Field Audited by 2022-2026

Filing Deadlines / Important Dates

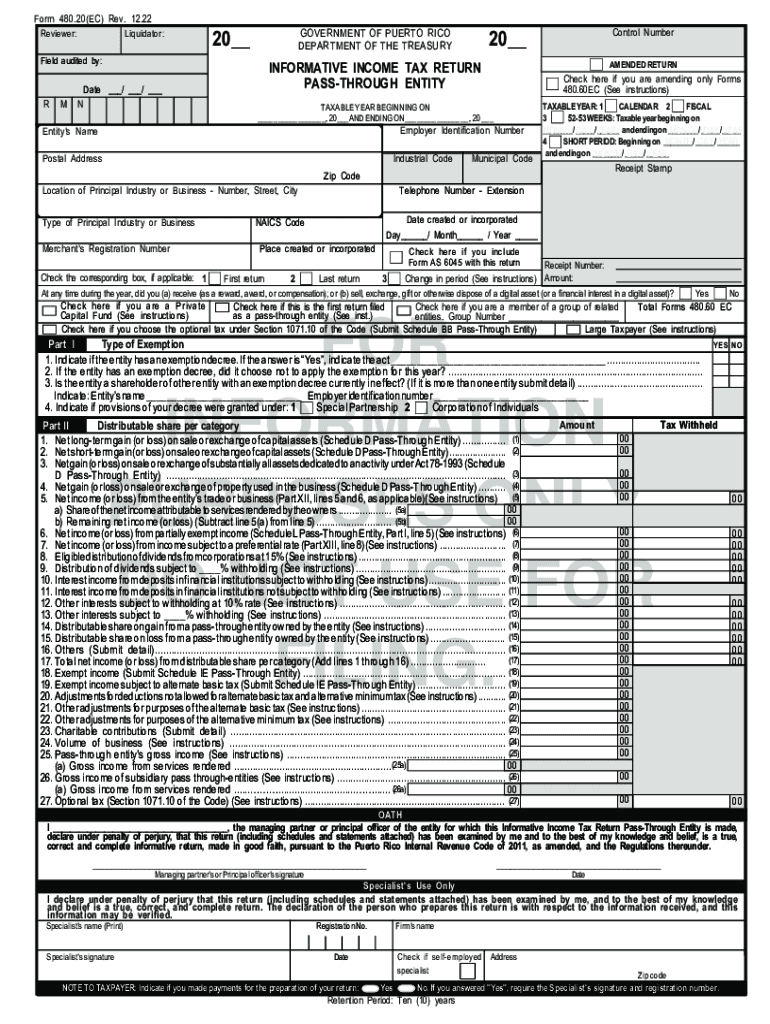

Understanding the filing deadlines for the Puerto Rico corporation tax return is crucial for compliance. Generally, corporations must file their income tax returns by the fifteenth day of the fourth month following the end of their fiscal year. For corporations operating on a calendar year basis, this means the return is due on April 15. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, if a corporation requires an extension, it must file Form 480.70 and pay any estimated taxes owed by the original deadline.

Required Documents

To complete the Puerto Rico corporation income tax return, businesses need to gather several essential documents. These typically include:

- Financial statements for the fiscal year

- Form 480.20, which reports income and deductions

- Form 480.30, detailing credits and payments

- Any supporting documentation for deductions and credits claimed

Having these documents organized will facilitate a smoother filing process and help ensure accuracy in reporting.

Steps to Complete the Puerto Rico Corporation Tax Return

Completing the Puerto Rico corporation income tax return involves several key steps:

- Gather all necessary financial documents and forms.

- Calculate total income and allowable deductions for the fiscal year.

- Complete Form 480.20, ensuring all income and deductions are accurately reported.

- Fill out Form 480.30 to claim any applicable tax credits.

- Review all entries for accuracy and completeness.

- Submit the forms either electronically or via mail by the deadline.

Following these steps will help ensure compliance with Puerto Rico's tax regulations.

Penalties for Non-Compliance

Failure to file the Puerto Rico corporation tax return on time can result in significant penalties. Corporations may face fines based on the amount of tax owed. Additionally, late payments can incur interest charges, compounding the financial burden. It is essential for businesses to stay informed about their filing obligations to avoid these penalties, which can impact overall financial health.

Form Submission Methods (Online / Mail / In-Person)

Corporations have several options for submitting their Puerto Rico corporation income tax return. The preferred method is electronic filing, which can be done through the Puerto Rico Department of Treasury's online portal. This method is efficient and often results in faster processing times. Alternatively, businesses can mail their completed forms to the appropriate tax office. For those who prefer in-person submissions, visiting a local tax office is also an option. Regardless of the method chosen, ensuring that the return is filed by the deadline is critical.

IRS Guidelines

While the Puerto Rico corporation tax return is primarily governed by local tax laws, it is also important for businesses to consider IRS guidelines. Corporations operating in both Puerto Rico and the mainland United States must comply with federal tax obligations as well. This includes understanding how income generated in Puerto Rico is reported on federal tax returns. Consulting with a tax professional can help navigate these complexities and ensure compliance with both local and federal requirements.

Quick guide on how to complete field audited by

Complete Field Audited By smoothly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents promptly without delays. Handle Field Audited By on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign Field Audited By with ease

- Locate Field Audited By and then click Get Form to initiate.

- Utilize the tools available to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details carefully, then click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Alter and eSign Field Audited By to ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct field audited by

Create this form in 5 minutes!

How to create an eSignature for the field audited by

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing a Puerto Rico corporation tax return using airSlate SignNow?

Filing a Puerto Rico corporation tax return with airSlate SignNow is straightforward. You can easily upload your necessary documents, eSign them, and send them to the appropriate tax authorities. Our platform ensures that your filings comply with local regulations while simplifying the entire process.

-

Are there any specific features in airSlate SignNow designed for Puerto Rico corporation tax return?

Yes, airSlate SignNow offers features specifically tailored for Puerto Rico corporation tax return needs. These include customizable templates, compliance reminders, and secure document storage. These features help streamline the tax return process and keep sensitive information safe.

-

How does airSlate SignNow enhance the efficiency of preparing a Puerto Rico corporation tax return?

airSlate SignNow enhances the efficiency of preparing your Puerto Rico corporation tax return by providing an intuitive interface and seamless document management. You can collaborate with team members in real time, which reduces errors and speeds up the overall preparation time. This means your tax returns can be filed more quickly and accurately.

-

What are the pricing options for airSlate SignNow when managing a Puerto Rico corporation tax return?

AirSlate SignNow offers competitive pricing plans that cater to businesses of all sizes handling Puerto Rico corporation tax returns. Each plan includes access to essential features, including document eSigning and management, with options to scale as your business grows. For specific pricing details, visit our pricing page.

-

Can airSlate SignNow integrate with accounting software for filing a Puerto Rico corporation tax return?

Absolutely! airSlate SignNow can integrate with popular accounting software, making it easier for you to manage your Puerto Rico corporation tax return processes. This integration allows you to import data directly to your tax forms, minimizing data entry and maximizing accuracy.

-

What benefits does airSlate SignNow provide for remote teams preparing a Puerto Rico corporation tax return?

AirSlate SignNow provides signNow benefits for remote teams, including cloud-based access, eSigning capabilities, and real-time collaboration. This means that team members can work together on the Puerto Rico corporation tax return from anywhere, ensuring that your filings are completed on time, no matter where your team is located.

-

Is airSlate SignNow compliant with Puerto Rico’s tax regulations for corporation tax returns?

Yes, airSlate SignNow ensures compliance with Puerto Rico's tax regulations for corporation tax returns. Our platform is regularly updated to reflect any changes in tax law, and we provide resources to guide you through the compliance process. Rest assured, your documentation is securely handled to meet all regulatory requirements.

Get more for Field Audited By

- Small claims va atj virginia judicial system court self help form

- Statement of claim and notice disagreement court forms

- Form 5dc50

- Temporary restraining order washington state courts form

- How to file for divorce in hawaii step by step guide form

- Self help information divorce familylawhelporghi

- Form 5dc53

- Form 5dc54

Find out other Field Audited By

- Sign Vermont Independent Contractor Agreement Template Free

- Sign Wisconsin Termination Letter Template Free

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement