14654 Form 2016

What is the 14654 Form

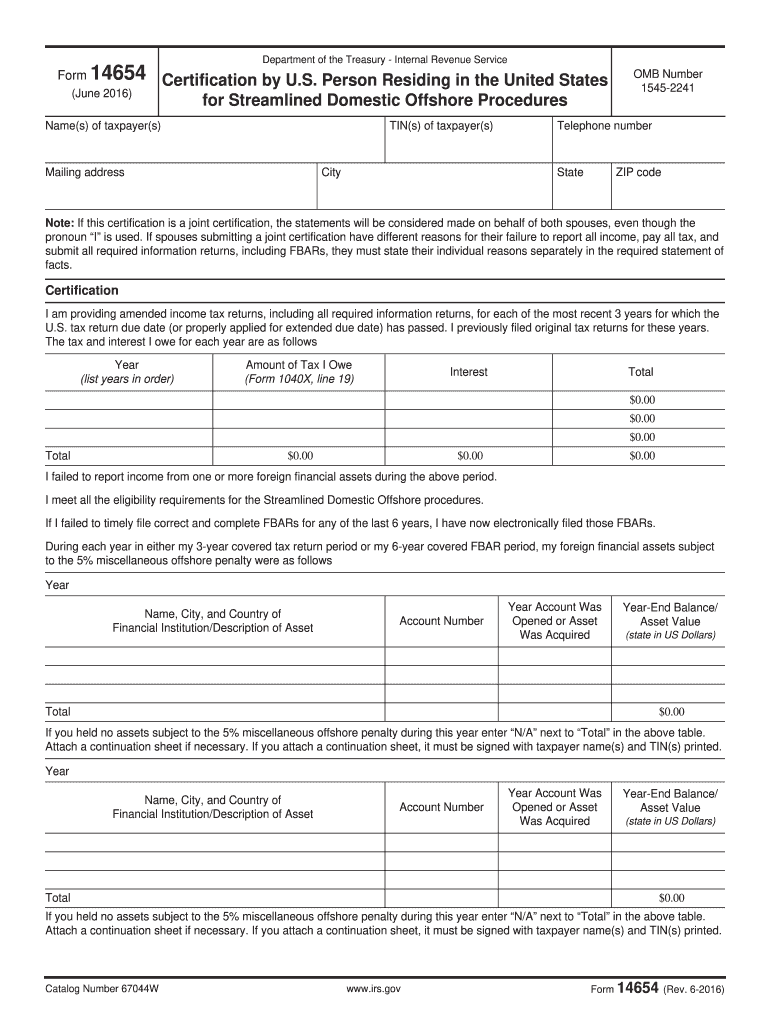

The 14654 Form is a specific document used primarily for regulatory or compliance purposes within various sectors. It serves as a formal means of communication between individuals or businesses and governing bodies. Understanding its purpose is crucial for ensuring proper usage and compliance with applicable regulations.

How to use the 14654 Form

Using the 14654 Form involves several straightforward steps. First, ensure you have the most current version of the form. Next, fill in the required fields accurately, providing all necessary information as specified. Once completed, review the form for any errors or omissions. Finally, submit the form according to the guidelines provided, whether online, by mail, or in person.

Steps to complete the 14654 Form

Completing the 14654 Form requires attention to detail. Follow these steps for successful completion:

- Download the latest version of the 14654 Form from a reliable source.

- Read the instructions carefully to understand the requirements.

- Fill in your personal or business information as required.

- Double-check all entries for accuracy.

- Sign and date the form where indicated.

- Submit the form through the designated method.

Legal use of the 14654 Form

The legal use of the 14654 Form is critical for ensuring compliance with relevant laws and regulations. This form must be completed accurately and submitted in accordance with established guidelines to be considered valid. Failure to adhere to these legal requirements can result in penalties or delays in processing.

Examples of using the 14654 Form

There are various scenarios in which the 14654 Form may be utilized. For instance, businesses may use it to report compliance with industry standards, while individuals may need it for personal legal matters. Each use case emphasizes the importance of accurate completion and timely submission to avoid complications.

Form Submission Methods (Online / Mail / In-Person)

The 14654 Form can typically be submitted through multiple methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission via a secure portal.

- Mailing a hard copy to the designated office.

- Delivering the form in person to a local office.

Choosing the appropriate method is essential for ensuring that the form is received and processed without delay.

Quick guide on how to complete 14654 2016 form

Easily prepare 14654 Form on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed papers, as you can easily locate the correct form and safely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents quickly without any delays. Handle 14654 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

The simplest way to edit and electronically sign 14654 Form effortlessly

- Locate 14654 Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your alterations.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searches, or errors that require printing new copies of documents. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign 14654 Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 14654 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 14654 2016 form

How to generate an eSignature for the 14654 2016 Form in the online mode

How to generate an electronic signature for your 14654 2016 Form in Google Chrome

How to create an electronic signature for putting it on the 14654 2016 Form in Gmail

How to generate an electronic signature for the 14654 2016 Form straight from your smartphone

How to make an electronic signature for the 14654 2016 Form on iOS

How to create an eSignature for the 14654 2016 Form on Android OS

People also ask

-

What is the 14654 Form and how can it be used with airSlate SignNow?

The 14654 Form is a specific document that businesses may need for various administrative processes. With airSlate SignNow, you can easily upload the 14654 Form, send it for electronic signatures, and track its status in real-time, streamlining your workflow.

-

How does airSlate SignNow ensure the security of my 14654 Form?

airSlate SignNow prioritizes security by using advanced encryption protocols to protect your 14654 Form during transmission and storage. Our platform complies with industry standards and regulations, ensuring that your sensitive information remains confidential and secure.

-

Can I customize the 14654 Form within airSlate SignNow?

Yes, airSlate SignNow allows you to customize the 14654 Form to suit your specific needs. You can add fields, modify text, and incorporate your branding elements, ensuring the form aligns with your business requirements.

-

What are the pricing options for using airSlate SignNow for the 14654 Form?

airSlate SignNow offers flexible pricing plans to cater to different business needs, including a free trial. Pricing is based on the features you require, allowing you to efficiently manage the 14654 Form without overspending.

-

Can I integrate airSlate SignNow with other applications for managing the 14654 Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM and document management systems, which enhances the process of handling the 14654 Form. This integration allows for a more streamlined workflow and improved efficiency.

-

What are the benefits of using airSlate SignNow for the 14654 Form?

Using airSlate SignNow for the 14654 Form provides numerous benefits, such as faster processing times, reduced paperwork, and improved accuracy. By leveraging our electronic signature capabilities, you can enhance productivity and ensure compliance with legal requirements.

-

Is it easy to train my team to use airSlate SignNow for the 14654 Form?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for your team to learn how to use it for the 14654 Form. We also provide comprehensive resources and customer support to ensure a smooth onboarding experience.

Get more for 14654 Form

Find out other 14654 Form

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself