Indiana Amended Individual Income Tax Return Form it 40X State Form 44405 R13 9 14 If You Are Not Filing for the Calendar Ye 2014

What is the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year

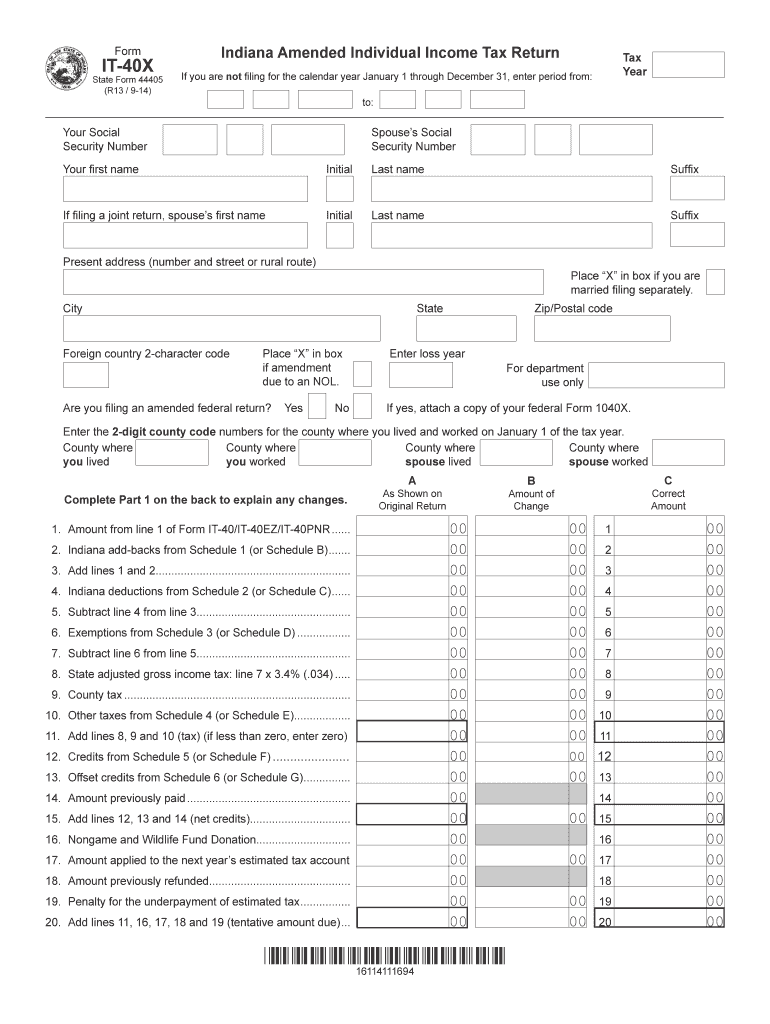

The Indiana Amended Individual Income Tax Return Form IT 40X, officially known as State Form 44405 R13 9 14, is specifically designed for taxpayers who need to amend their previously filed Indiana individual income tax returns. This form is used when a taxpayer discovers errors or omissions in their original filing, such as incorrect income reporting, missed deductions, or changes in filing status. It allows individuals to correct these mistakes and ensure their tax records are accurate, which is essential for compliance with state tax laws.

Steps to Complete the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year

Completing the Indiana Amended Individual Income Tax Return Form IT 40X involves several key steps:

- Gather all relevant documents, including your original tax return and any supporting documentation for the changes you are making.

- Clearly indicate the changes being made on the form. This includes providing updated figures and explanations for each correction.

- Ensure that all required fields are filled out accurately, including your name, address, and Social Security number.

- Review the form for completeness and accuracy before submission to avoid delays or penalties.

- Sign and date the form, as an unsigned form may be considered invalid.

How to Obtain the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year

The Indiana Amended Individual Income Tax Return Form IT 40X can be obtained through various channels. Taxpayers can download the form directly from the Indiana Department of Revenue's official website. Additionally, physical copies may be available at local tax offices or libraries. It is important to ensure you are using the most current version of the form to comply with state regulations.

Legal Use of the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year

The legal use of the Indiana Amended Individual Income Tax Return Form IT 40X is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted within the appropriate time frame, typically within three years from the original filing date. Additionally, the form must include the necessary signatures to ensure it is legally binding. Adhering to these guidelines helps prevent potential legal issues with the Indiana Department of Revenue.

Filing Deadlines / Important Dates

When filing the Indiana Amended Individual Income Tax Return Form IT 40X, it is crucial to be aware of the deadlines. Generally, amended returns should be filed within three years of the original due date of the return being amended. This timeline ensures that taxpayers can correct any errors without facing penalties. It is advisable to check the Indiana Department of Revenue's website for any updates or changes to these deadlines.

Key Elements of the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year

Key elements of the Indiana Amended Individual Income Tax Return Form IT 40X include:

- Taxpayer identification information, including Social Security number and address.

- Details of the original return, including the tax year and amounts reported.

- Specific changes being made, with clear explanations for each adjustment.

- Signature and date fields to validate the submission.

Quick guide on how to complete indiana amended individual income tax return form it 40x state form 44405 r13 9 14 if you are not filing for the calendar year

Effortlessly Prepare Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Ye on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly without delays. Handle Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Ye on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and Electronically Sign Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Ye Without Stress

- Obtain Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Ye and click on Get Form to begin.

- Utilize the tools available to finalize your document.

- Highlight important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you prefer to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Ye and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indiana amended individual income tax return form it 40x state form 44405 r13 9 14 if you are not filing for the calendar year

Create this form in 5 minutes!

How to create an eSignature for the indiana amended individual income tax return form it 40x state form 44405 r13 9 14 if you are not filing for the calendar year

How to create an eSignature for the Indiana Amended Individual Income Tax Return Form It 40x State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year in the online mode

How to generate an eSignature for your Indiana Amended Individual Income Tax Return Form It 40x State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year in Chrome

How to create an eSignature for putting it on the Indiana Amended Individual Income Tax Return Form It 40x State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year in Gmail

How to create an eSignature for the Indiana Amended Individual Income Tax Return Form It 40x State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year from your mobile device

How to create an eSignature for the Indiana Amended Individual Income Tax Return Form It 40x State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year on iOS

How to make an eSignature for the Indiana Amended Individual Income Tax Return Form It 40x State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Year on Android

People also ask

-

What is the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14?

The Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 is a form used by individuals to correct errors on their previously filed Indiana income tax returns. This form allows taxpayers to make adjustments for various reasons, ensuring accurate tax reporting and compliance with Indiana state tax laws.

-

How can I obtain the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14?

You can obtain the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 from the Indiana Department of Revenue's website or directly from airSlate SignNow. Our platform offers an easy way to fill out and eSign the form online, streamlining the process signNowly.

-

What are the benefits of using airSlate SignNow for the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14?

Using airSlate SignNow to complete the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 provides a user-friendly experience and ensures secure submissions. Our platform allows you to eSign documents conveniently, saving time and reducing errors while completing the amendment process.

-

Is there a cost associated with filing the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 using airSlate SignNow?

Yes, there is a nominal fee for utilizing airSlate SignNow's services to file the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14. However, this cost is signNowly lower compared to potential penalties or mistakes that could arise from incorrect filing.

-

What features does airSlate SignNow offer for the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14?

airSlate SignNow offers features such as electronic signatures, document tracking, and templates tailored for the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14. These features help ensure that your documents are managed efficiently and securely throughout the filing process.

-

Can I integrate airSlate SignNow with other software to file the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14?

Yes, airSlate SignNow supports integration with various software solutions, allowing you to streamline your workflow while filing the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14. This integration makes it easier to manage your documents and tax filings all in one place.

-

What should I do if I need assistance with the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14?

If you require assistance with the Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14, our customer support team is here to help. You can signNow out to us via chat or email, and we'll provide guidance to ensure that you correctly complete your form.

Get more for Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Ye

Find out other Indiana Amended Individual Income Tax Return Form IT 40X State Form 44405 R13 9 14 If You Are Not Filing For The Calendar Ye

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe