Ny Mandatory First Installment 2018

What is the NY Mandatory First Installment

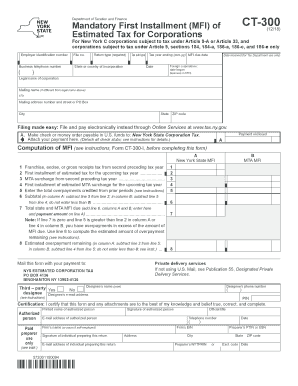

The NY Mandatory First Installment, often referred to as the NY CT 300, is a form required by the New York State Department of Taxation and Finance for certain business entities. This form is primarily used to report and remit the first installment of estimated tax payments for corporations. It is particularly relevant for businesses that anticipate owing tax for the current year, ensuring compliance with state tax regulations.

Steps to Complete the NY Mandatory First Installment

Completing the NY CT 300 involves several key steps to ensure accuracy and compliance:

- Gather necessary financial information, including previous tax returns and current financial statements.

- Calculate the estimated tax liability for the current year based on projected income.

- Determine the amount of the first installment due, which is typically a percentage of the estimated tax liability.

- Fill out the NY CT 300 form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

Legal Use of the NY Mandatory First Installment

The NY CT 300 form must be filed in accordance with New York State tax laws. Legal use of this form includes timely submission to avoid penalties and interest. Properly completing and filing the form ensures that businesses meet their tax obligations and maintain compliance with state regulations. Failure to file the form can result in significant penalties, making it crucial for businesses to adhere to the guidelines set forth by the state.

Filing Deadlines / Important Dates

Filing deadlines for the NY CT 300 are critical to avoid penalties. Typically, the first installment is due on the fifteenth day of the fourth month following the end of the tax year. For most corporations, this means the deadline falls on April 15. It is important for businesses to mark their calendars and ensure that the form is submitted on time to maintain compliance and avoid unnecessary fees.

Required Documents

To complete the NY CT 300, businesses need to prepare several documents:

- Previous year’s tax return for reference.

- Current financial statements, including profit and loss statements.

- Documentation supporting income projections for the current year.

Having these documents ready will streamline the completion of the form and help ensure accurate reporting of estimated tax liabilities.

Form Submission Methods

The NY CT 300 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing the completed form to the designated tax office.

- In-person delivery at local tax offices, if necessary.

Choosing the appropriate submission method can help ensure timely processing of the form.

Penalties for Non-Compliance

Failure to file the NY CT 300 on time can result in significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on unpaid taxes, increasing the total amount owed.

- Potential audits or additional scrutiny from tax authorities.

Understanding these consequences emphasizes the importance of timely and accurate filing of the NY CT 300.

Quick guide on how to complete form ct 3001218mandatory first installment mfi of estimated tax for corporationsct300

Prepare Ny Mandatory First Installment effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Ny Mandatory First Installment on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Ny Mandatory First Installment with ease

- Locate Ny Mandatory First Installment and then click Get Form to begin.

- Employ the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method of delivering your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiresome form searches, or errors requiring new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Ny Mandatory First Installment and ensure clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 3001218mandatory first installment mfi of estimated tax for corporationsct300

Create this form in 5 minutes!

How to create an eSignature for the form ct 3001218mandatory first installment mfi of estimated tax for corporationsct300

How to generate an electronic signature for your Form Ct 3001218mandatory First Installment Mfi Of Estimated Tax For Corporationsct300 online

How to create an eSignature for the Form Ct 3001218mandatory First Installment Mfi Of Estimated Tax For Corporationsct300 in Chrome

How to create an eSignature for signing the Form Ct 3001218mandatory First Installment Mfi Of Estimated Tax For Corporationsct300 in Gmail

How to make an electronic signature for the Form Ct 3001218mandatory First Installment Mfi Of Estimated Tax For Corporationsct300 from your mobile device

How to create an eSignature for the Form Ct 3001218mandatory First Installment Mfi Of Estimated Tax For Corporationsct300 on iOS

How to make an electronic signature for the Form Ct 3001218mandatory First Installment Mfi Of Estimated Tax For Corporationsct300 on Android

People also ask

-

What is NY CT 300 and how does it relate to airSlate SignNow?

NY CT 300 is a form used for reporting New York corporate taxes. With airSlate SignNow, businesses can easily eSign and send this document securely. Our platform streamlines the process, ensuring compliance with state regulations while simplifying corporate document management.

-

How can airSlate SignNow help me with the NY CT 300 form?

AirSlate SignNow allows you to fill out the NY CT 300 form electronically and ensures that all necessary signatures are collected efficiently. This process minimizes the chances of errors and helps in maintaining accurate records. Additionally, our service streamlines your workflow, saving you time.

-

What features does airSlate SignNow offer for managing the NY CT 300?

Our platform provides features such as customizable templates, electronic signatures, and secure storage specifically for documents like the NY CT 300. These tools help you automate your document workflow, ensuring that you can complete and send necessary forms quickly and safely.

-

Is airSlate SignNow cost-effective for filing the NY CT 300?

Yes, airSlate SignNow offers competitive pricing plans that make it a cost-effective solution for filing the NY CT 300. You can choose a plan that fits your business needs, helping you save money while benefiting from a professional-grade eSignature service.

-

What are the benefits of using airSlate SignNow for the NY CT 300?

Using airSlate SignNow for the NY CT 300 facilitates faster processing, enhanced accuracy, and improved tracking of documents. The sleek interface and user-friendly design make it accessible for users of all skill levels, helping you manage your corporate taxes more effectively.

-

Can I integrate airSlate SignNow with other software for managing the NY CT 300?

Yes, airSlate SignNow can be easily integrated with various business applications like CRM systems and accounting software, allowing you to manage the NY CT 300 seamlessly. These integrations enhance productivity by connecting your document management processes across multiple platforms.

-

Do I need to pay extra for electronic signatures when filing the NY CT 300?

No, airSlate SignNow includes electronic signatures as part of all its pricing plans, ensuring that you can eSign the NY CT 300 without any additional fees. This transparency in pricing means you can complete your tax filing without unexpected costs.

Get more for Ny Mandatory First Installment

Find out other Ny Mandatory First Installment

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document