Form 8917 2017

What is the Form 8917

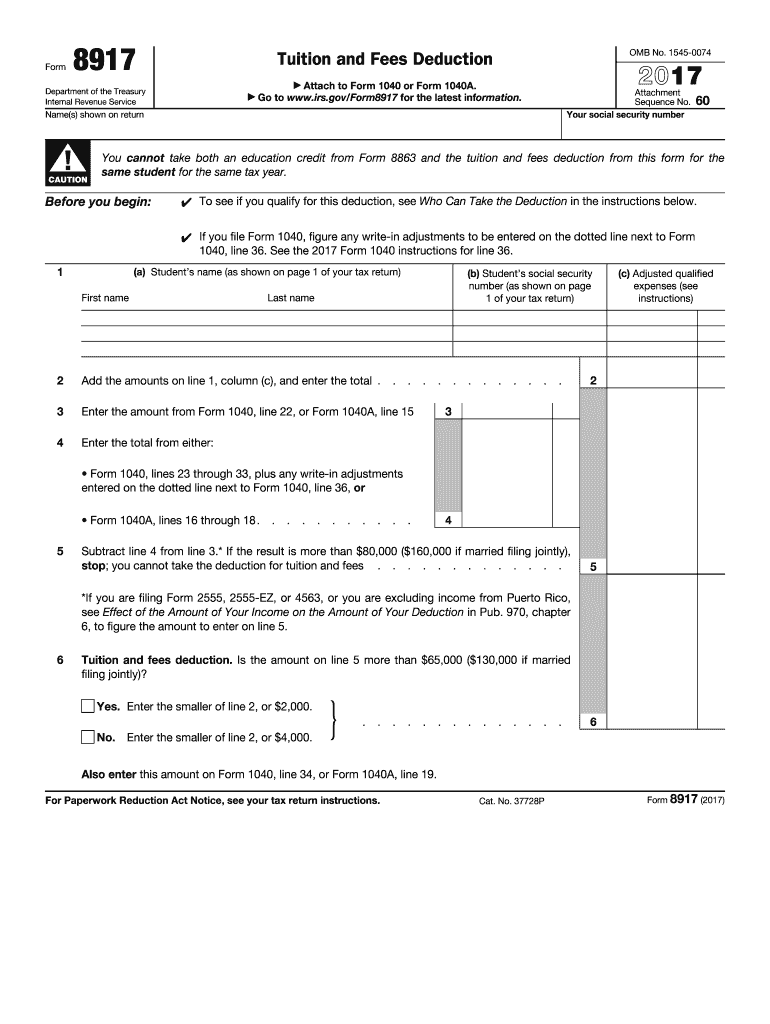

The Form 8917 is an IRS document used to claim the tuition and fees deduction for eligible students. This form allows taxpayers to deduct qualified education expenses from their taxable income, thereby reducing their overall tax liability. The deduction can be beneficial for individuals who have incurred tuition and related fees for higher education, making it an important tool for many taxpayers in the United States.

How to use the Form 8917

To use the Form 8917 effectively, taxpayers must first determine their eligibility based on the IRS guidelines. Once eligibility is confirmed, the next step is to gather all necessary documentation, including receipts for tuition payments and any other relevant educational expenses. After collecting the required information, taxpayers can fill out the form, ensuring that all sections are completed accurately. It is important to keep a copy of the form and any supporting documents for personal records and future reference.

Steps to complete the Form 8917

Completing the Form 8917 involves several key steps:

- Gather necessary documents, including tuition receipts and Form 1098-T.

- Determine the amount of qualified expenses that can be deducted.

- Fill out the form, entering personal information and the total amount of qualified expenses.

- Review the completed form for accuracy, ensuring all required fields are filled.

- Submit the form with your tax return, either electronically or by mail.

Legal use of the Form 8917

The legal use of the Form 8917 is governed by IRS regulations. Taxpayers must ensure that they meet the eligibility criteria to claim the tuition and fees deduction. This includes being enrolled in an eligible educational institution and paying qualified expenses. It is essential to use the most current version of the form and to follow all IRS guidelines to avoid any potential issues with the deduction.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8917 align with the general tax filing deadlines in the United States. Typically, individual tax returns must be filed by April 15 of each year. If taxpayers are claiming the tuition and fees deduction, they should ensure that the form is submitted along with their tax return by this date. Extensions may be available, but it is crucial to check IRS guidelines for specific details regarding extensions and late filings.

Eligibility Criteria

To qualify for the tuition and fees deduction using Form 8917, taxpayers must meet specific eligibility criteria:

- The taxpayer must be responsible for paying qualified education expenses.

- The student must be enrolled at an eligible educational institution.

- Qualified expenses must be incurred for higher education, including tuition and certain fees.

- The deduction is subject to income limits, which may affect eligibility.

Quick guide on how to complete f8917 2017 form

Discover the simplest method to complete and endorse your Form 8917

Are you still spending time preparing your official documents on paper instead of handling them online? airSlate SignNow offers a superior way to fulfill and endorse your Form 8917 and comparable forms for public services. Our intelligent eSignature solution equips you with everything necessary to manage your paperwork swiftly and in compliance with official standards - robust PDF editing, handling, safeguarding, signing, and sharing tools all available within a user-friendly environment.

Only a few steps are necessary to complete and endorse your Form 8917:

- Incorporate the fillable template to the editor by utilizing the Get Form button.

- Verify what information you must include in your Form 8917.

- Navigate through the fields using the Next option to ensure nothing is overlooked.

- Employ Text, Check, and Cross tools to fill in the gaps with your information.

- Modify the content using Text boxes or Images from the upper toolbar.

- Emphasize what is truly signNow or Conceal areas that are no longer relevant.

- Select Sign to generate a legally valid eSignature using any method you prefer.

- Include the Date beside your signature and conclude your task with the Done button.

Store your completed Form 8917 in the Documents folder within your profile, download it, or transfer it to your selected cloud storage. Our service also provides versatile file sharing. There's no need to print your forms when you can submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct f8917 2017 form

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

Create this form in 5 minutes!

How to create an eSignature for the f8917 2017 form

How to create an eSignature for your F8917 2017 Form in the online mode

How to generate an eSignature for your F8917 2017 Form in Chrome

How to create an electronic signature for putting it on the F8917 2017 Form in Gmail

How to create an eSignature for the F8917 2017 Form from your smart phone

How to generate an eSignature for the F8917 2017 Form on iOS devices

How to make an eSignature for the F8917 2017 Form on Android devices

People also ask

-

What is Form 8917 and how can it help me?

Form 8917 is used to claim the Tuition and Fees Deduction on your federal tax return. This form can help reduce your taxable income if you paid qualified education expenses. Understanding how to fill out Form 8917 accurately can maximize your potential tax benefits.

-

How do I fill out Form 8917 using airSlate SignNow?

Using airSlate SignNow, you can easily fill out Form 8917 by uploading your completed document or creating a new one. Our platform allows you to add signatures and necessary fields seamlessly, ensuring your form is ready for submission. With our user-friendly interface, completing Form 8917 has never been easier.

-

Is airSlate SignNow a cost-effective solution for managing Form 8917?

Yes, airSlate SignNow offers a cost-effective solution for managing your Form 8917 and other important documents. With competitive pricing plans, you can streamline your document signing process without breaking the bank. Our solution provides great value, especially for those who need to manage multiple forms like Form 8917 throughout the year.

-

What features does airSlate SignNow offer for Form 8917?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and real-time tracking for Form 8917. These tools simplify the process of completing and sending your form, ensuring that you meet deadlines and maintain compliance. Additionally, our platform supports electronic signatures, making it easy to finalize your Form 8917 quickly.

-

Can I integrate airSlate SignNow with other applications to manage Form 8917?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Microsoft Office. This means you can easily access and manage your Form 8917 alongside your other documents, enhancing your workflow efficiency. Our integrations allow for a more cohesive document management experience.

-

How secure is my information when using airSlate SignNow for Form 8917?

Your information is highly secure when using airSlate SignNow for Form 8917. We employ advanced encryption methods and comply with industry standards to protect your sensitive data. You can trust that your personal and financial information related to Form 8917 is safeguarded throughout the signing process.

-

What are the benefits of using airSlate SignNow for Form 8917 over traditional methods?

Using airSlate SignNow for Form 8917 offers numerous benefits over traditional methods, including faster processing times and reduced paperwork. Electronic signatures eliminate the need for printing and scanning, saving you time and effort. Additionally, you can access your Form 8917 from anywhere, making it easier to manage your tax documents on the go.

Get more for Form 8917

Find out other Form 8917

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form