IRP Schedule B Tn 2014

What is the IRP Schedule B TN

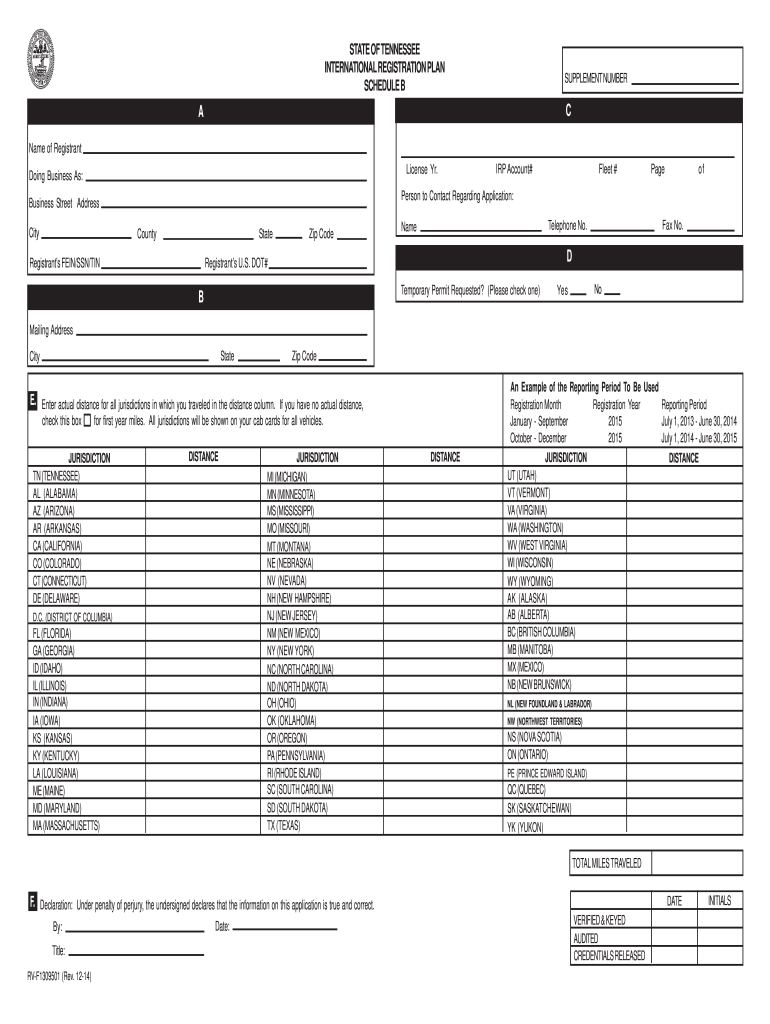

The IRP Schedule B TN is a specific form used in the state of Tennessee for reporting and documenting the distribution of income and expenses related to certain tax obligations. This form is part of the International Registration Plan (IRP), which allows for the registration of commercial vehicles that travel in multiple jurisdictions. The IRP Schedule B TN is essential for ensuring compliance with state and federal tax regulations, particularly for businesses operating across state lines.

How to use the IRP Schedule B TN

To effectively use the IRP Schedule B TN, individuals and businesses must accurately complete the form with the required information regarding their vehicle operations. This includes detailing the types of vehicles registered, the jurisdictions in which they operate, and the corresponding mileage. Proper usage of this form helps in calculating the appropriate fees and taxes owed to each jurisdiction based on the reported data.

Steps to complete the IRP Schedule B TN

Completing the IRP Schedule B TN involves several key steps:

- Gather necessary documentation, including vehicle registration details and mileage records.

- Fill out the form with accurate information about each vehicle, including its weight, type, and the states in which it operates.

- Calculate the total miles driven in each jurisdiction to determine the appropriate tax obligations.

- Review the completed form for accuracy before submission.

- Submit the form to the appropriate state agency, either online or via mail.

Legal use of the IRP Schedule B TN

The legal use of the IRP Schedule B TN is governed by both state and federal regulations. It is crucial for businesses to ensure that the information provided on the form is truthful and complete, as inaccuracies can lead to penalties or legal issues. The form serves as a legal document that supports compliance with tax laws and vehicle registration requirements.

Filing Deadlines / Important Dates

Filing deadlines for the IRP Schedule B TN are critical for compliance. Generally, the form must be submitted by specific dates each year, which can vary based on the type of vehicle and the jurisdiction. It is advisable to check with the Tennessee Department of Revenue or relevant state agencies for the most current deadlines to avoid late fees or penalties.

Required Documents

When preparing to complete the IRP Schedule B TN, several documents are typically required:

- Proof of vehicle ownership, such as a title or bill of sale.

- Mileage records for the reporting period.

- Previous registration documents, if applicable.

- Any additional documentation required by the state for specific vehicle types.

Form Submission Methods (Online / Mail / In-Person)

The IRP Schedule B TN can be submitted through various methods, providing flexibility for users. Options typically include:

- Online submission via the Tennessee Department of Revenue’s website.

- Mailing the completed form to the designated state agency.

- In-person submission at local revenue offices, where assistance may be available.

Quick guide on how to complete irp schedule b tn

Complete IRP Schedule B Tn effortlessly on any gadget

Digital document handling has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to locate the correct form and safely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents rapidly without hold-ups. Manage IRP Schedule B Tn on any device using airSlate SignNow’s Android or iOS applications and enhance any document-focused operation today.

The easiest way to edit and eSign IRP Schedule B Tn seamlessly

- Locate IRP Schedule B Tn and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify the information and click on the Done button to preserve your modifications.

- Choose how you'd like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Edit and eSign IRP Schedule B Tn and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irp schedule b tn

Create this form in 5 minutes!

How to create an eSignature for the irp schedule b tn

How to create an electronic signature for your Irp Schedule B Tn online

How to make an electronic signature for the Irp Schedule B Tn in Google Chrome

How to generate an eSignature for signing the Irp Schedule B Tn in Gmail

How to create an electronic signature for the Irp Schedule B Tn straight from your mobile device

How to create an electronic signature for the Irp Schedule B Tn on iOS devices

How to create an electronic signature for the Irp Schedule B Tn on Android devices

People also ask

-

What is the IRP Schedule B Tn and why is it important?

The IRP Schedule B Tn is an essential form for commercial vehicle operators in Tennessee, detailing the jurisdictions where vehicles are registered for International Registration Plan (IRP) purposes. It helps ensure compliance with state regulations and simplifies the process for obtaining vehicle registration. Accurate completion of the IRP Schedule B Tn can help businesses avoid fines and streamline their registration processes.

-

How can airSlate SignNow help with completing the IRP Schedule B Tn?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and eSign the IRP Schedule B Tn online. With its user-friendly interface, businesses can quickly complete necessary forms, ensuring all information is accurate and submitted on time. This efficiency helps organizations save time and reduce errors in their documentation.

-

Is there a cost associated with using airSlate SignNow for the IRP Schedule B Tn?

Yes, airSlate SignNow offers affordable pricing plans that cater to various business needs, making it cost-effective for those needing to manage documents like the IRP Schedule B Tn. The pricing structure is transparent, and you can choose a plan that fits your budget while ensuring you have access to all the necessary features for efficient document management.

-

What features does airSlate SignNow offer for managing the IRP Schedule B Tn?

airSlate SignNow includes features such as customizable templates, in-app signing, document tracking, and secure storage, making it ideal for managing documents like the IRP Schedule B Tn. These features enhance productivity and ensure that all documents are handled efficiently, securely, and in compliance with regulations.

-

Can I integrate airSlate SignNow with other tools for processing the IRP Schedule B Tn?

Absolutely! airSlate SignNow offers integrations with various business applications such as CRM systems, cloud storage services, and project management tools. This means you can seamlessly incorporate the IRP Schedule B Tn into your existing workflow, enhancing collaboration and streamlining processes across your organization.

-

What are the benefits of using airSlate SignNow for the IRP Schedule B Tn?

Using airSlate SignNow for the IRP Schedule B Tn provides numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy in submissions. The ability to eSign documents digitally expedites the process, while features like reminders and notifications ensure that deadlines are met without hassle.

-

Is airSlate SignNow secure for handling sensitive documents like the IRP Schedule B Tn?

Yes, airSlate SignNow prioritizes security, utilizing advanced encryption and compliance standards to protect sensitive documents, including the IRP Schedule B Tn. Businesses can confidently use the platform knowing that their data is secure and that they meet all necessary legal requirements for document handling.

Get more for IRP Schedule B Tn

Find out other IRP Schedule B Tn

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast