P87 Form 2011-2026

What is the P87 Form

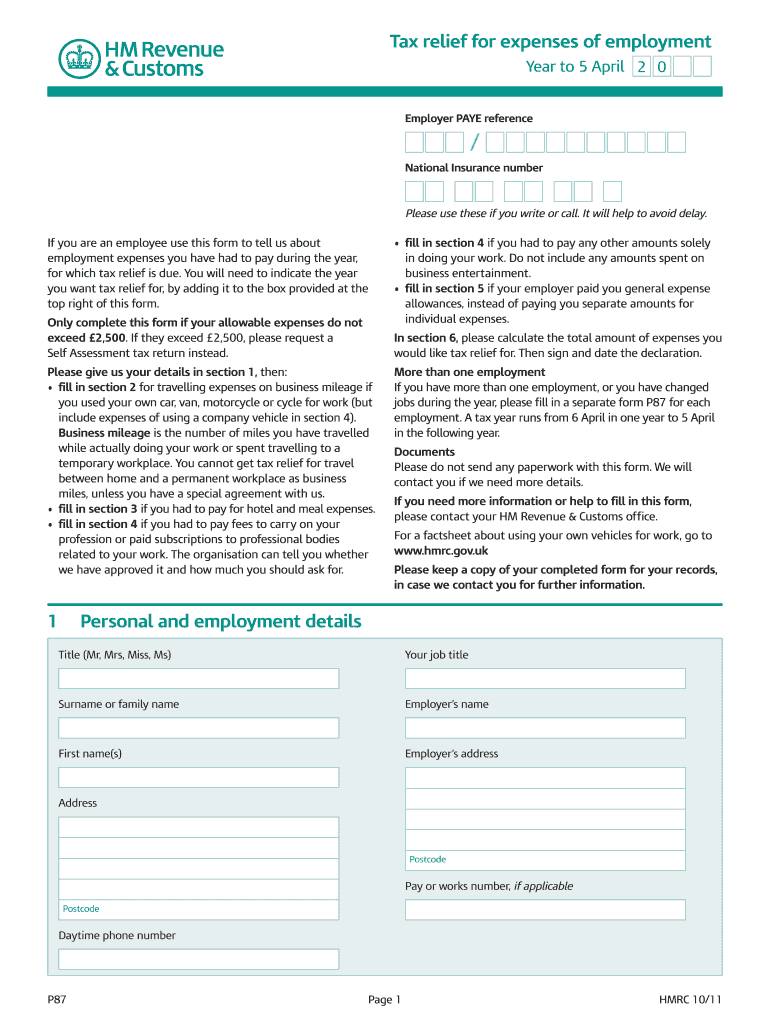

The P87 form is a tax document used in the United States for individuals to claim certain deductions related to employment expenses. This form is particularly relevant for employees who incur costs while performing their job duties, which are not reimbursed by their employers. The P87 form allows taxpayers to detail these expenses and potentially reduce their taxable income, leading to a lower tax liability. Understanding the purpose of the P87 form is essential for those looking to maximize their deductions and ensure compliance with tax regulations.

How to obtain the P87 Form

Obtaining the P87 form is a straightforward process. Taxpayers can download the form directly from the official IRS website or other authorized sources. The P87 form is available in PDF format, making it easy to print and fill out. Additionally, many tax preparation software programs include the P87 form, allowing users to complete it digitally. Ensuring that you have the most current version of the form is crucial, as tax regulations can change, affecting the information required.

Steps to complete the P87 Form

Completing the P87 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including receipts for any expenses you plan to claim. Next, fill out your personal information, including your name, address, and Social Security number. Then, itemize your expenses in the designated sections of the form. Be sure to provide clear descriptions and amounts for each expense. Finally, review the completed form for any errors before submitting it. Accurate completion of the P87 form is essential to avoid delays in processing and potential issues with the IRS.

Legal use of the P87 Form

The legal use of the P87 form is governed by IRS regulations. To ensure that the form is valid, taxpayers must adhere to specific guidelines regarding the types of expenses that can be claimed. This includes only claiming expenses that are ordinary and necessary for their job. Additionally, keeping thorough records and documentation to support the claims made on the P87 form is vital. Failure to comply with these legal requirements can result in penalties or disallowance of the claimed deductions during an audit.

Key elements of the P87 Form

The P87 form contains several key elements that taxpayers must understand to complete it effectively. These include sections for personal information, a detailed list of claimed expenses, and a signature line for verification. Each section is designed to capture specific information that the IRS requires for processing the form. Understanding these elements helps ensure that all necessary information is provided, reducing the risk of errors that could lead to complications with tax filings.

Examples of using the P87 Form

There are various scenarios in which the P87 form can be utilized effectively. For instance, a teacher who purchases classroom supplies out of pocket may use the P87 form to claim those expenses. Similarly, a sales representative who travels for work can document travel expenses incurred while meeting clients. These examples illustrate how the P87 form serves as a valuable tool for employees seeking to recover costs associated with their job responsibilities.

Filing Deadlines / Important Dates

Filing deadlines for the P87 form typically align with the overall tax filing deadlines set by the IRS. Taxpayers should be aware of these important dates to ensure timely submission. Generally, individual tax returns are due on April fifteenth of each year. However, if additional time is needed, taxpayers can file for an extension, which may also apply to the P87 form. Staying informed about these deadlines is crucial to avoid penalties and ensure compliance with tax regulations.

Quick guide on how to complete p87 form 100057253

Effortlessly Prepare P87 Form on Any Device

Managing documents online has gained signNow popularity among businesses and individuals. It offers a sustainable and eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the essential tools to swiftly create, modify, and eSign your documents without any delays. Handle P87 Form on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

Effortless Editing and eSigning of P87 Form

- Find P87 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign P87 Form while ensuring excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the p87 form 100057253

How to create an eSignature for the P87 Form 100057253 online

How to create an electronic signature for the P87 Form 100057253 in Google Chrome

How to make an eSignature for signing the P87 Form 100057253 in Gmail

How to make an electronic signature for the P87 Form 100057253 right from your smartphone

How to make an electronic signature for the P87 Form 100057253 on iOS

How to make an eSignature for the P87 Form 100057253 on Android

People also ask

-

What is the P87 Form and how is it used?

The P87 Form is a tax return form used in the UK for claiming tax relief on employment expenses. It is particularly beneficial for individuals who incur costs related to their job, such as travel or work-related purchases. By utilizing an electronic solution like airSlate SignNow, you can easily complete and eSign your P87 Form, streamlining the submission process.

-

How can airSlate SignNow help with submitting a P87 Form?

airSlate SignNow simplifies the process of submitting your P87 Form by allowing you to fill it out electronically and securely eSign it. This not only saves time but also ensures that your form is submitted accurately and on time. With our platform, you can manage all your documents from one place, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for the P87 Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, providing you with the tools necessary to eSign documents, including the P87 Form, without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for handling the P87 Form?

airSlate SignNow offers features like document templates, secure eSigning, and real-time tracking to help you manage your P87 Form with ease. You can create a template for your P87 Form, ensuring you never miss a detail when filling it out. Additionally, our platform provides a user-friendly interface that enhances the overall experience.

-

Can I integrate airSlate SignNow with other applications for my P87 Form?

Absolutely! airSlate SignNow offers seamless integrations with a variety of applications such as Google Drive, Dropbox, and more. This allows you to easily access and manage your P87 Form alongside other important documents, ensuring a smooth workflow without any hassle.

-

What are the benefits of using airSlate SignNow for my P87 Form?

Using airSlate SignNow for your P87 Form offers numerous benefits, including faster processing times and improved accuracy. Our platform reduces the risk of errors that can occur with paper forms, leading to quicker tax refunds. Additionally, the electronic format allows you to store and retrieve your document with just a few clicks.

-

Is airSlate SignNow secure for handling sensitive information on the P87 Form?

Yes, airSlate SignNow prioritizes security and employs advanced encryption methods to protect your sensitive information on the P87 Form. You can trust that your data is safe while using our platform, as we comply with industry standards and regulations to ensure confidentiality and security.

Get more for P87 Form

- Scout advancement progress chart boy scouts cub scouts form

- Texas supplemental employment verification form

- Blue cross blue shield por producer of record form tx

- Iop request form blue cross and blue shield of texas

- Blank pregnancy notification form

- Form bca 1030rev dec 2003 articles of amendment business

- Certificate of purchase illinois form

- Il designated form

Find out other P87 Form

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT