any Device

Managing documents online has surged in popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents swiftly without delays. Handle F8917 Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based process today.

How to Edit and eSign F8917 Form with Ease

- Find F8917 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of the documents or hide sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal authority as a traditional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you want to send your form; via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate reprinting documents. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choosing. Edit and eSign F8917 Form to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f8917 2016 form

Create this form in 5 minutes!

How to create an eSignature for the f8917 2016 form

How to generate an electronic signature for your F8917 2016 Form online

How to generate an electronic signature for the F8917 2016 Form in Chrome

How to generate an eSignature for putting it on the F8917 2016 Form in Gmail

How to create an electronic signature for the F8917 2016 Form from your smart phone

How to create an eSignature for the F8917 2016 Form on iOS

How to create an electronic signature for the F8917 2016 Form on Android devices

People also ask

-

What is the F8917 Form and its purpose?

The F8917 Form is a vital document used for reporting certain tax obligations. It serves as a means for organizations and businesses to comply with federal tax requirements, ensuring accurate reporting and submission of necessary details to the IRS.

-

How can airSlate SignNow help with the F8917 Form?

airSlate SignNow provides an intuitive platform for electronically signing and sending the F8917 Form. Our solution simplifies the paperwork process, allowing efficient document management and ensuring compliance with all tax reporting requirements.

-

Is there a cost associated with using airSlate SignNow for the F8917 Form?

Yes, airSlate SignNow offers a cost-effective solution tailored to business needs. Pricing plans vary, allowing customers to choose a suitable option that provides access to features necessary for managing the F8917 Form and other business documents.

-

What features does airSlate SignNow offer for the F8917 Form?

airSlate SignNow includes features like customizable templates, secure eSigning, automated workflows, and document tracking specifically for the F8917 Form. These features enhance efficiency and help ensure that all documents are handled correctly and on time.

-

Can I integrate airSlate SignNow with other software for handling the F8917 Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage the F8917 Form alongside your existing tools. Whether you use CRM systems or cloud storage solutions, our platform will enhance your workflow.

-

What are the benefits of using airSlate SignNow for the F8917 Form?

Using airSlate SignNow for the F8917 Form provides numerous benefits, including faster processing times, reduced paperwork, and increased reliability. Our solution empowers businesses to efficiently manage their documents while ensuring compliance with tax regulations.

-

Is my information secure when using airSlate SignNow for the F8917 Form?

Yes, security is a top priority at airSlate SignNow. When using our platform for the F8917 Form, all data is encrypted and stored securely, ensuring that sensitive information remains protected and confidential throughout the signing and submission process.

Get more for F8917 Form

Find out other F8917 Form

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application