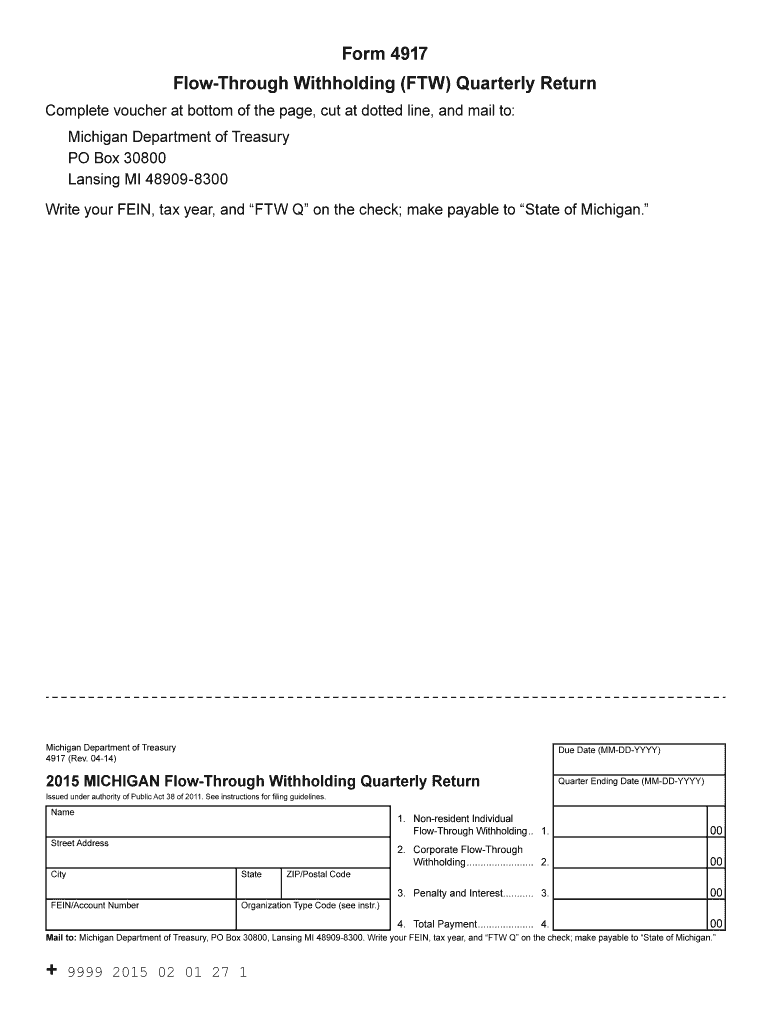

Michigan Flow through Withholding Form 2015

What is the Michigan Flow Through Withholding Form

The Michigan Flow Through Withholding Form is a tax document used by certain business entities, such as partnerships and S corporations, to report income that passes through to individual shareholders or partners. This form ensures that the state of Michigan collects withholding taxes on income that is not directly taxed at the entity level but is instead passed on to individual taxpayers. The form is essential for compliance with state tax regulations and helps to ensure that the appropriate amount of tax is withheld from the income distributed to individuals.

How to use the Michigan Flow Through Withholding Form

Using the Michigan Flow Through Withholding Form involves several key steps. First, the entity must complete the form accurately, providing necessary information about the business and the individuals receiving income. Once completed, the form should be submitted to the Michigan Department of Treasury. It is important to ensure that the withholding amounts are calculated correctly based on the income distributed to each partner or shareholder. This form serves as a record of the withholding for both the entity and the individuals, who will report this information on their personal tax returns.

Steps to complete the Michigan Flow Through Withholding Form

Completing the Michigan Flow Through Withholding Form requires attention to detail. Follow these steps for accurate completion:

- Gather necessary information about the business entity and individual recipients.

- Fill in the entity's name, address, and identification number.

- List the names, addresses, and Social Security numbers or taxpayer identification numbers of each individual receiving income.

- Calculate the total income distributed to each individual and the corresponding withholding amount.

- Review the form for accuracy and completeness before submission.

Legal use of the Michigan Flow Through Withholding Form

The legal use of the Michigan Flow Through Withholding Form is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted by the appropriate deadlines. It is also crucial that the withholding amounts are calculated in accordance with Michigan tax regulations. Failure to comply with these legal requirements can result in penalties for the business entity and the individuals involved. Therefore, understanding the legal implications of this form is essential for both compliance and proper tax reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan Flow Through Withholding Form are critical to avoid penalties. Typically, the form must be filed annually, and the due date aligns with the entity's tax return deadline. It is important to check for any specific dates set by the Michigan Department of Treasury, as these can vary based on the type of entity and the fiscal year. Timely submission ensures compliance with state regulations and helps prevent unnecessary fines.

Form Submission Methods (Online / Mail / In-Person)

The Michigan Flow Through Withholding Form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online: Many entities choose to file electronically through the Michigan Department of Treasury's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the state.

- In-Person: Some businesses may opt to deliver the form in person at local tax offices, ensuring immediate receipt.

Quick guide on how to complete michigan flow through withholding 2015 form

Accomplish Michigan Flow Through Withholding Form effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers a superb environmentally friendly option to conventional printed and signed papers, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Michigan Flow Through Withholding Form on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to edit and eSign Michigan Flow Through Withholding Form with ease

- Locate Michigan Flow Through Withholding Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow provides expressly for that purpose.

- Create your signature using the Sign tool, which takes moments and bears the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Michigan Flow Through Withholding Form to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct michigan flow through withholding 2015 form

Create this form in 5 minutes!

How to create an eSignature for the michigan flow through withholding 2015 form

How to generate an eSignature for your Michigan Flow Through Withholding 2015 Form in the online mode

How to generate an eSignature for your Michigan Flow Through Withholding 2015 Form in Chrome

How to generate an electronic signature for signing the Michigan Flow Through Withholding 2015 Form in Gmail

How to make an electronic signature for the Michigan Flow Through Withholding 2015 Form straight from your mobile device

How to generate an electronic signature for the Michigan Flow Through Withholding 2015 Form on iOS

How to generate an eSignature for the Michigan Flow Through Withholding 2015 Form on Android devices

People also ask

-

What is the Michigan Flow Through Withholding Form?

The Michigan Flow Through Withholding Form is a document that allows businesses to withhold taxes for non-resident partners, members, or shareholders in a flow-through entity. Understanding how to complete this form is crucial for compliance with Michigan tax laws and regulations. Using airSlate SignNow can simplify the process of managing and eSigning this important document.

-

How can airSlate SignNow help with the Michigan Flow Through Withholding Form?

airSlate SignNow streamlines the signing and submission process for the Michigan Flow Through Withholding Form. With its intuitive interface, businesses can easily upload, eSign, and send documents securely. This ensures that you can manage tax compliance effectively without the hassle of traditional paperwork.

-

Is there a cost associated with using airSlate SignNow for the Michigan Flow Through Withholding Form?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. The pricing plans are flexible and cater to various needs, allowing you to choose one that best fits your usage of the Michigan Flow Through Withholding Form. You’ll save time and resources compared to traditional methods.

-

What features does airSlate SignNow offer for the Michigan Flow Through Withholding Form?

airSlate SignNow offers features such as electronic signatures, document templates, and integration capabilities with various cloud storage services. These features facilitate easier management of the Michigan Flow Through Withholding Form. You can also track the status of documents in real time, ensuring timely submissions.

-

Are there any benefits to using airSlate SignNow for business compliance with the Michigan Flow Through Withholding Form?

Using airSlate SignNow ensures that your Michigan Flow Through Withholding Form is processed quickly and accurately, reducing the risk of errors. The digital platform allows for easy updates and revisions, guaranteeing that your form stays compliant with state regulations. This ultimately saves you time and mitigates compliance risks.

-

Can airSlate SignNow integrate with other software when handling the Michigan Flow Through Withholding Form?

Absolutely! airSlate SignNow offers seamless integration with various software tools, including accounting and tax preparation platforms. This integration simplifies the process of managing the Michigan Flow Through Withholding Form, enabling your team to work more efficiently and stay organized.

-

How secure is the information submitted through airSlate SignNow for the Michigan Flow Through Withholding Form?

AirSlate SignNow prioritizes the security of your documents and personal information. All submissions of the Michigan Flow Through Withholding Form are encrypted, and the platform is compliant with industry-standard security protocols. You can have peace of mind knowing that your sensitive data is protected.

Get more for Michigan Flow Through Withholding Form

Find out other Michigan Flow Through Withholding Form

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself