Iowa Withholding Form 2017

What is the Iowa Withholding Form

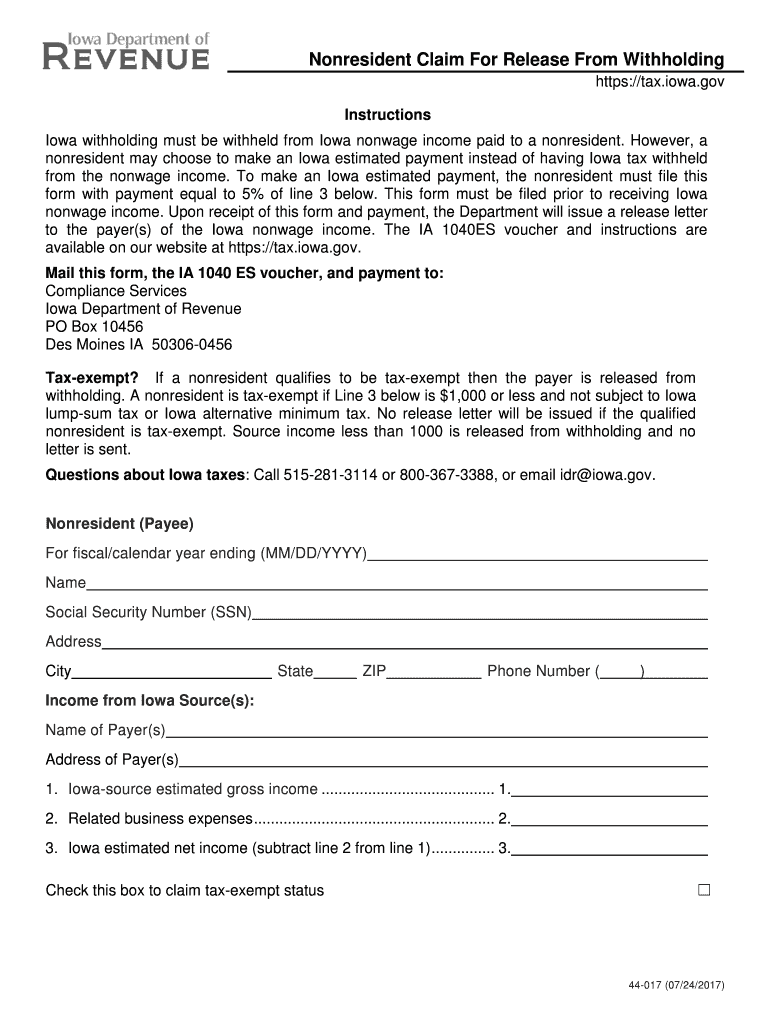

The Iowa Withholding Form, often referred to as the Iowa W-4, is a crucial document used by employees to indicate their tax withholding preferences to their employers. This form helps determine the amount of state income tax that will be withheld from an employee's paycheck. It is essential for ensuring that the correct amount of tax is withheld, preventing underpayment or overpayment of taxes throughout the year.

How to use the Iowa Withholding Form

To effectively use the Iowa Withholding Form, employees should first complete the form accurately by providing personal information, such as name, address, and Social Security number. Next, employees must indicate their filing status and any allowances they wish to claim. This information will guide employers in calculating the appropriate withholding amount. It is advisable to review the form periodically, especially after major life changes, to ensure that withholding remains accurate.

Steps to complete the Iowa Withholding Form

Completing the Iowa Withholding Form involves several straightforward steps:

- Obtain the form from your employer or download it from the Iowa Department of Revenue website.

- Fill in your personal information, including your full name, address, and Social Security number.

- Select your filing status, which may be single, married, or head of household.

- Claim the number of allowances you wish to take, which can affect your withholding amount.

- Sign and date the form to validate it.

Legal use of the Iowa Withholding Form

The Iowa Withholding Form is legally binding once it is completed and submitted to your employer. It must comply with state regulations regarding tax withholding. Employers are required to honor the information provided on the form unless they have a valid reason to question its accuracy. It is important for employees to ensure that the information is correct to avoid potential legal issues related to tax compliance.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Iowa Withholding Form is essential for compliance. Generally, employees should submit their completed form to their employer as soon as they begin employment or when they wish to make changes to their withholding. Employers are responsible for withholding the correct amount of state income tax from the first paycheck after receiving the completed form. It is also important to stay informed about any updates to state tax laws that may affect withholding requirements.

Form Submission Methods (Online / Mail / In-Person)

The Iowa Withholding Form can typically be submitted in several ways, depending on the employer's policies. Most employers prefer that the form be submitted in person or via email to ensure quick processing. Some employers may allow submission by mail. It is advisable to check with your employer for their preferred submission method to ensure timely and accurate withholding adjustments.

Quick guide on how to complete 2012 ia 1040es 2017 2019 form

Complete Iowa Withholding Form effortlessly on any device

Digital document management has become favored among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Iowa Withholding Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign Iowa Withholding Form without hassle

- Find Iowa Withholding Form and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight pertinent sections of your documents or conceal sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your needs in document management with just a few clicks from any device you choose. Edit and eSign Iowa Withholding Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 ia 1040es 2017 2019 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 ia 1040es 2017 2019 form

How to generate an eSignature for the 2012 Ia 1040es 2017 2019 Form online

How to generate an eSignature for your 2012 Ia 1040es 2017 2019 Form in Chrome

How to create an electronic signature for signing the 2012 Ia 1040es 2017 2019 Form in Gmail

How to create an eSignature for the 2012 Ia 1040es 2017 2019 Form from your smart phone

How to create an eSignature for the 2012 Ia 1040es 2017 2019 Form on iOS

How to make an eSignature for the 2012 Ia 1040es 2017 2019 Form on Android devices

People also ask

-

What is the iowa withholding form 2019 used for?

The iowa withholding form 2019 is used by employers to report income tax withheld from employees’ wages. It helps ensure compliance with state tax regulations. Proper use of this form is vital for accurate tax reporting and employee payroll management.

-

How can I obtain the iowa withholding form 2019 through airSlate SignNow?

You can easily obtain the iowa withholding form 2019 by utilizing airSlate SignNow’s template library. Simply search for the form within our platform, and you can fill it out online, eSign it, and send it to necessary recipients without any hassle.

-

Is airSlate SignNow a cost-effective solution for managing the iowa withholding form 2019?

Yes, airSlate SignNow offers a cost-effective solution for managing the iowa withholding form 2019 along with other essential documents. Our platform provides various pricing plans, ensuring you only pay for the features you need, while maximizing your productivity and efficiency.

-

What features does airSlate SignNow offer for filling out the iowa withholding form 2019?

airSlate SignNow provides intuitive features such as electronic signatures, document templates, and secure storage for the iowa withholding form 2019. These tools enable smooth collaboration, easy tracking, and compliance with the latest state regulations.

-

Can I integrate airSlate SignNow with other tools for the iowa withholding form 2019?

Absolutely! airSlate SignNow seamlessly integrates with various business applications to help streamline your process for the iowa withholding form 2019. This ensures that you can work efficiently with your existing tools, enhancing your overall productivity.

-

What are the benefits of using airSlate SignNow for the iowa withholding form 2019?

Using airSlate SignNow for the iowa withholding form 2019 provides numerous benefits, including increased efficiency, enhanced security for sensitive documents, and simplified workflows. Our platform also allows for faster processing times, which means employers can focus more on their business.

-

Is it legally valid to eSign the iowa withholding form 2019 using airSlate SignNow?

Yes, eSigning the iowa withholding form 2019 using airSlate SignNow is legally valid in accordance with eSignature laws. This compliance ensures that your electronically signed documents remain enforceable and recognized by state authorities.

Get more for Iowa Withholding Form

Find out other Iowa Withholding Form

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement