Irs Form 6251 2018

What is the IRS Form 6251?

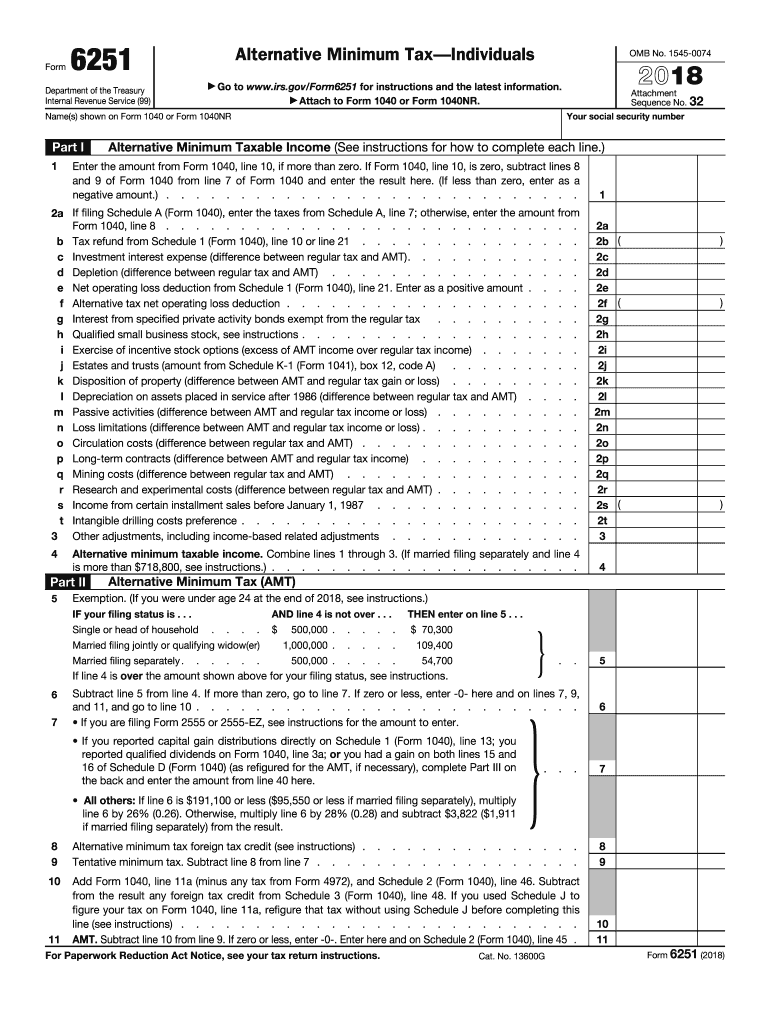

The IRS Form 6251, known as the Alternative Minimum Tax (AMT) Form, is used by taxpayers to determine if they owe the alternative minimum tax. This tax is designed to ensure that individuals who benefit from certain tax advantages still pay a minimum amount of tax. The form calculates the AMT by adding back certain deductions and tax preferences that are allowed under the regular tax system but not under the AMT rules. It is essential for taxpayers who may have a higher income or significant deductions to complete this form accurately to avoid underpayment penalties.

Steps to Complete the IRS Form 6251

Completing the IRS Form 6251 involves several steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including your income statements and any relevant deductions. Follow these steps:

- Begin with Part I, where you report your taxable income.

- Proceed to Part II, which requires you to add back specific deductions and adjustments.

- Calculate your AMT income by following the instructions provided for each line.

- Complete Part III to determine your AMT liability.

- Finally, transfer the calculated amount to your main tax return.

Review the completed form for accuracy before submission to avoid potential issues with the IRS.

How to Obtain the IRS Form 6251

The IRS Form 6251 can be obtained through several methods. Taxpayers can download the form directly from the IRS website in PDF format. Additionally, many tax preparation software programs include the form as part of their package, making it easy to complete electronically. For those who prefer paper forms, they can request a physical copy by calling the IRS or visiting a local IRS office. It is important to ensure that you are using the correct version of the form for the tax year you are filing.

Legal Use of the IRS Form 6251

The IRS Form 6251 must be used legally and accurately to ensure compliance with tax laws. Taxpayers are required to file this form if their income exceeds certain thresholds or if they have specific deductions that may trigger the AMT. Failing to file the form when necessary can result in penalties and interest on unpaid taxes. It is crucial to understand the legal implications of the AMT and to consult with a tax professional if there are uncertainties regarding the form's requirements.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 6251 align with the standard tax return deadlines. Typically, individual taxpayers must file their federal tax returns by April fifteenth of each year. If additional time is needed, taxpayers can file for an extension, which usually extends the deadline to October fifteenth. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest. It is important to stay informed about any changes to deadlines that the IRS may announce each tax year.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 6251 can be submitted through various methods, allowing taxpayers flexibility in how they file. For those using tax preparation software, the form can often be submitted electronically along with the main tax return. Alternatively, taxpayers may choose to print the completed form and mail it to the IRS, ensuring that it is sent to the correct address based on their state of residence. In-person submissions are generally not an option, as the IRS primarily processes forms through mail or electronic filing. Always check the IRS guidelines for the most current submission methods.

Quick guide on how to complete form 6251 2018 2019

Uncover the easiest method to complete and sign your Irs Form 6251

Are you still spending time preparing your official documents on paper instead of doing it online? airSlate SignNow offers a superior way to finalize and sign your Irs Form 6251 and other forms for public services. Our intelligent eSignature solution provides you with all the necessary tools to handle documents swiftly and in line with formal standards - comprehensive PDF editing, managing, securing, signing, and sharing features are all available within a user-friendly interface.

Only a few steps are needed to fill out and sign your Irs Form 6251:

- Insert the fillable template into the editor using the Get Form button.

- Verify what information you need to provide in your Irs Form 6251.

- Move between the fields using the Next feature to ensure you don’t miss anything.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is important or Obscure areas that are no longer relevant.

- Click on Sign to create a legally valid eSignature using any preferred method.

- Insert the Date beside your signature and complete your task with the Done button.

Store your completed Irs Form 6251 in the Documents folder of your profile, download it, or transfer it to your preferred cloud storage. Our solution also supports versatile file sharing. There’s no need to print your forms when you submit them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct form 6251 2018 2019

FAQs

-

Why is the alternative minimum tax form of 6251 so onerous to fill out?

To make things simpler, ironically.The purpose of the AMT is to ensure that the uber rich pay at least a minimum amount of taxes, but has since morphed into something that hits the upper middle classes*. It does that by having fewer tax brackets, fewer allowed deductions and a higher standard deduction. What you owe is whatever causes you to pay more taxes.However, this needs to be done in addition to the traditional tax calculation. So you need to take your calculations of your various income measures, and put back in various deductions that are disallowed under AMT rules. Or have to be recalculated. It’s a pain.Either someone decided that this was easier than having a completely separate tax form to calculate your AMt tax or someone lobbied to have mor complicated taxes so you’d go to one of the tax places or download tax software.*With the Trump tax changes, AMT affects fewer people.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the form 6251 2018 2019

How to generate an eSignature for your Form 6251 2018 2019 online

How to create an eSignature for your Form 6251 2018 2019 in Google Chrome

How to create an electronic signature for signing the Form 6251 2018 2019 in Gmail

How to make an eSignature for the Form 6251 2018 2019 right from your mobile device

How to make an electronic signature for the Form 6251 2018 2019 on iOS

How to generate an electronic signature for the Form 6251 2018 2019 on Android

People also ask

-

What is IRS Form 6251 and why is it important?

IRS Form 6251 is used to calculate the Alternative Minimum Tax (AMT) for individuals and corporations. It is important because it ensures that taxpayers pay a minimum amount of tax, regardless of deductions or credits. Understanding how to fill out IRS Form 6251 can help you avoid unexpected tax liabilities.

-

How can airSlate SignNow help with IRS Form 6251?

AirSlate SignNow streamlines the process of signing and sending IRS Form 6251, allowing you to manage your tax documents efficiently. With its eSigning capabilities, you can quickly obtain necessary signatures, ensuring timely filing of your tax forms. This can reduce the stress of tax season and help you stay organized.

-

What are the pricing options for airSlate SignNow when managing IRS Form 6251?

AirSlate SignNow offers a variety of pricing plans to accommodate different business needs for handling IRS Form 6251 and other documents. Whether you are an individual or a large organization, there is a plan that fits your budget. You can choose a monthly or annual subscription based on your usage requirements.

-

Can I integrate airSlate SignNow with my accounting software for IRS Form 6251?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage IRS Form 6251 and other tax documents. This integration allows you to import data directly into your forms, reducing manual entry errors and saving you time. It's a perfect solution for businesses looking to streamline their tax processes.

-

Is airSlate SignNow secure for handling sensitive documents like IRS Form 6251?

Absolutely! AirSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your sensitive documents such as IRS Form 6251. You can trust that your tax information is safe and secure while using our platform.

-

What features does airSlate SignNow offer for completing IRS Form 6251?

AirSlate SignNow provides features such as eSignature, document templates, and real-time collaboration to enhance your experience with IRS Form 6251. These tools help simplify the process of preparing and signing your tax forms quickly and efficiently. You can also track document status to ensure everything is completed on time.

-

How do I start using airSlate SignNow for IRS Form 6251?

Starting with airSlate SignNow for IRS Form 6251 is easy! Simply sign up for an account on our website, choose a pricing plan, and begin uploading your documents. With user-friendly tools, you can quickly create, edit, and eSign IRS Form 6251 in just a few clicks.

Get more for Irs Form 6251

Find out other Irs Form 6251

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation