Michigan Form Return 2016-2026

What is the Michigan Form Return

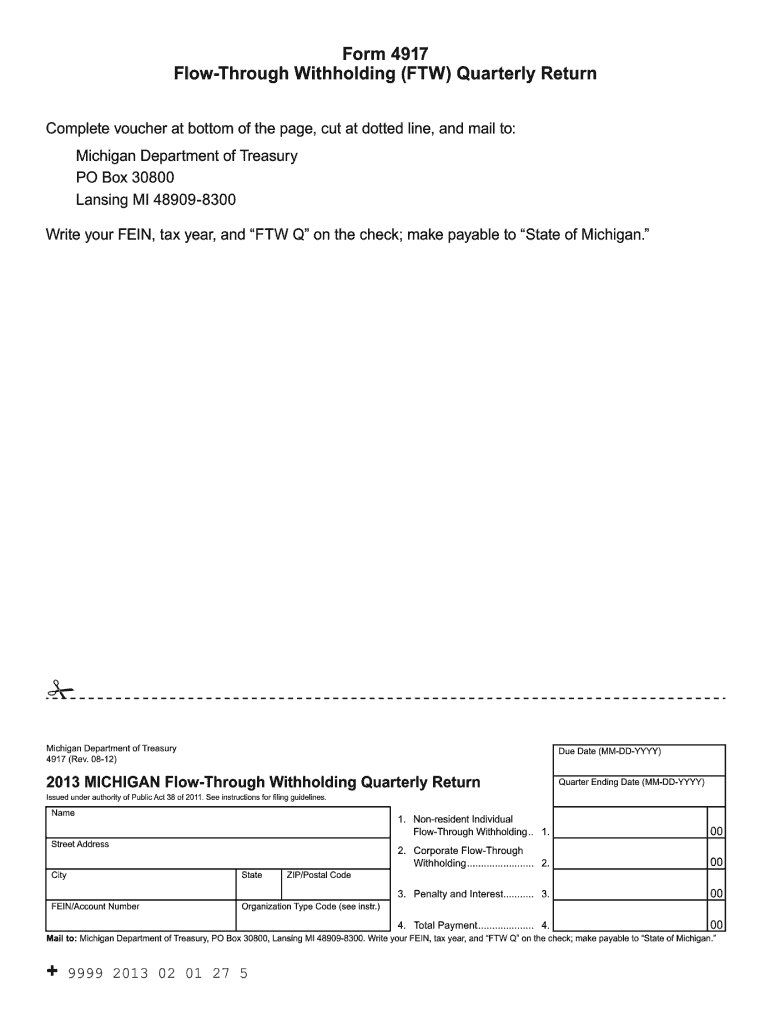

The Michigan Form Return, specifically the 4917 withholding form, is a tax document required for businesses to report flow through withholding. This form is essential for entities such as partnerships and S corporations that pass income through to their owners. The form captures the necessary information about the income generated and the taxes withheld, ensuring compliance with state tax regulations. Understanding the purpose of this form is crucial for accurate tax reporting and avoiding penalties.

Steps to complete the Michigan Form Return

Completing the Michigan Form Return involves a series of methodical steps to ensure accuracy and compliance. Begin by gathering all necessary financial records, including income statements and prior tax documents. Next, fill out the form by providing detailed information about the business entity, including its name, address, and tax identification number. You must also report the total income and the amount of withholding. After completing the form, review all entries for accuracy before submitting it. Finally, keep a copy for your records, as it may be needed for future reference.

Filing Deadlines / Important Dates

Timely filing of the Michigan Form Return is critical to avoid penalties. The due date for submitting the 4917 withholding form typically aligns with the quarterly tax deadlines. For most businesses, these deadlines are the last day of the month following the end of each quarter. It is essential to mark your calendar with these dates to ensure compliance and avoid interest or penalties for late submission.

Legal use of the Michigan Form Return

The legal use of the Michigan Form Return is governed by state tax laws. This form must be completed accurately and submitted on time to fulfill tax obligations. Failure to comply can result in penalties, including fines and interest on unpaid taxes. Additionally, businesses must ensure that the information reported is truthful and complete, as discrepancies can lead to audits or legal repercussions. Utilizing electronic means for submission can enhance security and streamline the filing process.

Required Documents

To successfully complete the Michigan Form Return, several documents are required. These include financial statements that detail income and expenses, prior year tax returns, and any relevant documentation supporting the withholding amounts. Additionally, businesses should have their Employer Identification Number (EIN) readily available. Collecting these documents in advance can facilitate a smoother filing process and ensure that all necessary information is accurately reported.

Who Issues the Form

The Michigan Form Return is issued by the Michigan Department of Treasury. This state agency is responsible for overseeing tax collection and ensuring compliance with tax laws. Businesses should refer to the official resources provided by the Department of Treasury for the most current version of the form and any updates regarding filing procedures or requirements.

Quick guide on how to complete 2013 michigan form return

Complete Michigan Form Return effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Michigan Form Return on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and eSign Michigan Form Return with ease

- Find Michigan Form Return and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Edit and eSign Michigan Form Return and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 michigan form return

Create this form in 5 minutes!

How to create an eSignature for the 2013 michigan form return

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is mi quarterly and how does it relate to airSlate SignNow?

Mi quarterly refers to the management and execution of quarterly tasks and workflows, which airSlate SignNow simplifies through its efficient eSigning capabilities. By integrating airSlate SignNow into your mi quarterly processes, you can streamline document approvals and improve productivity within your organization.

-

How does airSlate SignNow's pricing align with mi quarterly tasks?

AirSlate SignNow offers flexible pricing plans tailored for various business sizes, ensuring that your mi quarterly tasks remain cost-effective. Whether you're a small startup or a large enterprise, you'll find a plan that fits your budget and needs, allowing you to manage your quarterly initiatives without breaking the bank.

-

What features of airSlate SignNow enhance mi quarterly document management?

AirSlate SignNow boasts features like customizable templates, advanced workflow automation, and real-time tracking, which enhance your mi quarterly document management. These tools help ensure that you can easily prepare, send, and track documents, making your quarterly operations both efficient and transparent.

-

How can airSlate SignNow benefit my team during mi quarterly reviews?

During mi quarterly reviews, airSlate SignNow facilitates a quick and secure way to gather feedback and necessary approvals. By utilizing eSigning and document collaboration features, your team can remain agile and focus on what truly matters—driving results and making informed decisions.

-

Does airSlate SignNow integrate with tools I use for mi quarterly planning?

Yes, airSlate SignNow offers seamless integrations with popular applications like Google Workspace, Salesforce, and Microsoft Office. This means you can incorporate airSlate SignNow into your existing tools for mi quarterly planning, enhancing your workflow without the need for extensive changes.

-

Is airSlate SignNow secure for handling mi quarterly financial documents?

Absolutely! AirSlate SignNow employs advanced security measures, including data encryption and compliance with industry standards, making it secure for handling sensitive mi quarterly financial documents. You can confidently send and store your documents, knowing they are protected.

-

Can airSlate SignNow help reduce delays in mi quarterly reporting?

Yes, airSlate SignNow signNowly reduces delays in mi quarterly reporting by enabling faster document turnaround. With the ability to eSign documents instantly and automate follow-ups, your team can ensure that all necessary reports are completed on time, enhancing overall productivity.

Get more for Michigan Form Return

- Annual leave form 14363716

- Mother teresa university online payment form

- Monumental life insurance forms online

- Ride along form

- Form 15h download in word format

- Mdc brooklyn visiting form

- Antrag auf kindergeld kindergeldantrag mit vorblatt form

- Hazel green high school student parking permit application form

Find out other Michigan Form Return

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile