Form 48020 Puerto Rico 2016

What is the Form 48020 Puerto Rico

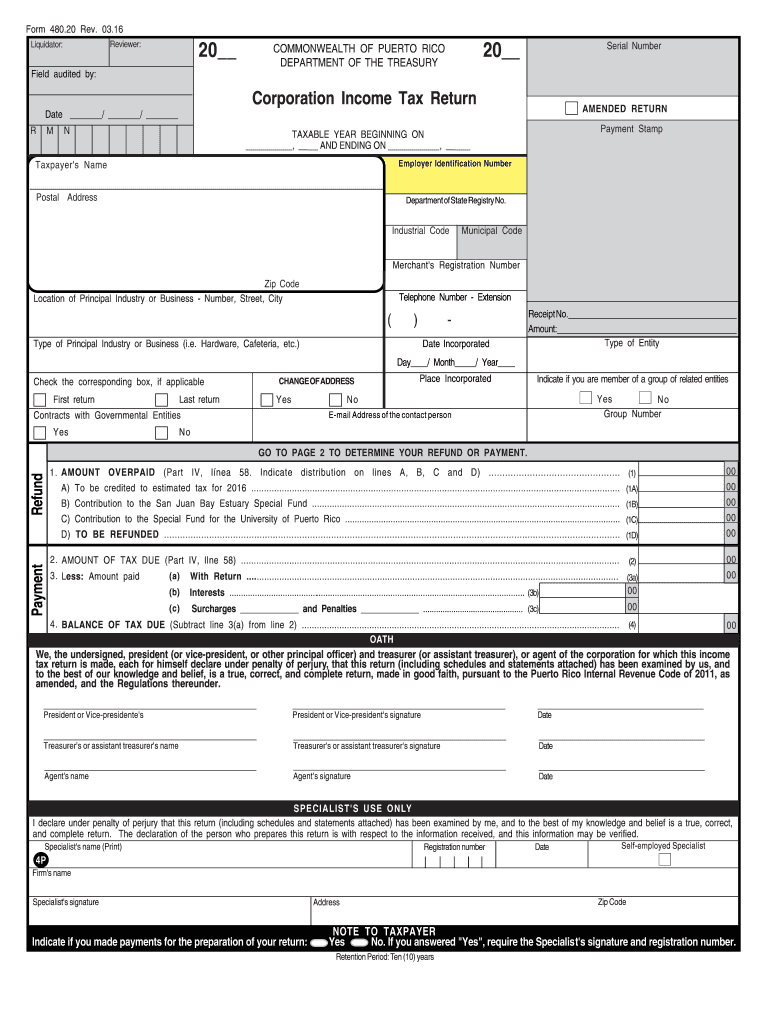

The Form 48020 Puerto Rico is a tax form used primarily for reporting income and expenses for individuals and businesses operating in Puerto Rico. This form is essential for ensuring compliance with local tax regulations and is utilized by both residents and non-residents who earn income within the territory. Understanding the purpose of this form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Form 48020 Puerto Rico

Using the Form 48020 Puerto Rico involves several steps that ensure proper completion and submission. First, gather all necessary financial documents, including income statements and expense receipts. Next, fill out the form accurately, providing detailed information about your income sources and deductions. It is important to review the completed form for any errors before submission. Finally, submit the form according to the guidelines provided by the Puerto Rico Department of Treasury.

Steps to complete the Form 48020 Puerto Rico

Completing the Form 48020 Puerto Rico requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the Puerto Rico Department of Treasury.

- Provide personal information, including your name, address, and taxpayer identification number.

- Report all sources of income, ensuring to include any applicable deductions.

- Verify all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form 48020 Puerto Rico

The legal use of the Form 48020 Puerto Rico is governed by the tax laws of Puerto Rico. To ensure compliance, it is essential to follow all regulations regarding the reporting of income. The form must be submitted by the designated deadline, and any discrepancies may lead to audits or penalties. Utilizing electronic signature solutions can enhance the legal validity of the form, ensuring that it meets all necessary requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form 48020 Puerto Rico are critical to avoid penalties. Typically, the form must be submitted by the specified date each year, which aligns with the tax season in Puerto Rico. It is advisable to keep track of any changes to deadlines announced by the Puerto Rico Department of Treasury to ensure timely filing.

Required Documents

To complete the Form 48020 Puerto Rico, certain documents are required. These include:

- Income statements, such as W-2 forms or 1099 forms.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

Having these documents ready will facilitate a smoother completion process.

Quick guide on how to complete 2011 form 48020 puerto rico 2016

Effortlessly Prepare Form 48020 Puerto Rico on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely keep it online. airSlate SignNow provides you with all the resources to create, edit, and electronically sign your documents quickly and without hold-ups. Handle Form 48020 Puerto Rico on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related procedure today.

How to modify and eSign Form 48020 Puerto Rico with ease

- Obtain Form 48020 Puerto Rico and click Get Form to begin.

- Utilize the available tools to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that task.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 48020 Puerto Rico to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 form 48020 puerto rico 2016

Create this form in 5 minutes!

How to create an eSignature for the 2011 form 48020 puerto rico 2016

How to create an electronic signature for the 2011 Form 48020 Puerto Rico 2016 in the online mode

How to create an electronic signature for your 2011 Form 48020 Puerto Rico 2016 in Chrome

How to generate an eSignature for putting it on the 2011 Form 48020 Puerto Rico 2016 in Gmail

How to create an eSignature for the 2011 Form 48020 Puerto Rico 2016 straight from your smart phone

How to create an eSignature for the 2011 Form 48020 Puerto Rico 2016 on iOS

How to create an eSignature for the 2011 Form 48020 Puerto Rico 2016 on Android devices

People also ask

-

What is Form 48020 Puerto Rico?

Form 48020 Puerto Rico is a tax form used by businesses to report income and withholding information for certain transactions. This form is essential for compliance with Puerto Rico's tax regulations. Understanding its requirements helps ensure that businesses avoid potential penalties.

-

How can airSlate SignNow help with Form 48020 Puerto Rico?

airSlate SignNow offers an efficient platform for electronically signing and managing Form 48020 Puerto Rico and other documents. With our user-friendly interface, businesses can streamline the signing process, ensuring timely and compliant submissions. This helps save time and improves overall workflow.

-

Is airSlate SignNow a cost-effective solution for managing Form 48020 Puerto Rico?

Yes, airSlate SignNow provides a cost-effective solution for managing Form 48020 Puerto Rico, with flexible pricing plans tailored to different business needs. Our platform minimizes paper use and reduces administrative costs, making it an economical choice for businesses of all sizes. Enjoy the benefits of an affordable, digital workflow.

-

What features does airSlate SignNow offer for handling Form 48020 Puerto Rico?

airSlate SignNow offers several features that simplify handling Form 48020 Puerto Rico, including document templates, secure eSignatures, and real-time tracking. These features enhance efficiency and ensure that all parties are informed throughout the signing process. Additionally, our robust security measures protect sensitive information.

-

Can I integrate airSlate SignNow with other platforms for Form 48020 Puerto Rico?

Yes, airSlate SignNow seamlessly integrates with various platforms and applications, making it easier to manage Form 48020 Puerto Rico within your existing workflows. Our integrations allow for effortless data syncing and document sharing, enhancing productivity and collaboration across teams. Discover how our solution can fit into your business ecosystem.

-

What are the benefits of using airSlate SignNow for Form 48020 Puerto Rico submissions?

Using airSlate SignNow for Form 48020 Puerto Rico submissions offers benefits such as improved efficiency, enhanced security, and easier tracking of document status. Our digital solution allows for faster processing times and eliminates the need for physical paperwork, signNowly reducing overhead costs. Experience hassle-free document management today.

-

Is it easy to get started with airSlate SignNow for Form 48020 Puerto Rico?

Absolutely! Getting started with airSlate SignNow for managing Form 48020 Puerto Rico is simple and intuitive. New users can quickly navigate our platform, access resources, and take advantage of our customer support. Join us to simplify your document workflow with minimal setup time.

Get more for Form 48020 Puerto Rico

Find out other Form 48020 Puerto Rico

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile