Form 48020 Puerto Rico 2017

What is the Form 48020 Puerto Rico

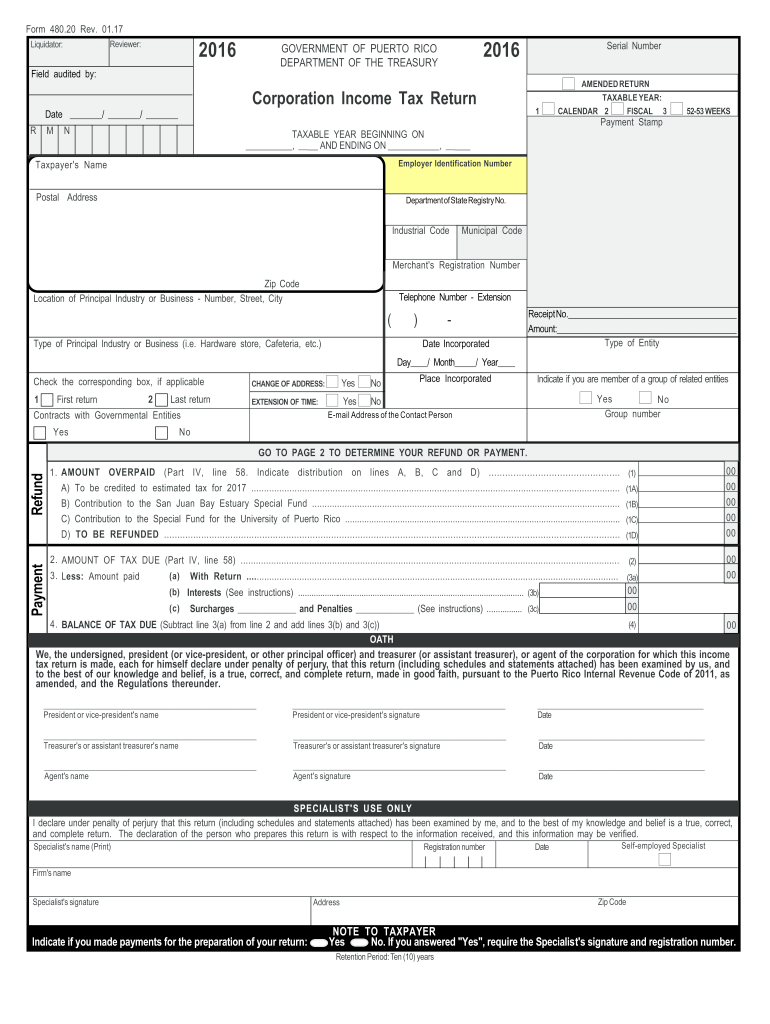

The Form 48020 Puerto Rico is a tax form used by individuals and businesses in Puerto Rico to report income and calculate tax liabilities. This form is essential for ensuring compliance with Puerto Rican tax regulations. It is primarily utilized for reporting income earned within the territory and is a crucial part of the tax filing process for residents and businesses operating in Puerto Rico.

How to use the Form 48020 Puerto Rico

Using the Form 48020 Puerto Rico involves several steps to ensure accurate reporting of income. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form with detailed information about your income sources, deductions, and credits. It's important to review the completed form for accuracy before submission. Once finalized, the form can be submitted electronically or via mail, depending on your preference and compliance with local regulations.

Steps to complete the Form 48020 Puerto Rico

Completing the Form 48020 Puerto Rico requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, such as W-2s, 1099s, and any other income-related paperwork.

- Fill in personal identification information, including your name, address, and taxpayer identification number.

- Report all sources of income, ensuring to include both earned and unearned income.

- Calculate any deductions or credits you may be eligible for, and apply them to your total income.

- Review the completed form for any errors or omissions.

- Submit the form either electronically through an approved platform or by mailing it to the appropriate tax authority.

Legal use of the Form 48020 Puerto Rico

The legal use of the Form 48020 Puerto Rico is governed by local tax laws and regulations. It is crucial that individuals and businesses complete the form accurately to avoid penalties or legal issues. The form serves as a declaration of income and is used by the Puerto Rican government to assess tax obligations. Failure to file or inaccuracies in reporting can lead to fines or other legal repercussions, making it essential to ensure compliance with all applicable laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 48020 Puerto Rico are typically aligned with the tax year, which runs from January first to December thirty-first. Taxpayers must file their forms by the designated deadline to avoid penalties. It is advisable to check the official tax authority announcements for any updates or changes to filing dates, as these can vary from year to year.

Form Submission Methods (Online / Mail / In-Person)

The Form 48020 Puerto Rico can be submitted through various methods to accommodate different preferences. Taxpayers can choose to file online using approved electronic filing platforms, which often provide a more efficient process. Alternatively, the form can be mailed directly to the tax authority or submitted in person at designated offices. Each method has its own set of guidelines and requirements, so it is important to follow the instructions specific to the chosen submission method.

Quick guide on how to complete 2011 form 48020 puerto rico 2017

Accomplish Form 48020 Puerto Rico seamlessly on any gadget

Digital document management has gained increased popularity among businesses and individuals alike. It presents an ideal sustainable option to conventional printed and signed documents, allowing you to access the right template and securely save it online. airSlate SignNow provides all the tools necessary to generate, edit, and electronically sign your documents swiftly without delays. Handle Form 48020 Puerto Rico on any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The simplest way to edit and electronically sign Form 48020 Puerto Rico effortlessly

- Locate Form 48020 Puerto Rico and then click Obtain Form to begin.

- Make use of the tools we provide to finish your document.

- Emphasize essential sections of your documents or conceal sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Completed button to save your changes.

- Select how you wish to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign Form 48020 Puerto Rico and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form 48020 puerto rico 2017

Create this form in 5 minutes!

How to create an eSignature for the 2011 form 48020 puerto rico 2017

How to make an electronic signature for the 2011 Form 48020 Puerto Rico 2017 online

How to make an eSignature for your 2011 Form 48020 Puerto Rico 2017 in Chrome

How to make an eSignature for signing the 2011 Form 48020 Puerto Rico 2017 in Gmail

How to create an eSignature for the 2011 Form 48020 Puerto Rico 2017 straight from your smart phone

How to make an electronic signature for the 2011 Form 48020 Puerto Rico 2017 on iOS devices

How to create an electronic signature for the 2011 Form 48020 Puerto Rico 2017 on Android devices

People also ask

-

What is Form 48020 Puerto Rico?

Form 48020 Puerto Rico is a tax form used by individuals and businesses in Puerto Rico to report certain types of income. This form is essential for ensuring compliance with local tax regulations and aids in the accurate reporting of financial information to the Puerto Rico Department of Treasury.

-

How can airSlate SignNow help with Form 48020 Puerto Rico?

airSlate SignNow offers a seamless platform for preparing, signing, and sending Form 48020 Puerto Rico electronically. The easy-to-use interface allows users to complete the form quickly, ensuring that all necessary signatures are collected in a timely manner.

-

Is there a cost associated with using airSlate SignNow for Form 48020 Puerto Rico?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs. Users can choose a plan that best fits their requirements while enjoying tools specifically designed to simplify the management of Form 48020 Puerto Rico.

-

What features does airSlate SignNow offer for Form 48020 Puerto Rico?

airSlate SignNow includes features such as customizable templates for Form 48020 Puerto Rico, cloud storage for easy document access, and eSignature capabilities. These features simplify the entire process of completing and submitting the form.

-

Can I collaborate with others using airSlate SignNow for Form 48020 Puerto Rico?

Absolutely! airSlate SignNow allows multiple users to collaborate on preparing Form 48020 Puerto Rico. You can easily share documents, track changes, and collect signatures from different individuals, ensuring efficient teamwork.

-

How secure is airSlate SignNow when handling Form 48020 Puerto Rico?

airSlate SignNow prioritizes the security of your documents, including Form 48020 Puerto Rico. With industry-standard encryption and authentication features, you can rest assured that your sensitive information will remain confidential and secure.

-

Does airSlate SignNow integrate with other software for Form 48020 Puerto Rico?

Yes, airSlate SignNow offers integrations with popular applications and services, enhancing the usability of Form 48020 Puerto Rico. This means you can easily import data or streamline document workflows with your existing tools.

Get more for Form 48020 Puerto Rico

Find out other Form 48020 Puerto Rico

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now