Sc Dor Coin Operated Form 2016

What is the Sc Dor Coin Operated Form

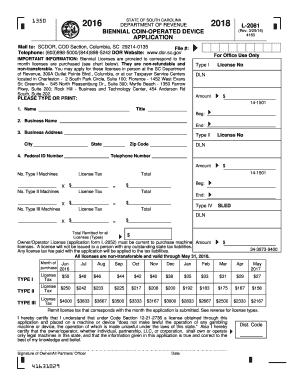

The Sc Dor Coin Operated Form is a specific document used primarily for reporting and managing coin-operated devices in the state of South Carolina. This form is essential for businesses that operate vending machines, arcade games, or similar equipment, ensuring compliance with state regulations. It provides a standardized method for reporting the number of devices, their locations, and the associated revenue, which is crucial for tax assessment and regulatory purposes.

How to use the Sc Dor Coin Operated Form

Using the Sc Dor Coin Operated Form involves several key steps. First, businesses must gather relevant information about their coin-operated devices, including the type, location, and revenue generated. Next, the form must be completed accurately, reflecting all necessary details. Once filled, it should be submitted to the appropriate state department, either online or via traditional mail, depending on the submission guidelines provided by the South Carolina Department of Revenue.

Steps to complete the Sc Dor Coin Operated Form

Completing the Sc Dor Coin Operated Form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary information about your coin-operated devices.

- Fill out the form, ensuring that all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the form according to the guidelines provided by the South Carolina Department of Revenue.

Legal use of the Sc Dor Coin Operated Form

The Sc Dor Coin Operated Form is legally binding when completed and submitted in accordance with state regulations. It serves as an official record for the South Carolina Department of Revenue, ensuring that businesses comply with tax obligations related to their coin-operated devices. Failure to submit this form accurately and on time can result in penalties or fines, emphasizing the importance of understanding its legal implications.

Key elements of the Sc Dor Coin Operated Form

Key elements of the Sc Dor Coin Operated Form include sections for reporting the number of devices, their locations, and the total revenue generated. Additionally, it may require information about the business entity operating the devices, such as the name, address, and tax identification number. Ensuring that all these elements are accurately reported is crucial for compliance and proper tax assessment.

Form Submission Methods

The Sc Dor Coin Operated Form can be submitted through various methods, allowing flexibility for businesses. Options typically include:

- Online submission through the South Carolina Department of Revenue's website.

- Mailing the completed form to the designated office.

- In-person submission at a local revenue office, if applicable.

Penalties for Non-Compliance

Non-compliance with the requirements of the Sc Dor Coin Operated Form can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Businesses are encouraged to stay informed about submission deadlines and ensure that their forms are completed accurately to avoid these consequences.

Quick guide on how to complete sc dor coin operated 2016 2019 form

Effortlessly prepare Sc Dor Coin Operated Form on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without any delays. Manage Sc Dor Coin Operated Form on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and electronically sign Sc Dor Coin Operated Form without hassle

- Obtain Sc Dor Coin Operated Form and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Sc Dor Coin Operated Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sc dor coin operated 2016 2019 form

Create this form in 5 minutes!

How to create an eSignature for the sc dor coin operated 2016 2019 form

How to generate an electronic signature for your Sc Dor Coin Operated 2016 2019 Form online

How to make an electronic signature for your Sc Dor Coin Operated 2016 2019 Form in Chrome

How to make an eSignature for signing the Sc Dor Coin Operated 2016 2019 Form in Gmail

How to make an electronic signature for the Sc Dor Coin Operated 2016 2019 Form right from your mobile device

How to create an eSignature for the Sc Dor Coin Operated 2016 2019 Form on iOS

How to generate an electronic signature for the Sc Dor Coin Operated 2016 2019 Form on Android

People also ask

-

What is the Sc Dor Coin Operated Form?

The Sc Dor Coin Operated Form is a customizable electronic document that allows users to collect payments in a secure manner. It is designed to streamline the payment process for services while offering an easy-to-use interface for both businesses and customers.

-

How does the Sc Dor Coin Operated Form benefit my business?

Using the Sc Dor Coin Operated Form can signNowly enhance your business's efficiency by automating payments. It reduces paperwork, speeds up transaction times, and minimizes the risk of errors, ultimately allowing you to focus on growing your business.

-

What are the pricing options for the Sc Dor Coin Operated Form?

The pricing for the Sc Dor Coin Operated Form varies based on the features and volume of use. Different packages are available, allowing businesses to choose a plan that best fits their needs and budget, ensuring cost-effectiveness.

-

Can I integrate the Sc Dor Coin Operated Form with other software?

Yes, the Sc Dor Coin Operated Form can seamlessly integrate with various software solutions, including CRM and accounting platforms. This capability enhances operational efficiency by ensuring all aspects of your business can communicate effectively.

-

Is the Sc Dor Coin Operated Form secure for transactions?

Absolutely, the Sc Dor Coin Operated Form employs advanced encryption and security protocols to protect sensitive transaction data. This ensures that all payments and personal information are handled securely, giving both you and your customers peace of mind.

-

How easy is it to set up the Sc Dor Coin Operated Form?

Setting up the Sc Dor Coin Operated Form is simple and user-friendly. With intuitive guides and customer support, you can have your form operational within minutes, allowing you to start processing payments quickly.

-

What features are included with the Sc Dor Coin Operated Form?

The Sc Dor Coin Operated Form includes features such as customizable templates, real-time payment tracking, and auto-notifications. These features enhance the user experience and make it an ideal solution for businesses looking to simplify their payment processes.

Get more for Sc Dor Coin Operated Form

- 1100 form

- Keiser university online transcript request form

- St thomas aquinas college request form

- Lackawanna college transcript form

- Critical need area designation application florida form

- Oakland landmark and heritage property application form

- Marta police officer form

- Oregon state university kidspirit kidspirit oregonstate form

Find out other Sc Dor Coin Operated Form

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe