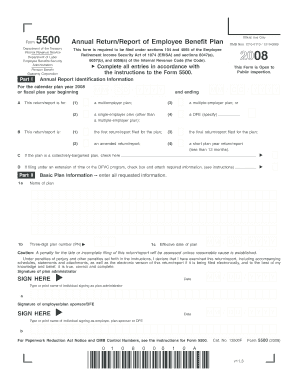

Form5500 Annual ReturnReport of Employee Benefit Plan Kaiser 2008

What is the Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser

The Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser is a crucial document required by the Employee Retirement Income Security Act (ERISA). It serves as an annual report that provides essential information about employee benefit plans. This form ensures compliance with federal regulations and offers transparency regarding the financial status and operations of the benefit plans. The information reported includes details about plan assets, liabilities, and operations, which helps the Department of Labor and other stakeholders monitor the health of employee benefit plans.

Steps to complete the Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser

Completing the Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser involves several key steps to ensure accuracy and compliance:

- Gather necessary information about the employee benefit plan, including plan documents, financial statements, and participant data.

- Access the appropriate version of the Form5500, which can be found on the official government website or through authorized providers.

- Fill out the form accurately, providing details such as plan identification information, financial data, and compliance statements.

- Review the completed form for any errors or omissions, ensuring all required sections are filled out correctly.

- Submit the form electronically through the Department of Labor's EFAST2 system or by mail, if applicable.

Legal use of the Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser

The legal use of the Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser is vital for maintaining compliance with ERISA and Internal Revenue Service regulations. This form must be filed annually to avoid penalties and ensure that the employee benefit plan remains in good standing. Proper completion and timely submission of the form demonstrate the plan's adherence to legal obligations, protecting both the plan sponsors and participants. Additionally, the form's data may be subject to audits, making accuracy and completeness critical for legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser are critical to avoid penalties. Generally, the form must be filed by the last day of the seventh month after the plan year ends. For plans operating on a calendar year, this means the deadline is July 31. If an extension is needed, plan sponsors can file Form 5558 to request an additional two and a half months. It is crucial to keep track of these dates to ensure compliance and avoid potential fines.

Required Documents

To complete the Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser, several documents are required:

- Plan documents, including summary plan descriptions and amendments.

- Financial statements, including balance sheets and income statements.

- Participant data, such as the number of participants and their contributions.

- Compliance documents, including any required disclosures or notices.

Who Issues the Form

The Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser is issued by the Employee Benefits Security Administration (EBSA), a division of the U.S. Department of Labor. This agency oversees the enforcement of ERISA and ensures that employee benefit plans comply with federal regulations. The EBSA provides guidelines and resources for plan sponsors to help them understand their obligations and properly complete the form.

Quick guide on how to complete form5500 annual returnreport of employee benefit plan kaiser

Effortlessly Prepare Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser on Any Device

The management of documents online has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and safely keep it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without complications. Handle Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Modify and Electronically Sign Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser with Ease

- Locate Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser and click Get Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using the specialized tools offered by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign feature, which takes just a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that require reprinting new copies. airSlate SignNow manages all your document management needs in just a few clicks from your selected device. Edit and electronically sign Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form5500 annual returnreport of employee benefit plan kaiser

Create this form in 5 minutes!

How to create an eSignature for the form5500 annual returnreport of employee benefit plan kaiser

How to make an eSignature for the Form5500 Annual Returnreport Of Employee Benefit Plan Kaiser in the online mode

How to generate an electronic signature for your Form5500 Annual Returnreport Of Employee Benefit Plan Kaiser in Google Chrome

How to create an electronic signature for signing the Form5500 Annual Returnreport Of Employee Benefit Plan Kaiser in Gmail

How to make an electronic signature for the Form5500 Annual Returnreport Of Employee Benefit Plan Kaiser straight from your smartphone

How to make an eSignature for the Form5500 Annual Returnreport Of Employee Benefit Plan Kaiser on iOS

How to generate an electronic signature for the Form5500 Annual Returnreport Of Employee Benefit Plan Kaiser on Android

People also ask

-

What is the Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser?

The Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser is a required filing for employee benefit plans, summarizing financial information and compliance with regulations. Using airSlate SignNow, businesses can streamline the process of completing and submitting this important form electronically, ensuring accuracy and timeliness.

-

How can airSlate SignNow help with the Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser?

airSlate SignNow simplifies the process of preparing and eSigning the Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser. Our platform allows users to fill out forms, obtain necessary signatures, and securely store documents, all while maintaining compliance with legal requirements.

-

What are the pricing options for using airSlate SignNow for Form5500 filings?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs, including options explicitly designed for handling Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser submissions. Customers can select from different subscription tiers, ensuring they only pay for the features they need.

-

Are there any integrations available with airSlate SignNow for Form5500 processing?

Yes, airSlate SignNow integrates seamlessly with numerous software applications to enhance the processing of the Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser. Popular integrations include cloud storage services, CRM systems, and accounting software, allowing for a more streamlined workflow.

-

What features does airSlate SignNow provide for completing the Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser?

AirSlate SignNow offers various features designed to aid in the completion of the Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser, including customizable templates, electronic signatures, and real-time tracking. These tools improve accuracy and ensure that filings are submitted on time.

-

Can airSlate SignNow help ensure compliance with the Form5500 reporting requirements?

Absolutely! airSlate SignNow is designed to help businesses comply with the Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser requirements through automated reminders, compliance checks, and secure document storage. This support reduces the risk of errors and missed deadlines.

-

What are the advantages of using airSlate SignNow for Form5500 submissions over traditional methods?

Using airSlate SignNow for Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser submissions offers several advantages, such as improved efficiency, reduced paperwork, and quicker processing times. Additionally, our electronic solution minimizes the chance of errors compared to traditional paper-based methods.

Get more for Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser

Find out other Form5500 Annual ReturnReport Of Employee Benefit Plan Kaiser

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter