CT 300 2017

What is the CT 300

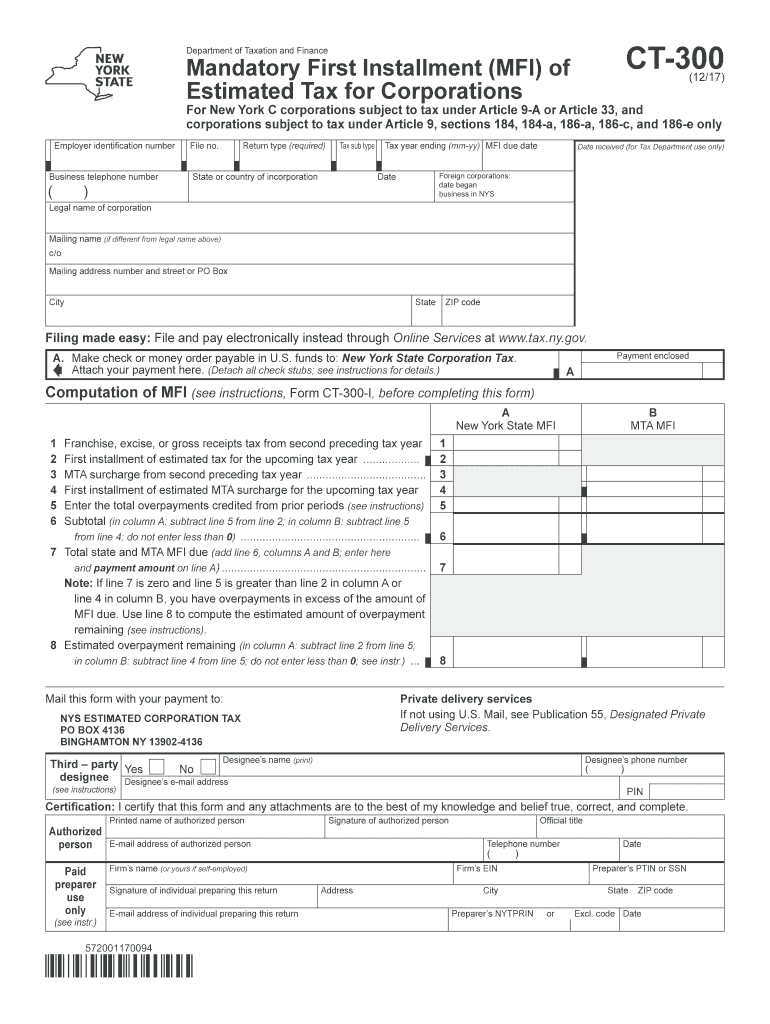

The CT 300 form is a crucial document used in the United States for reporting and paying certain taxes, particularly for businesses. It serves as a tax return for entities that fall under specific classifications, such as corporations or partnerships. Understanding the purpose and requirements of the CT 300 is essential for compliance with tax regulations.

How to use the CT 300

To effectively use the CT 300 form, taxpayers must accurately fill out the required fields, ensuring that all information is correct and complete. This includes providing details about the business entity, income, deductions, and any applicable credits. Proper use of the form can help avoid penalties and ensure timely processing by tax authorities.

Steps to complete the CT 300

Completing the CT 300 involves several key steps:

- Gather necessary documents, including financial statements and previous tax returns.

- Fill out the form with accurate business information, including the entity type and tax identification number.

- Calculate the total income and applicable deductions to determine the tax liability.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline to avoid late fees.

Legal use of the CT 300

The CT 300 form must be used in accordance with federal and state tax laws. It is essential for businesses to ensure that their submissions comply with the relevant regulations to maintain legal standing. Failure to adhere to these laws can result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Timely filing of the CT 300 is critical. The deadlines may vary based on the business entity type and the specific tax year. Generally, the form is due on the fifteenth day of the fourth month following the end of the tax year. It is advisable to check for any state-specific deadlines or extensions that may apply.

Required Documents

When completing the CT 300, several documents are typically required, including:

- Financial statements for the reporting period.

- Previous year’s tax returns for reference.

- Records of any deductions or credits claimed.

- Tax identification number and business registration information.

Form Submission Methods

The CT 300 can be submitted through various methods, including:

- Online submission via the designated tax authority's website.

- Mailing a paper copy to the appropriate tax office.

- In-person submission at local tax offices, where applicable.

Quick guide on how to complete ct 300

Complete CT 300 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents since you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage CT 300 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign CT 300 effortlessly

- Find CT 300 and click on Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose how you would like to submit your form, either by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Edit and eSign CT 300 and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 300

Create this form in 5 minutes!

How to create an eSignature for the ct 300

How to generate an electronic signature for the Ct 300 in the online mode

How to make an electronic signature for the Ct 300 in Google Chrome

How to make an eSignature for signing the Ct 300 in Gmail

How to generate an eSignature for the Ct 300 straight from your smart phone

How to create an eSignature for the Ct 300 on iOS

How to create an eSignature for the Ct 300 on Android

People also ask

-

What is the CT 300 in relation to airSlate SignNow?

The CT 300 refers to a specific plan offered by airSlate SignNow that provides businesses with a comprehensive eSignature solution. This plan is designed to empower users to send, sign, and manage documents efficiently, making it an ideal choice for organizations looking for a cost-effective way to streamline their document workflows.

-

How much does the CT 300 plan cost?

The CT 300 plan pricing is competitive and tailored to fit various business needs. By choosing the CT 300, customers gain access to a robust eSignature solution without breaking the bank, making it an excellent investment for businesses of all sizes.

-

What features are included in the CT 300 plan?

The CT 300 plan includes a range of features such as unlimited eSignatures, customizable templates, and advanced security options. These features ensure that businesses can manage their document signing processes efficiently while maintaining compliance and security.

-

How can the CT 300 benefit my business?

By using the CT 300 plan from airSlate SignNow, your business can signNowly reduce the time spent on document management. The solution streamlines eSigning processes, enhances productivity, and improves customer satisfaction, leading to more effective operations overall.

-

Is the CT 300 plan suitable for small businesses?

Absolutely! The CT 300 plan is designed with small businesses in mind, offering affordable pricing and essential features that meet their needs. This plan allows small enterprises to utilize advanced eSignature technology without the complexities and costs associated with larger solutions.

-

Can I integrate the CT 300 with other software tools?

Yes, the CT 300 plan is designed to seamlessly integrate with a variety of business tools and applications. This integration capability enhances your workflow efficiency, allowing you to connect airSlate SignNow with platforms you already use, such as CRM and project management software.

-

What kind of support is available for CT 300 users?

Users of the CT 300 plan receive robust customer support from airSlate SignNow. This includes access to a dedicated support team that can assist with any questions or issues that arise, ensuring that your eSignature processes run smoothly.

Get more for CT 300

Find out other CT 300

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free