Nonresident Request for Release from Withholding 44 017 2011

Understanding the Nonresident Request for Release From Withholding 44-017

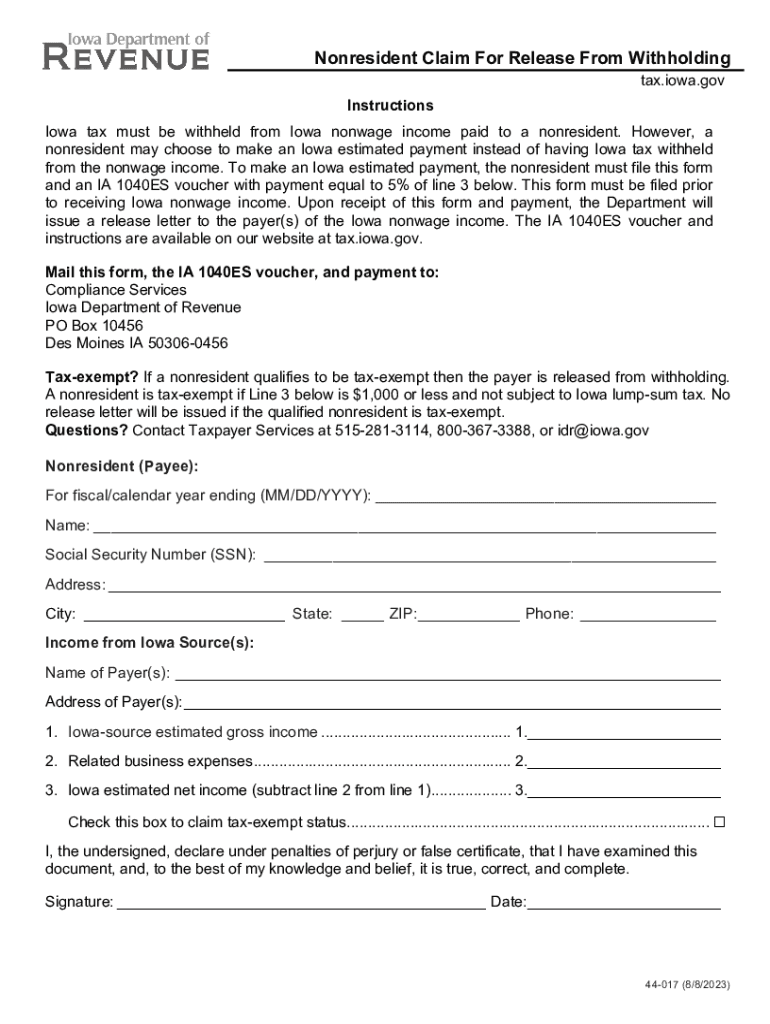

The Nonresident Request for Release From Withholding 44-017 is a specific form used by nonresident individuals or entities in Iowa to request a release from state income tax withholding. This form is particularly relevant for those who earn income in Iowa but are not residents of the state. By submitting this form, taxpayers can potentially avoid unnecessary withholding on their earnings, ensuring that they are only taxed on income that is rightfully subject to Iowa income tax.

Steps to Complete the Nonresident Request for Release From Withholding 44-017

Completing the Nonresident Request for Release From Withholding 44-017 involves several key steps:

- Gather necessary personal and financial information, including your Social Security number and details about the income earned in Iowa.

- Clearly indicate the reason for your request on the form, ensuring that it aligns with Iowa tax regulations.

- Provide any supporting documentation that may be required, such as proof of residency in another state.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Nonresident Request for Release From Withholding 44-017

To be eligible to file the Nonresident Request for Release From Withholding 44-017, individuals must meet specific criteria. Generally, this includes:

- Being a nonresident of Iowa while earning income within the state.

- Having a valid reason for requesting a release from withholding, such as being subject to a lower tax rate or exempt status in their home state.

- Providing accurate and complete information on the form to support their request.

Required Documents for Submission

When submitting the Nonresident Request for Release From Withholding 44-017, certain documents may be required to support the application. These can include:

- Proof of residency in another state, such as a driver's license or utility bill.

- Any relevant tax documents that show income earned in Iowa.

- Previous tax returns that may demonstrate nonresident status.

Filing Deadlines for the Nonresident Request for Release From Withholding 44-017

It is essential to be aware of the filing deadlines associated with the Nonresident Request for Release From Withholding 44-017. Typically, the form should be submitted before the tax year ends to avoid unnecessary withholding. Keeping track of these deadlines helps ensure compliance with Iowa tax regulations and can prevent potential penalties.

Form Submission Methods

The Nonresident Request for Release From Withholding 44-017 can be submitted through various methods:

- Online submission through the Iowa Department of Revenue website, if available.

- Mailing the completed form to the appropriate Iowa tax office.

- In-person delivery at designated Iowa tax offices, ensuring that the form is submitted directly to a tax representative.

Quick guide on how to complete nonresident request for release from withholding 44 017

Complete Nonresident Request For Release From Withholding 44 017 with ease on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Handle Nonresident Request For Release From Withholding 44 017 on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related workflow today.

The simplest way to modify and eSign Nonresident Request For Release From Withholding 44 017 effortlessly

- Obtain Nonresident Request For Release From Withholding 44 017 and click on Get Form to begin.

- Utilize our tools to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, invitation link, or download it to your computer.

No more worrying about lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign Nonresident Request For Release From Withholding 44 017 and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nonresident request for release from withholding 44 017

Create this form in 5 minutes!

How to create an eSignature for the nonresident request for release from withholding 44 017

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to tax Iowa information?

airSlate SignNow is an innovative platform that allows businesses to send and eSign documents quickly and securely. For individuals and businesses needing to manage tax Iowa information, our platform streamlines the process of signing important tax documents, making it easier to stay compliant and organized.

-

Can I use airSlate SignNow for filing Iowa state tax forms?

Yes, you can use airSlate SignNow to eSign and manage your Iowa state tax forms. With our user-friendly features, you can easily gather signatures on necessary documents related to your tax Iowa information, ensuring a smooth filing process and helping you to meet deadlines.

-

What pricing plans are available for airSlate SignNow?

airSlate SignNow offers a range of pricing plans that cater to different business needs. Our plans are cost-effective and designed to provide comprehensive solutions to manage and eSign documents related to tax Iowa information and beyond, ensuring you only pay for what you need.

-

What are the key features of airSlate SignNow?

Key features of airSlate SignNow include customizable templates, easy document sharing, and advanced security settings. These features enhance your ability to manage tax Iowa information securely and efficiently, providing a seamless experience for all electronic signature workflows.

-

How secure is airSlate SignNow when handling sensitive tax documents?

Security is a top priority at airSlate SignNow, and we use industry-leading encryption to protect your sensitive information. When managing tax Iowa information, you can trust that your documents are encrypted and stored securely, reducing the risk of unauthorized access.

-

Does airSlate SignNow integrate with other tools for tax management?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software. This allows you to streamline the management of tax Iowa information and enhance productivity by connecting the tools you already use for handling your tax preparation and filing.

-

Can I track the status of my eSigned tax documents in airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your eSigned tax documents in real-time. This capability is essential for managing tax Iowa information, ensuring you are always aware of where your documents are in the signing process.

Get more for Nonresident Request For Release From Withholding 44 017

- Atlanta center for wellness form

- Vascular solutions pc charlotte vein clinic form

- Supervision of cardiac and pulmonary rehabilitation services form

- Personal representative form

- To be sent form

- Nationwide annuity beneficiary claim form 405698628

- Visiting trainee rotation request form legacy health

- The egyptian and nubian empires worksheet answers form

Find out other Nonresident Request For Release From Withholding 44 017

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now