It40x 2017

What is the It40x

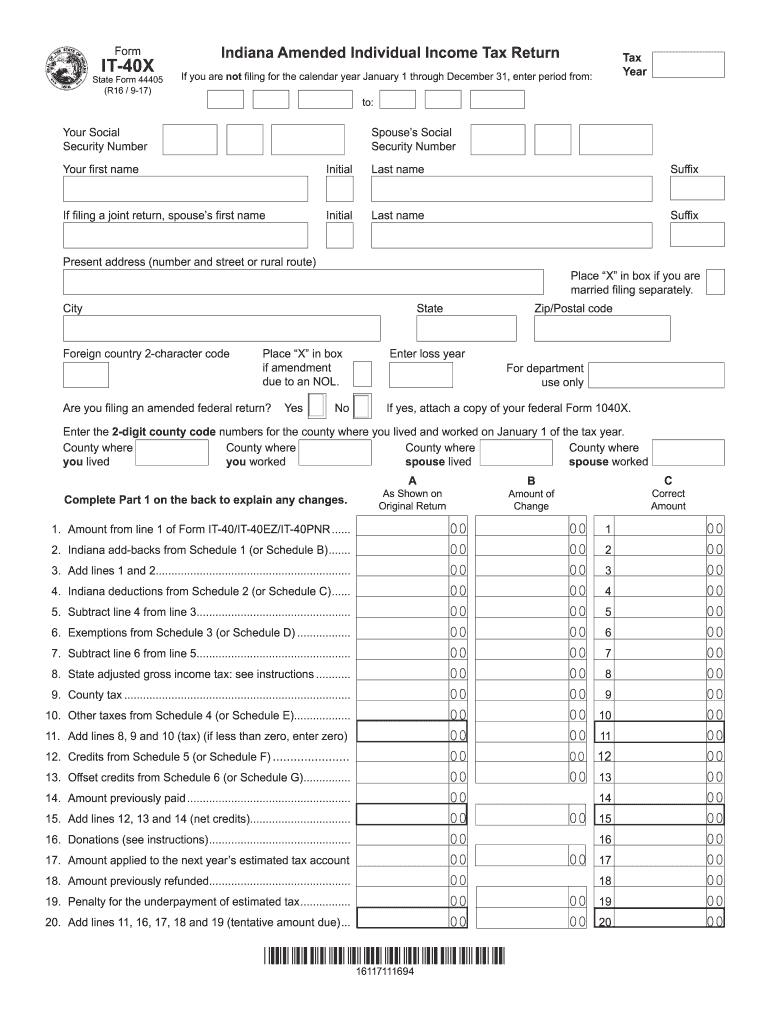

The It40x is a state tax form used in Indiana for individuals who need to report their income and calculate their tax liability. This form is specifically designed for residents and part-year residents of Indiana. It allows taxpayers to detail their income, claim deductions, and determine their tax credits. Understanding the purpose and structure of the It40x is essential for accurate tax reporting and compliance with state regulations.

How to use the It40x

Using the It40x involves several steps to ensure accurate completion. Taxpayers should first gather all necessary financial documents, including W-2 forms, 1099s, and any relevant receipts for deductions. Next, individuals will fill out the form by entering their income, deductions, and credits. It is important to double-check all entries for accuracy. Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference.

Steps to complete the It40x

Completing the It40x requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including income statements and deduction records.

- Fill in personal information, including name, address, and Social Security number.

- Report all sources of income accurately, including wages, interest, and dividends.

- Claim applicable deductions and credits, ensuring to follow the guidelines for each.

- Review the completed form for any errors or omissions.

- Submit the form electronically through a secure platform or mail it to the appropriate tax authority.

Legal use of the It40x

The It40x must be used in compliance with Indiana tax laws to be considered legally valid. This includes ensuring that all information provided is truthful and accurate. Taxpayers should be aware of the legal implications of submitting false information, which can lead to penalties or audits. Utilizing a reliable eSignature solution can enhance the legal standing of the submitted form, ensuring that it meets all necessary requirements.

Filing Deadlines / Important Dates

Filing deadlines for the It40x are crucial for compliance. Typically, the deadline for submitting the form is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any changes in deadlines due to state regulations or special circumstances, such as natural disasters or emergency declarations.

Required Documents

To complete the It40x accurately, several documents are required. These include:

- W-2 forms from employers for reporting wages.

- 1099 forms for reporting other income sources, such as freelance work or interest.

- Receipts for deductible expenses, including medical costs or educational expenses.

- Any prior year tax returns for reference.

Form Submission Methods (Online / Mail / In-Person)

The It40x can be submitted through various methods to accommodate taxpayer preferences. Options include:

- Online submission through a secure e-filing platform, which is often faster and more efficient.

- Mailing a paper copy of the completed form to the designated state tax office.

- In-person submission at local tax offices, although this may require an appointment.

Quick guide on how to complete form m1x amended minnesota income tax minnesota department

Easily Prepare It40x on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle It40x on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign It40x Effortlessly

- Find It40x and click Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools provided by airSlate SignNow specifically for this purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form - via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements within a few clicks from any device of your choice. Modify and electronically sign It40x to ensure effective communication at every stage of your document preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form m1x amended minnesota income tax minnesota department

Create this form in 5 minutes!

How to create an eSignature for the form m1x amended minnesota income tax minnesota department

How to create an eSignature for the Form M1x Amended Minnesota Income Tax Minnesota Department in the online mode

How to create an eSignature for your Form M1x Amended Minnesota Income Tax Minnesota Department in Google Chrome

How to make an electronic signature for signing the Form M1x Amended Minnesota Income Tax Minnesota Department in Gmail

How to make an eSignature for the Form M1x Amended Minnesota Income Tax Minnesota Department from your smartphone

How to make an electronic signature for the Form M1x Amended Minnesota Income Tax Minnesota Department on iOS devices

How to make an eSignature for the Form M1x Amended Minnesota Income Tax Minnesota Department on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to it 40 x?

airSlate SignNow is an innovative eSignature solution that empowers businesses to send and sign documents effortlessly. With its user-friendly interface and affordable pricing, it 40 x enhances productivity by streamlining document workflows, making it an essential tool for modern businesses.

-

What features does airSlate SignNow offer that align with it 40 x?

airSlate SignNow offers a range of features including customizable templates, secure document storage, and multi-party signing capabilities. These features support it 40 x by enabling businesses to handle high volumes of documents efficiently, improving overall workflow.

-

How does airSlate SignNow optimize my business processes in an it 40 x environment?

In an it 40 x environment, airSlate SignNow optimizes business processes by automating document handling, thereby reducing turnaround times. With integrations to various platforms, it allows teams to collaborate seamlessly, enhancing operational efficiency across all levels.

-

What is the pricing structure of airSlate SignNow and how does it compare to competitors in the it 40 x space?

airSlate SignNow offers a competitive pricing structure that provides signNow savings for businesses managing multiple documents. Compared to competitors in the it 40 x space, its cost-effective plan allows organizations to maximize their investment while reaping the full benefits of eSignature technology.

-

Is airSlate SignNow suitable for small businesses looking to scale with it 40 x?

Absolutely! airSlate SignNow is particularly well-suited for small businesses that need to scale operations efficiently. With its intuitive design and robust features, it 40 x allows small enterprises to harness the power of eSignatures for growth without overwhelming costs.

-

Can airSlate SignNow integrate with other tools in my tech stack for an it 40 x solution?

Yes, airSlate SignNow easily integrates with a variety of other tools within your tech stack, such as CRM and project management applications. This capability makes it 40 x an integral part of your workflow, ensuring that all your tools work together seamlessly for maximum efficiency.

-

What security measures does airSlate SignNow implement that support it 40 x?

airSlate SignNow ensures the utmost security for your documents through advanced encryption and compliance with major regulations such as GDPR and HIPAA. With these security measures in place, it 40 x protects sensitive information while allowing businesses to send and sign documents with peace of mind.

Get more for It40x

- Well care exam forms and anticipatory guidance

- Nc mvr 330 form

- Department of justice executive office for immigration review immigration court 1100 commerce street suite 4b41 dallas texas form

- Illinois sales tax st 1 form

- Stepparent adoption consent to adoption by a parent in or outside cdss ca form

- Osss 7 application for certificate of ownership newjersey form

- 4817 conditional lien release california department of hcd ca form

- Private patrol operator 2015 2019 form

Find out other It40x

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity