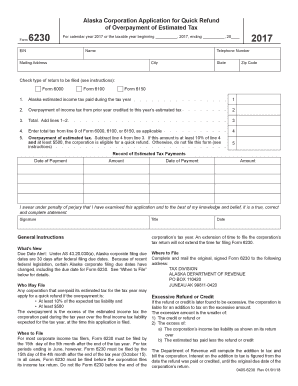

Application for Quick Refund of Overpayment to Estimated Tax and 2017

What is the Application For Quick Refund Of Overpayment To Estimated Tax And

The Application For Quick Refund Of Overpayment To Estimated Tax And is a specific form used by taxpayers in the United States to request a refund for any overpayment made towards their estimated tax obligations. This form is particularly relevant for individuals or businesses that have overpaid their estimated taxes and seek to recover those funds efficiently. By utilizing this application, taxpayers can streamline the process of obtaining their refunds, ensuring that they receive their money back in a timely manner.

How to use the Application For Quick Refund Of Overpayment To Estimated Tax And

Using the Application For Quick Refund Of Overpayment To Estimated Tax And involves several straightforward steps. First, ensure that you have accurately calculated your overpayment amount. Next, obtain the form through the appropriate IRS channels or financial institutions. Once you have the form, fill it out completely, providing all necessary information such as your personal details, tax identification number, and the amount of overpayment. Finally, submit the completed form through the designated submission method, which may include online filing, mailing, or in-person delivery to the appropriate tax office.

Steps to complete the Application For Quick Refund Of Overpayment To Estimated Tax And

Completing the Application For Quick Refund Of Overpayment To Estimated Tax And requires careful attention to detail. Begin by gathering all relevant financial documents that support your claim of overpayment. Next, follow these steps:

- Obtain the application form from the IRS website or your tax professional.

- Fill in your personal information accurately, including your name, address, and Social Security number.

- Clearly state the amount of overpayment you are claiming.

- Sign and date the application to validate your request.

- Review the form for any errors before submission.

After ensuring the form is complete, submit it according to the guidelines provided by the IRS.

Required Documents

When submitting the Application For Quick Refund Of Overpayment To Estimated Tax And, certain documents may be required to support your claim. These typically include:

- Proof of payment, such as bank statements or receipts.

- Previous tax returns that demonstrate your estimated tax payments.

- Any correspondence from the IRS regarding your estimated taxes.

Having these documents ready can facilitate a smoother review process by the IRS.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the Application For Quick Refund Of Overpayment To Estimated Tax And. Generally, the application should be submitted as soon as you identify an overpayment. However, there may be specific deadlines based on your tax situation or the tax year in question. Keeping track of these dates can help ensure that you receive your refund without unnecessary delays.

Eligibility Criteria

To be eligible for the Application For Quick Refund Of Overpayment To Estimated Tax And, you must meet certain criteria. Primarily, you should have made an overpayment on your estimated taxes. Additionally, you need to be a taxpayer in good standing with the IRS, meaning you have filed all required tax returns and paid any outstanding taxes owed. Understanding these eligibility requirements can help you determine if you can successfully file for a refund.

Quick guide on how to complete application for quick refund of overpayment to estimated tax and

Complete Application For Quick Refund Of Overpayment To Estimated Tax And effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It offers a great eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Application For Quick Refund Of Overpayment To Estimated Tax And on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Application For Quick Refund Of Overpayment To Estimated Tax And seamlessly

- Find Application For Quick Refund Of Overpayment To Estimated Tax And and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Application For Quick Refund Of Overpayment To Estimated Tax And and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for quick refund of overpayment to estimated tax and

Create this form in 5 minutes!

How to create an eSignature for the application for quick refund of overpayment to estimated tax and

How to create an electronic signature for the Application For Quick Refund Of Overpayment To Estimated Tax And in the online mode

How to make an eSignature for the Application For Quick Refund Of Overpayment To Estimated Tax And in Google Chrome

How to make an eSignature for putting it on the Application For Quick Refund Of Overpayment To Estimated Tax And in Gmail

How to make an electronic signature for the Application For Quick Refund Of Overpayment To Estimated Tax And from your smartphone

How to make an eSignature for the Application For Quick Refund Of Overpayment To Estimated Tax And on iOS

How to make an eSignature for the Application For Quick Refund Of Overpayment To Estimated Tax And on Android devices

People also ask

-

What is the Application For Quick Refund Of Overpayment To Estimated Tax And?

The Application For Quick Refund Of Overpayment To Estimated Tax And is a streamlined process that allows you to request refunds for overpaid estimated taxes. This form enables taxpayers to quickly initiate refunds and manage their finances more effectively.

-

How can airSlate SignNow help with my Application For Quick Refund Of Overpayment To Estimated Tax And?

airSlate SignNow provides a user-friendly platform to electronically sign and send your Application For Quick Refund Of Overpayment To Estimated Tax And. Its features ensure that your documents are securely handled and easily accessible, speeding up the refund process.

-

What are the costs associated with using airSlate SignNow for the Application For Quick Refund Of Overpayment To Estimated Tax And?

airSlate SignNow offers various pricing plans designed to meet diverse business needs. You can find affordable options that provide all the tools necessary for effectively handling your Application For Quick Refund Of Overpayment To Estimated Tax And.

-

Are there any integrations available for managing the Application For Quick Refund Of Overpayment To Estimated Tax And?

Yes, airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Salesforce, and more. This makes managing your Application For Quick Refund Of Overpayment To Estimated Tax And easy, allowing for better workflow and document management.

-

What are the benefits of using airSlate SignNow for the Application For Quick Refund Of Overpayment To Estimated Tax And?

Using airSlate SignNow for your Application For Quick Refund Of Overpayment To Estimated Tax And offers several benefits, including faster processing times, enhanced security for your documents, and reduction in paperwork. It helps streamline workflows and improves overall efficiency.

-

Is airSlate SignNow easy to use for completing the Application For Quick Refund Of Overpayment To Estimated Tax And?

Absolutely! airSlate SignNow is designed to be user-friendly, allowing you to quickly complete the Application For Quick Refund Of Overpayment To Estimated Tax And without any technical expertise. You can easily navigate the platform and complete your tasks efficiently.

-

What kind of customer support does airSlate SignNow provide for the Application For Quick Refund Of Overpayment To Estimated Tax And?

airSlate SignNow offers robust customer support to assist you with your Application For Quick Refund Of Overpayment To Estimated Tax And. You can signNow out to our knowledgeable team via chat, email, or phone for any inquiries or help you might need.

Get more for Application For Quick Refund Of Overpayment To Estimated Tax And

Find out other Application For Quick Refund Of Overpayment To Estimated Tax And

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP