Form 8917 2011

What is the Form 8917

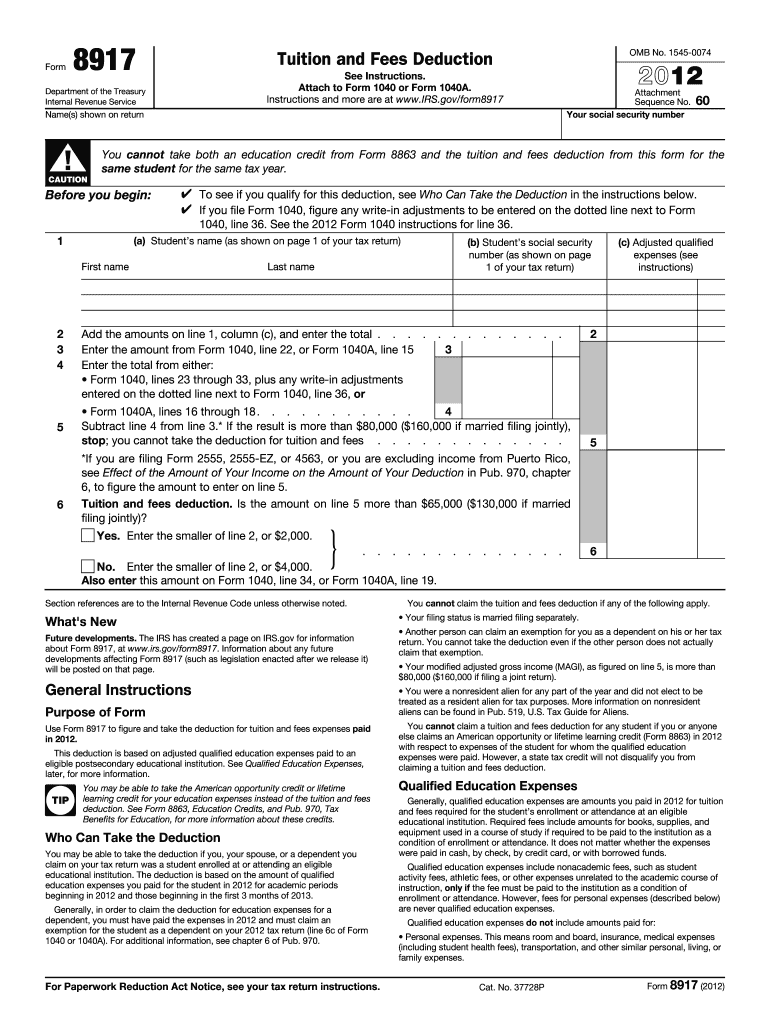

The Form 8917 is a tax document used by individuals in the United States to claim the Tuition and Fees Deduction. This form allows eligible taxpayers to deduct qualified education expenses from their taxable income, potentially reducing their overall tax liability. The deduction is designed to assist students and their families in managing the costs associated with higher education. Understanding the specifics of this form is essential for anyone looking to benefit from educational tax breaks.

How to use the Form 8917

To effectively use Form 8917, taxpayers must first determine their eligibility for the Tuition and Fees Deduction. This involves identifying qualified education expenses, which may include tuition, fees, and certain related expenses. Once eligibility is confirmed, the form must be filled out accurately, reflecting the total amount of qualified expenses. After completing the form, it should be submitted with your federal tax return, either electronically or via mail, depending on your filing method.

Steps to complete the Form 8917

Completing Form 8917 involves several key steps:

- Gather necessary documentation, including Form 1098-T from educational institutions.

- Determine the total qualified education expenses incurred during the tax year.

- Fill out the form, entering personal information and the total qualified expenses.

- Calculate the deduction amount based on the total expenses and any applicable limits.

- Review the completed form for accuracy before submission.

Legal use of the Form 8917

Form 8917 is legally recognized as a valid means for claiming the Tuition and Fees Deduction under U.S. tax law. To ensure compliance, taxpayers must adhere to the guidelines set forth by the IRS regarding eligibility and qualified expenses. It is crucial to maintain accurate records of all educational expenses and to submit the form within the designated filing periods. Failure to comply with these regulations may result in penalties or disallowance of the deduction.

Filing Deadlines / Important Dates

To ensure the timely processing of Form 8917, it is important to be aware of key filing deadlines. Typically, the deadline for submitting your federal tax return, along with Form 8917, is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also consider any state-specific deadlines that may apply to their tax filings.

Eligibility Criteria

To qualify for the Tuition and Fees Deduction using Form 8917, taxpayers must meet specific eligibility criteria. This includes being a student enrolled in an eligible educational institution, incurring qualified education expenses, and having a modified adjusted gross income below certain thresholds. Additionally, taxpayers cannot claim the deduction if they are married filing separately or if they are claimed as a dependent on someone else's tax return.

Quick guide on how to complete form 8917 2011

Effortlessly Prepare Form 8917 on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily locate the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without delays. Manage Form 8917 on any device with the airSlate SignNow applications for Android or iOS, and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Form 8917 with Ease

- Find Form 8917 and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred delivery method for your form, by email, SMS, or invitation link, or download it to your computer.

Leave behind the worries of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Form 8917 and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8917 2011

Create this form in 5 minutes!

How to create an eSignature for the form 8917 2011

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is Form 8917 and why do I need it?

Form 8917 is used for claiming the Tuition and Fees Deduction on your federal tax return. It helps reduce your taxable income based on qualified education expenses, making it a vital tool for taxpayers seeking to maximize their education-related deductions.

-

How can airSlate SignNow assist with completing Form 8917?

airSlate SignNow offers a user-friendly platform to prepare, send, and eSign Form 8917 efficiently. With its straightforward document management capabilities, you can easily fill out the necessary details and obtain required signatures, ensuring a smooth submission process.

-

Is there a cost associated with using airSlate SignNow for Form 8917?

Yes, airSlate SignNow provides a cost-effective solution with various pricing plans tailored to meet businesses’ needs. Whether you’re an individual or a large organization, you can choose a plan that fits your workflow for handling documents like Form 8917.

-

What features does airSlate SignNow offer for managing Form 8917?

airSlate SignNow includes features such as document templates, automated workflows, and real-time tracking. These tools streamline the process of preparing Form 8917, allowing you to ensure accuracy and compliance effortlessly.

-

How does airSlate SignNow ensure the security of my Form 8917?

Security is a top priority for airSlate SignNow, which employs advanced encryption protocols and secure cloud storage. Your Form 8917 and other documents are protected against unauthorized access, ensuring your sensitive information remains confidential.

-

Can I integrate airSlate SignNow with other software to help with Form 8917?

Absolutely! airSlate SignNow seamlessly integrates with various tools and platforms, enhancing your workflow. This allows you to pull data directly into your Form 8917 from existing systems, saving you time and reducing the risk of errors.

-

What are the benefits of using airSlate SignNow for Form 8917?

Using airSlate SignNow for Form 8917 provides efficiency, accuracy, and convenience. The easy-to-use interface minimizes time spent on document handling, while electronic signatures expedite the approval process, so you can submit your forms faster.

Get more for Form 8917

- Applying to hong kong banks results after visiting 20 in 2 form

- Copy n 1 in case of acceptance to be returned by the form

- Salvation army receipt form

- Limited warranty for small packaged products form

- Ashgrove marketing 2016 calendar order form p

- New student tuition ampamp fee scheduleinternational school of form

- Ncsf recertification form

- Hanger plate carrier with form

Find out other Form 8917

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast