Ia 1040es Form 2014

What is the Ia 1040es Form

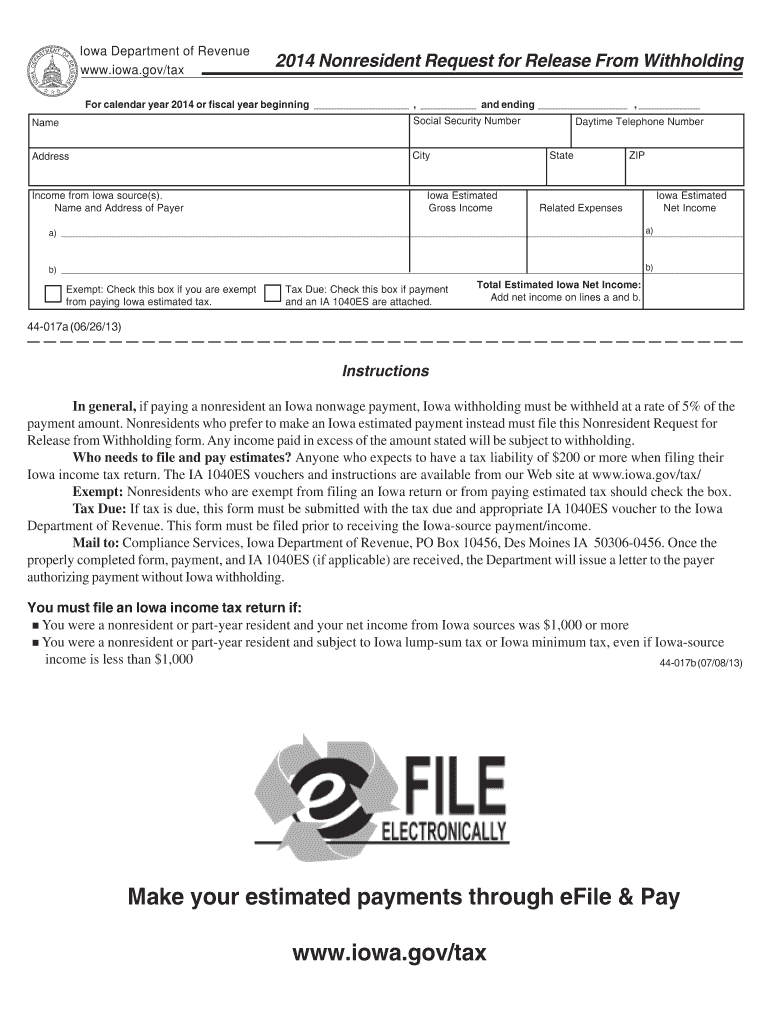

The Ia 1040es Form is a tax document used by individuals in Iowa to make estimated tax payments. This form is essential for taxpayers who expect to owe taxes of $1,000 or more when they file their annual return. It allows individuals to pay their taxes in installments throughout the year, rather than in one lump sum at the end of the tax year. This can help manage cash flow and avoid penalties for underpayment.

How to use the Ia 1040es Form

Using the Ia 1040es Form involves several key steps. First, determine your expected tax liability for the year. This can be based on your previous year's tax return or current income estimates. Once you have this figure, you can calculate your estimated payments, which are typically due quarterly. Fill out the form with your personal information, including your name, address, and Social Security number, and indicate the amount you wish to pay for each quarter.

Steps to complete the Ia 1040es Form

Completing the Ia 1040es Form requires careful attention to detail. Follow these steps:

- Gather your financial documents, including previous tax returns and current income statements.

- Calculate your expected tax liability for the year.

- Divide your estimated tax amount by four to determine quarterly payments.

- Fill out the Ia 1040es Form with your personal information and payment amounts.

- Review the form for accuracy before submission.

- Submit the form and payment by the due dates to avoid penalties.

Legal use of the Ia 1040es Form

The Ia 1040es Form is legally recognized for making estimated tax payments in Iowa. To ensure its legal validity, it must be filled out accurately and submitted on time. Compliance with state tax regulations is crucial, as failure to do so can result in penalties or interest charges. Keeping records of your payments and any correspondence with the Iowa Department of Revenue is also important for legal and tax purposes.

Filing Deadlines / Important Dates

Filing deadlines for the Ia 1040es Form are important to keep in mind. Estimated tax payments are typically due on the 15th of April, June, September, and January of the following year. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Staying aware of these dates helps prevent late fees and ensures compliance with tax obligations.

Who Issues the Form

The Ia 1040es Form is issued by the Iowa Department of Revenue. This state agency is responsible for collecting taxes and administering tax laws in Iowa. Taxpayers can obtain the form directly from the Iowa Department of Revenue's website or through their local tax offices. It is important to use the most current version of the form to ensure compliance with any changes in tax laws or regulations.

Quick guide on how to complete 2012 ia 1040es 2014 form

Complete Ia 1040es Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Ia 1040es Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Ia 1040es Form comfortably

- Locate Ia 1040es Form and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Ia 1040es Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 ia 1040es 2014 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 ia 1040es 2014 form

How to generate an electronic signature for your 2012 Ia 1040es 2014 Form in the online mode

How to generate an eSignature for the 2012 Ia 1040es 2014 Form in Google Chrome

How to generate an eSignature for putting it on the 2012 Ia 1040es 2014 Form in Gmail

How to make an eSignature for the 2012 Ia 1040es 2014 Form straight from your mobile device

How to make an eSignature for the 2012 Ia 1040es 2014 Form on iOS

How to generate an eSignature for the 2012 Ia 1040es 2014 Form on Android

People also ask

-

What is the Ia 1040es Form and why do I need it?

The Ia 1040es Form is a tax form used by individuals in Iowa to estimate and pay their state income tax. It's essential for taxpayers who expect to owe at least $1,000 in tax after subtracting their withholding and refundable credits. Filing the Ia 1040es Form helps you avoid penalties and manage your tax obligations effectively.

-

How can airSlate SignNow help me with the Ia 1040es Form?

AirSlate SignNow provides an efficient platform for preparing and signing your Ia 1040es Form electronically. With its user-friendly interface, you can easily upload, fill out, and eSign the form, ensuring a quick and seamless submission process. This saves you time and reduces the hassle of dealing with paperwork.

-

Is there a cost associated with using airSlate SignNow for the Ia 1040es Form?

Yes, airSlate SignNow operates on a subscription model, with various pricing plans to suit different needs. The cost is reasonable, especially considering the convenience and efficiency it offers when handling documents like the Ia 1040es Form. Check our pricing page for specific details and choose a plan that works for you.

-

What features does airSlate SignNow offer for managing the Ia 1040es Form?

AirSlate SignNow offers several features for managing the Ia 1040es Form, including customizable templates, secure eSigning, and document tracking. These features streamline the preparation process, ensuring that your form is completed accurately and submitted on time. Additionally, you can collaborate with others, making it easier to gather necessary information.

-

Can I integrate airSlate SignNow with other software for the Ia 1040es Form?

Absolutely! AirSlate SignNow supports integration with various software applications, including popular accounting and tax software. This allows you to import data directly into your Ia 1040es Form, minimizing manual entry and reducing errors. Check our integrations page to see all compatible applications.

-

What benefits does airSlate SignNow provide for filing the Ia 1040es Form?

Using airSlate SignNow for your Ia 1040es Form offers numerous benefits, including enhanced convenience, quicker turnaround times, and improved accuracy. The electronic eSigning feature eliminates the need for printing and mailing, while document tracking ensures you stay updated on the status of your submission. Overall, it simplifies the tax filing process.

-

Is my data secure when using airSlate SignNow for the Ia 1040es Form?

Yes, your data is secure with airSlate SignNow. We utilize advanced encryption technologies to protect your personal information when filling out the Ia 1040es Form, ensuring that your documents are safe from unauthorized access. Our commitment to data security means you can use our platform with confidence.

Get more for Ia 1040es Form

Find out other Ia 1040es Form

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online