Alaska Corporation Application for Quick Refund of Overpayment of 2019-2026

What is the AK 6230 Corporation Application for Quick Refund of Overpayment?

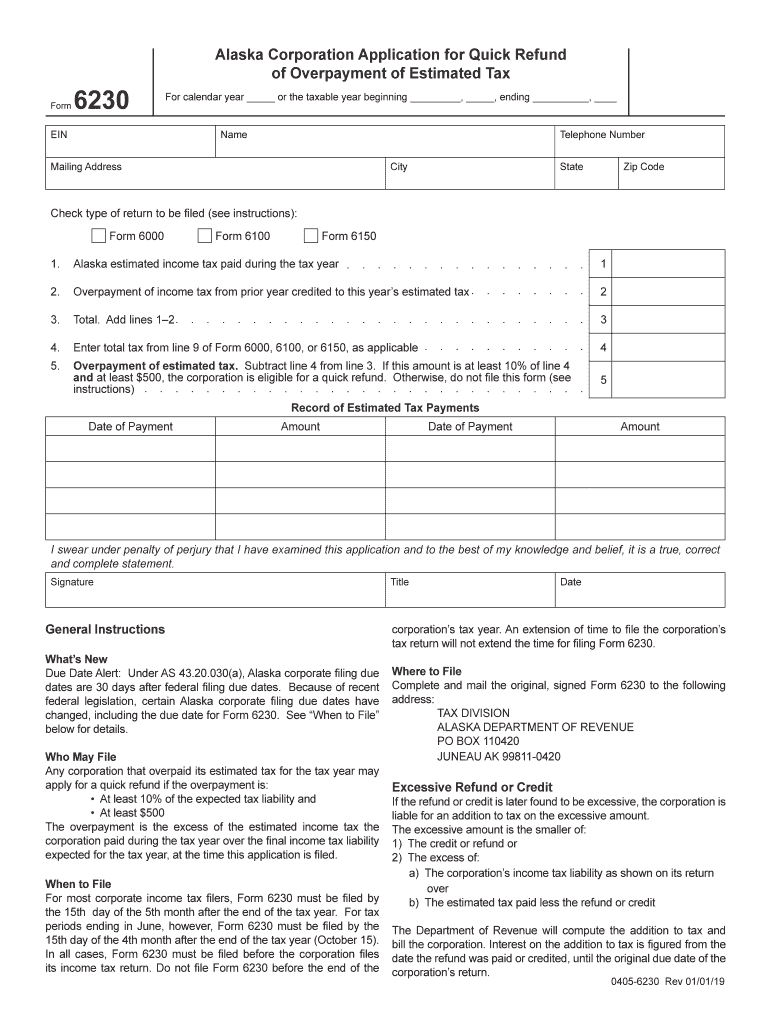

The AK 6230 Corporation Application for Quick Refund of Overpayment is a specific form used by corporations in Alaska to request a refund for any overpayment made to the state. This application is essential for businesses that have inadvertently paid more than their tax liability. Understanding this form is crucial for ensuring that corporations can recover their funds efficiently and comply with state regulations.

Steps to Complete the AK 6230 Corporation Application for Quick Refund of Overpayment

Completing the AK 6230 Corporation Application involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather Required Information: Collect all necessary documentation, including previous tax returns and payment records.

- Fill Out the Application: Complete the form with accurate details regarding the overpayment and the reason for the refund request.

- Attach Supporting Documents: Include any relevant documentation that supports your claim for a refund.

- Review for Accuracy: Double-check all entries for correctness to avoid delays.

- Submit the Application: Send the completed form and attachments to the appropriate state department.

Legal Use of the AK 6230 Corporation Application for Quick Refund of Overpayment

The AK 6230 Corporation Application is legally binding when completed correctly. It must adhere to the guidelines set forth by the Alaska Department of Revenue. The application is considered valid if it includes the necessary signatures and supporting documentation. Ensuring compliance with state laws is vital for the legitimacy of the refund request.

Eligibility Criteria for the AK 6230 Corporation Application for Quick Refund of Overpayment

To be eligible to file the AK 6230 Corporation Application, corporations must meet specific criteria. These include:

- Having made an overpayment on state taxes.

- Being in good standing with the Alaska Department of Revenue.

- Providing accurate and complete information on the application.

Required Documents for the AK 6230 Corporation Application for Quick Refund of Overpayment

When submitting the AK 6230 Corporation Application, several documents are necessary to support the claim. These typically include:

- Previous tax returns showing the overpayment.

- Payment receipts or proof of payment to the state.

- Any correspondence with the Alaska Department of Revenue regarding the overpayment.

Form Submission Methods for the AK 6230 Corporation Application

The AK 6230 Corporation Application can be submitted through various methods, ensuring flexibility for businesses. The available submission methods include:

- Online Submission: Corporations can submit the application electronically through the Alaska Department of Revenue's online portal.

- Mail: The completed form can be mailed to the designated office of the Alaska Department of Revenue.

- In-Person: Businesses may also choose to deliver the application in person at the appropriate state office.

Quick guide on how to complete alaska corporation application for quick refund of overpayment of

Effortlessly Prepare Alaska Corporation Application For Quick Refund Of Overpayment Of on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed forms, allowing you to access the necessary templates and securely keep them online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents quickly and without complications. Manage Alaska Corporation Application For Quick Refund Of Overpayment Of on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Edit and Electronically Sign Alaska Corporation Application For Quick Refund Of Overpayment Of with Ease

- Find Alaska Corporation Application For Quick Refund Of Overpayment Of and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Mark important sections of the files or obscure private information with tools specifically designed by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign feature, which only takes seconds and carries the same legal standing as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Alaska Corporation Application For Quick Refund Of Overpayment Of while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska corporation application for quick refund of overpayment of

Create this form in 5 minutes!

How to create an eSignature for the alaska corporation application for quick refund of overpayment of

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the AK 6230 Corporation and how does it relate to airSlate SignNow?

The AK 6230 Corporation is a business entity that utilizes airSlate SignNow's innovative solutions for managing electronic signatures and document workflows. This integration enhances the efficiency of document handling, making it simpler for corporations like AK 6230 to streamline their operations. By leveraging airSlate SignNow, the AK 6230 Corporation can improve its operational efficiency and accelerate business processes.

-

What features does airSlate SignNow offer to the AK 6230 Corporation?

AirSlate SignNow provides a robust set of features tailored to meet the needs of the AK 6230 Corporation, including customizable templates, secure eSigning, and real-time document status tracking. These capabilities allow the corporation to manage documents efficiently while ensuring compliance and security. Additionally, airSlate SignNow's user-friendly interface simplifies the signing process for all parties involved.

-

How much does airSlate SignNow cost for the AK 6230 Corporation?

The pricing for airSlate SignNow is designed to accommodate businesses of all sizes, including the AK 6230 Corporation. Subscriptions typically start at competitive rates, which provide access to essential features. For tailored pricing, businesses should contact sales for personalized quotes that reflect the specific needs of the AK 6230 Corporation.

-

Can the AK 6230 Corporation integrate airSlate SignNow with other applications?

Yes, the AK 6230 Corporation can integrate airSlate SignNow with various other applications, enhancing its functionality and streamlining workflows. Examples of integrations include CRM software, project management tools, and cloud storage services. These integrations enable the AK 6230 Corporation to maintain seamless operations across its preferred platforms.

-

What are the security measures that airSlate SignNow employs for the AK 6230 Corporation?

AirSlate SignNow prioritizes the security of its users, including the AK 6230 Corporation, by implementing advanced encryption protocols and compliance with industry standards. This ensures that all electronic signatures and document transactions remain secure and confidential. The AK 6230 Corporation can have peace of mind knowing that its sensitive information is well-protected.

-

What benefits can the AK 6230 Corporation expect from using airSlate SignNow?

By using airSlate SignNow, the AK 6230 Corporation can expect numerous benefits such as increased efficiency, reduced turnaround times, and improved workflow management. The platform enables rapid document processing through its intuitive interface, allowing teams to focus on core business activities rather than administrative tasks. Additionally, companies like the AK 6230 Corporation benefit from enhanced customer satisfaction due to quicker document transactions.

-

Is there customer support available for the AK 6230 Corporation using airSlate SignNow?

Yes, the AK 6230 Corporation can access dedicated customer support when using airSlate SignNow. Support options include live chat, email assistance, and an extensive knowledge base, ensuring that all user queries can be addressed promptly. This level of support helps the AK 6230 Corporation maximize the value of its investment in airSlate SignNow.

Get more for Alaska Corporation Application For Quick Refund Of Overpayment Of

- California initial disclosures form

- Fm 1013 447970120 form

- Instructions to the sheriff of the county of sacramento form

- State court civil forms

- State court duces tecum subpoena macon bibb form

- City of scottsdale lienminhtv com form

- Translated materialstexas health and human services form

- If you intend to make a claim for personal injury or property damage under the massachusetts form

Find out other Alaska Corporation Application For Quick Refund Of Overpayment Of

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed