Iowa Nonresident Withholding Form 2019-2026

What is the Iowa Nonresident Withholding Form

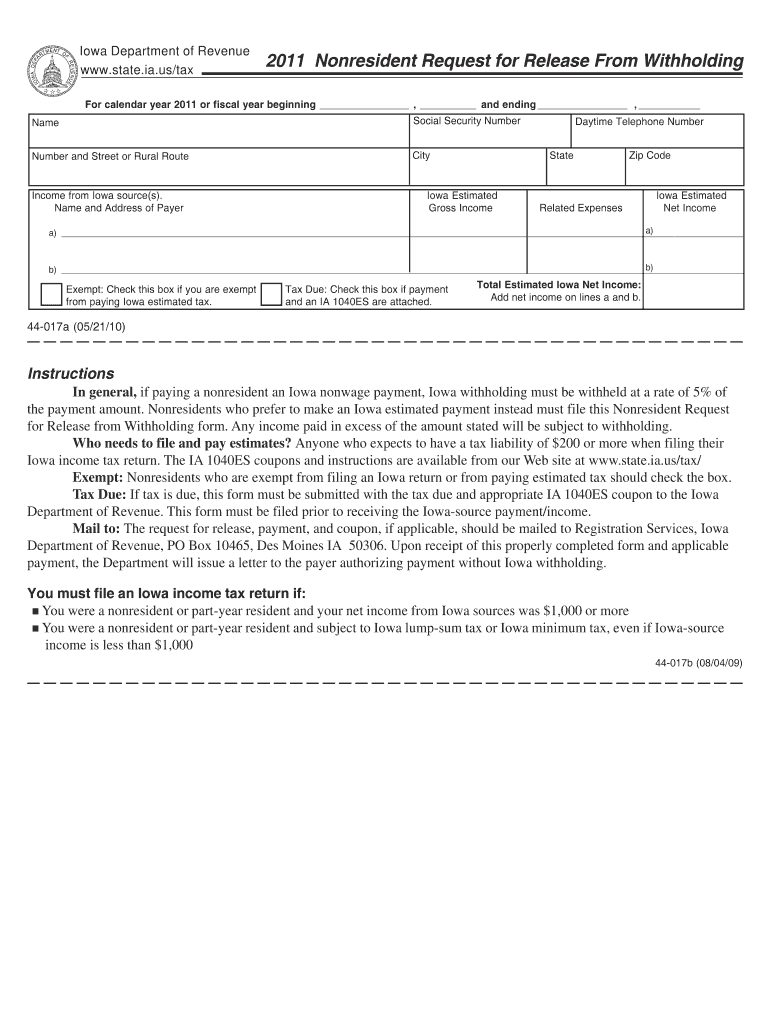

The Iowa Nonresident Withholding Form, commonly referred to as IA 1040ES, is a tax document used by nonresident individuals and entities earning income in Iowa. This form allows these taxpayers to report and remit state income tax withheld on their earnings. It is essential for ensuring compliance with Iowa tax regulations and helps facilitate the proper collection of state taxes from those who do not reside in Iowa but earn income within its borders.

How to use the Iowa Nonresident Withholding Form

Using the Iowa Nonresident Withholding Form involves several steps. First, gather all relevant income information, including wages, dividends, and any other earnings sourced from Iowa. Next, accurately fill out the form, ensuring that all income is reported and that the correct withholding amounts are calculated based on Iowa tax rates. Once completed, the form must be submitted to the Iowa Department of Revenue by the appropriate deadline to avoid penalties.

Steps to complete the Iowa Nonresident Withholding Form

Completing the Iowa Nonresident Withholding Form requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the IA 1040ES form from the Iowa Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report all sources of income earned in Iowa, ensuring accuracy in the amounts provided.

- Calculate the total amount of tax withheld based on the income reported.

- Review the completed form for any errors or omissions.

- Submit the form by mail or electronically, depending on your preference and the options available.

Legal use of the Iowa Nonresident Withholding Form

The legal use of the Iowa Nonresident Withholding Form is governed by state tax laws. To be considered valid, the form must be filled out accurately and submitted on time. Failure to comply with Iowa tax regulations can result in penalties, including fines and interest on unpaid taxes. It is crucial to understand the legal implications of the form and to ensure that all information provided is truthful and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Iowa Nonresident Withholding Form are critical to ensure compliance. Generally, nonresident taxpayers must submit the form by April fifteenth of the year following the tax year in which income was earned. It is essential to stay informed about any changes to these deadlines, as they can vary based on state regulations or specific circumstances, such as extensions granted by the Iowa Department of Revenue.

Form Submission Methods (Online / Mail / In-Person)

The Iowa Nonresident Withholding Form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Some taxpayers may have the option to file electronically through the Iowa Department of Revenue’s online portal.

- Mail: Completed forms can be mailed to the designated address provided by the Iowa Department of Revenue.

- In-Person: Taxpayers may also choose to submit their forms in person at local tax offices, although this is less common.

Quick guide on how to complete iowa nonresident withholding 2011 form

Complete Iowa Nonresident Withholding Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without any hold-ups. Manage Iowa Nonresident Withholding Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-based process today.

How to alter and eSign Iowa Nonresident Withholding Form without any hassle

- Obtain Iowa Nonresident Withholding Form and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the information and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, via email, SMS, or invitation link, or download it to your PC.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign Iowa Nonresident Withholding Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct iowa nonresident withholding 2011 form

Create this form in 5 minutes!

How to create an eSignature for the iowa nonresident withholding 2011 form

How to create an electronic signature for your PDF file in the online mode

How to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What is the ia 1040es form and why is it important?

The ia 1040es form is used for making estimated tax payments in Iowa. It is essential for individuals who expect to owe tax, as it helps avoid penalties for underpayment at year-end.

-

How can airSlate SignNow assist with the ia 1040es form?

airSlate SignNow streamlines the process of completing and electronically signing the ia 1040es form. With our user-friendly interface, you can quickly fill out, sign, and send your forms securely.

-

Is there a cost associated with using airSlate SignNow for the ia 1040es?

Yes, there are pricing plans available for businesses that need to eSign documents, including the ia 1040es. Each plan offers different features, allowing you to choose one that best fits your needs and budget.

-

What features does airSlate SignNow offer for managing documents like the ia 1040es?

airSlate SignNow provides features such as customizable templates, secure document storage, and real-time tracking for documents including the ia 1040es. These tools enhance efficiency and ensure compliance.

-

Can I integrate airSlate SignNow with other software to manage the ia 1040es?

Absolutely! airSlate SignNow integrates seamlessly with various applications and services, making it easier to manage the ia 1040es alongside your other business tools. This ensures a more streamlined workflow.

-

What are the benefits of using airSlate SignNow for the ia 1040es process?

Using airSlate SignNow for the ia 1040es provides benefits such as faster processing times and reduced paper usage. It allows you to complete your tax documentation securely from anywhere, enhancing overall productivity.

-

How secure is my information when using airSlate SignNow for the ia 1040es?

airSlate SignNow prioritizes the security of your data when handling the ia 1040es form. We use advanced encryption protocols and adhere to best practices to ensure that your information remains confidential and secure.

Get more for Iowa Nonresident Withholding Form

Find out other Iowa Nonresident Withholding Form

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation