Form 13844 Irs Form 2018

What is the Form 13844 IRS Form

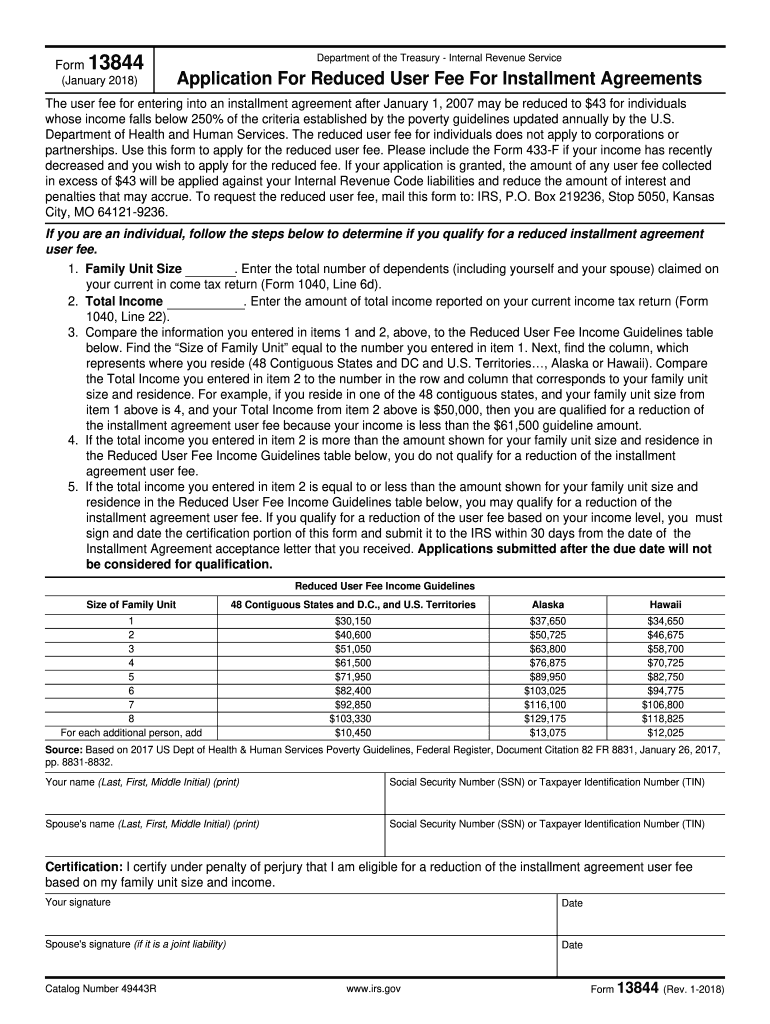

The Form 13844 is an official IRS document used primarily for claiming the IRS Recovery Rebate Credit. This form allows eligible individuals to reconcile the amount of economic impact payments they received with the amount they are entitled to based on their tax situation. It is particularly relevant for taxpayers who may not have received the full amount of their stimulus payments or who did not receive any payments at all.

Understanding the purpose of the Form 13844 is crucial for ensuring compliance with tax regulations and maximizing potential refunds. This form is typically utilized during the annual tax filing process, and it is essential for those who qualify to complete it accurately to avoid any discrepancies with the IRS.

Steps to Complete the Form 13844 IRS Form

Completing the Form 13844 involves several key steps to ensure accuracy and compliance. Begin by gathering necessary documents, including your prior year’s tax return and any notices received from the IRS regarding economic impact payments.

Next, follow these steps:

- Enter your personal information, including your name, Social Security number, and filing status.

- Indicate the total amount of economic impact payments you received.

- Calculate the amount you are eligible to claim based on your adjusted gross income and family size.

- Provide any additional information required, such as qualifying children under the age of 17.

- Review the completed form for accuracy before submission.

Ensure that you keep a copy of the completed Form 13844 for your records, as it may be needed for future reference or in case of an audit.

How to Obtain the Form 13844 IRS Form

The Form 13844 can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. To access the form from the IRS website, navigate to the forms and publications section, where you can find and download the PDF version of the form.

It is important to ensure that you are using the most current version of the form to avoid any issues with your tax filing. If you prefer a physical copy, you may also request that the IRS mail you the form, though this may take additional time.

Filing Deadlines / Important Dates

Filing deadlines for the Form 13844 align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due by April 15. If you are filing for the previous tax year, ensure that you submit the Form 13844 by this deadline to avoid penalties and interest on any unpaid taxes.

In some cases, if you miss the April deadline, you may still have the opportunity to file for an extension. However, it is crucial to understand that an extension to file does not extend the time to pay any taxes owed.

Required Documents

When completing the Form 13844, certain documents are necessary to support your claims. These may include:

- Your previous year’s tax return, which provides context for your income and filing status.

- IRS notices regarding economic impact payments, which detail the amounts received.

- Any additional documentation that supports your eligibility for the Recovery Rebate Credit, such as information about qualifying dependents.

Having these documents readily available can streamline the completion process and help ensure that your submission is accurate and complete.

Form Submission Methods (Online / Mail / In-Person)

The Form 13844 can be submitted in various ways, depending on your preference and the requirements of the IRS. You may choose to file electronically through tax preparation software that supports IRS forms, which can expedite processing and reduce the likelihood of errors.

If you prefer to submit the form by mail, ensure that you send it to the appropriate IRS address based on your location and whether you are enclosing a payment. In-person submissions are generally not accepted for this specific form, as it is primarily processed through electronic or mail channels.

Quick guide on how to complete irs 5050 2018 2019 form

Discover the simplest method to complete and sign your Form 13844 Irs Form

Are you still spending valuable time creating your official paperwork on paper instead of online? airSlate SignNow offers a superior approach to complete and sign your Form 13844 Irs Form and related forms for public services. Our advanced eSignature platform equips you with all the necessary tools to manage documents efficiently and in compliance with official standards - robust PDF editing, organizing, securing, signing, and sharing capabilities readily available within an intuitive interface.

Only a few steps are required to complete and sign your Form 13844 Irs Form:

- Upload the editable template to the editor using the Get Form button.

- Review the information you need to input in your Form 13844 Irs Form.

- Move between the fields using the Next button to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to fill in the fields with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Blackout sections that are no longer relevant.

- Click on Sign to create a legally valid eSignature using your preferred method.

- Add the Date beside your signature and finish your task by clicking the Done button.

Store your completed Form 13844 Irs Form in the Documents folder of your profile, download it, or transfer it to your chosen cloud storage. Our service also offers flexible file sharing options. There’s no need to print your forms when you wish to submit them to the correct public office - send them through email, fax, or by opting for USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct irs 5050 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the irs 5050 2018 2019 form

How to create an electronic signature for the Irs 5050 2018 2019 Form in the online mode

How to generate an electronic signature for your Irs 5050 2018 2019 Form in Chrome

How to create an electronic signature for putting it on the Irs 5050 2018 2019 Form in Gmail

How to make an electronic signature for the Irs 5050 2018 2019 Form from your smartphone

How to generate an electronic signature for the Irs 5050 2018 2019 Form on iOS devices

How to make an electronic signature for the Irs 5050 2018 2019 Form on Android devices

People also ask

-

What is the 13844 form, and why is it important?

The 13844 form is a critical document used for various business processes, especially in e-signature and document management. Understanding its requirements and how to complete it can streamline your workflows, ensuring compliance and efficiency in your operations.

-

How does airSlate SignNow support the 13844 form?

airSlate SignNow provides a user-friendly interface for completing and signing the 13844 form electronically. With our solution, you can easily send, receive, and manage this form securely, saving time and reducing the need for paper documents.

-

What are the pricing options for using airSlate SignNow with the 13844 form?

Our pricing plans are tailored to fit different business needs when handling the 13844 form. We offer flexible options, including monthly and annual subscriptions, ensuring you only pay for the features you need to efficiently manage your signing processes.

-

Are there integrations available for managing the 13844 form?

Yes, airSlate SignNow integrates seamlessly with various applications to simplify the management of the 13844 form. Key integrations include CRM systems, cloud storage solutions, and project management tools, enhancing your workflow efficiency signNowly.

-

What features does airSlate SignNow offer for the 13844 form?

airSlate SignNow offers a range of features specifically designed to improve the handling of the 13844 form. Key features include customizable templates, automated reminders, and secure signing options, helping you manage your documents with ease.

-

Can I track the status of the 13844 form with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your 13844 form in real-time. You can monitor who has viewed or signed the document, ensuring transparency and keeping your workflow moving smoothly.

-

Is there customer support for issues related to the 13844 form?

Yes, airSlate SignNow offers dedicated customer support to assist you with any issues related to the 13844 form. Our team is available to guide you through the process and ensure a seamless user experience.

Get more for Form 13844 Irs Form

Find out other Form 13844 Irs Form

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter