Furman V Cheng U S Patent and Trademark Office Uspto Form

Understanding the Furman v. Cheng at the U.S. Patent and Trademark Office

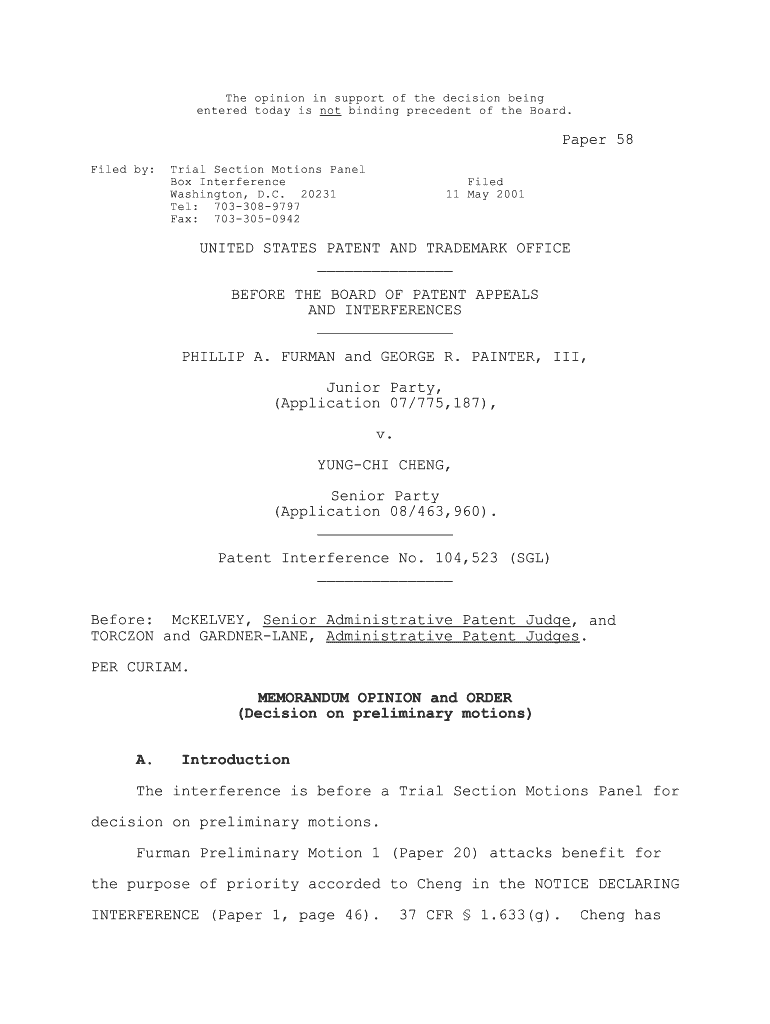

The Furman v. Cheng case is significant in the context of U.S. patent law and the operations of the U.S. Patent and Trademark Office (USPTO). This case addresses the legal principles surrounding patent applications and the responsibilities of applicants. Understanding this case can provide insight into how patent applications are evaluated and the standards that must be met for approval.

In essence, the case highlights the importance of thorough documentation and adherence to legal requirements when submitting patent applications. It serves as a reminder that applicants must be diligent in ensuring that their submissions meet all necessary criteria to avoid potential legal challenges.

Steps to Complete the Furman v. Cheng Form

Completing the Furman v. Cheng form involves several key steps to ensure that all necessary information is accurately provided. The following steps outline the process:

- Gather all relevant documentation related to your patent application, including prior art and supporting materials.

- Carefully review the form to understand the specific requirements and sections that need to be filled out.

- Provide detailed information about the invention, including its purpose, functionality, and any unique features.

- Ensure that all signatures are obtained from relevant parties, as required by the USPTO.

- Double-check all entries for accuracy and completeness before submission.

- Submit the form electronically or via mail, ensuring compliance with USPTO submission guidelines.

Legal Use of the Furman v. Cheng Form

The Furman v. Cheng form must be used in accordance with U.S. patent law to ensure its legal validity. This means that the information provided must be truthful and complete, as any misrepresentation can lead to legal consequences, including the potential invalidation of the patent.

Additionally, the form must be filed within the appropriate timeframes set by the USPTO to maintain the rights associated with the patent application. Understanding the legal implications of using this form is crucial for any applicant seeking to protect their intellectual property.

Required Documents for the Furman v. Cheng Submission

When preparing to submit the Furman v. Cheng form, several documents are typically required to support the application. These may include:

- A detailed description of the invention, including drawings or diagrams if applicable.

- Prior art references that demonstrate the uniqueness of the invention.

- Any relevant agreements or contracts that pertain to the invention.

- Proof of payment for any associated filing fees.

Collecting these documents in advance can streamline the submission process and help ensure compliance with USPTO requirements.

Examples of Using the Furman v. Cheng Form

Practical examples of using the Furman v. Cheng form can help clarify its application in real-world scenarios. For instance, an inventor seeking to patent a new type of biodegradable packaging would need to complete this form, detailing the innovative aspects of the material and its environmental benefits.

Another example could involve a technology company applying for a patent on a new software algorithm. In this case, the company would need to provide comprehensive documentation demonstrating how their algorithm differs from existing technologies, along with any supporting research.

Eligibility Criteria for the Furman v. Cheng Form

To be eligible to submit the Furman v. Cheng form, applicants must meet certain criteria established by the USPTO. These criteria typically include:

- The applicant must be the inventor or the legal representative of the inventor.

- The invention must be novel, non-obvious, and useful.

- The application must be filed within one year of any public disclosure of the invention.

Understanding these eligibility requirements is essential for applicants to ensure that their submissions are valid and have the potential for approval.

Quick guide on how to complete furman v cheng us patent and trademark office uspto

Effortlessly Complete Furman V Cheng U S Patent And Trademark Office Uspto on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to find the right form and safely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Handle Furman V Cheng U S Patent And Trademark Office Uspto on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

The Easiest Way to Edit and eSign Furman V Cheng U S Patent And Trademark Office Uspto without Stress

- Find Furman V Cheng U S Patent And Trademark Office Uspto and click on Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Select important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from the device you prefer. Edit and eSign Furman V Cheng U S Patent And Trademark Office Uspto to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I take my child (16yrs) to the U.S if my immigrant visa is approved? My husband, a US citizen, filled out form I 130 for me and mentioned this child as migrating in future.

Just petition using a I-130 yourself. Read the instructions very carefully. I am not sure but it’s possible that the affidavit of support will need to be filled by your husband since he is the citizen and he filled one for you - again, check the instructions very carefully. It should be a pretty clear, straightforward process.Your child is still well below the age limit and should be fine. If there are any problems, do the same thing you did with your own process - use the numbers you are given to check on the process and if you see it stuck call to make sure they have everything they need early.It is my understanding that the age limit of the child is based on the petition date, so go ahead and do it.You still have plenty of time at 16, just don’t delay.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the furman v cheng us patent and trademark office uspto

How to generate an electronic signature for your Furman V Cheng Us Patent And Trademark Office Uspto in the online mode

How to make an eSignature for the Furman V Cheng Us Patent And Trademark Office Uspto in Chrome

How to create an eSignature for signing the Furman V Cheng Us Patent And Trademark Office Uspto in Gmail

How to make an eSignature for the Furman V Cheng Us Patent And Trademark Office Uspto right from your smartphone

How to generate an eSignature for the Furman V Cheng Us Patent And Trademark Office Uspto on iOS

How to make an eSignature for the Furman V Cheng Us Patent And Trademark Office Uspto on Android devices

People also ask

-

What is chengus and how does it relate to airSlate SignNow?

Chengus is a term associated with the ease of use and integration capabilities offered by airSlate SignNow. By utilizing chengus, businesses can streamline their document signing processes, ensuring that all transactions are quick and secure. This innovative solution enhances workflow efficiency and signNowly reduces the turnaround time for important documents.

-

What pricing plans available for chengus users of airSlate SignNow?

airSlate SignNow offers several pricing plans tailored for chengus users, ranging from basic to advanced features. Each plan is designed to fit various business needs and budgets, ensuring that every customer can find a solution that works for them. Additionally, airSlate SignNow often provides discounts for annual subscriptions, helping businesses save money.

-

What features does airSlate SignNow offer for chengus users?

For chengus users, airSlate SignNow includes a robust suite of features such as customizable templates, real-time collaboration, and automated reminders. These features enhance productivity and ensure that documents are processed efficiently. Additionally, eSigning capabilities ensure legal compliance and security for all transactions.

-

How can airSlate SignNow benefit my business in terms of chengus?

Implementing airSlate SignNow can greatly benefit your business by simplifying the signing process, which is at the core of chengus. This platform allows team members to send, sign, and manage documents from anywhere, leading to increased productivity. Furthermore, the intuitive interface reduces the learning curve for new users.

-

Is airSlate SignNow easy to integrate with existing systems for chengus?

Yes, airSlate SignNow is designed to seamlessly integrate with various existing systems, catering to the needs of chengus users. You can easily connect it with tools like CRMs, cloud storage services, and other platforms, enhancing your overall workflow. This flexibility ensures that businesses can adapt airSlate SignNow to their specific needs without disruption.

-

What security measures does airSlate SignNow offer for chengus?

airSlate SignNow prioritizes security for chengus users by implementing advanced encryption and compliance with industry standards. This ensures that all documents and signatures are protected from unauthorized access. Additionally, audit trails and user verification help maintain the integrity of every transaction.

-

Can I try airSlate SignNow for free while exploring chengus?

Yes, airSlate SignNow offers a free trial for new users interested in exploring chengus. This trial allows businesses to experience the robust features and functionalities without any upfront costs. It’s an excellent opportunity to see how airSlate SignNow can streamline your document processes.

Get more for Furman V Cheng U S Patent And Trademark Office Uspto

Find out other Furman V Cheng U S Patent And Trademark Office Uspto

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement