Form CT 300, Mandatory First Installment MFI of Estimated 2021-2026

What is the Form CT-300, Mandatory First Installment MFI Of Estimated

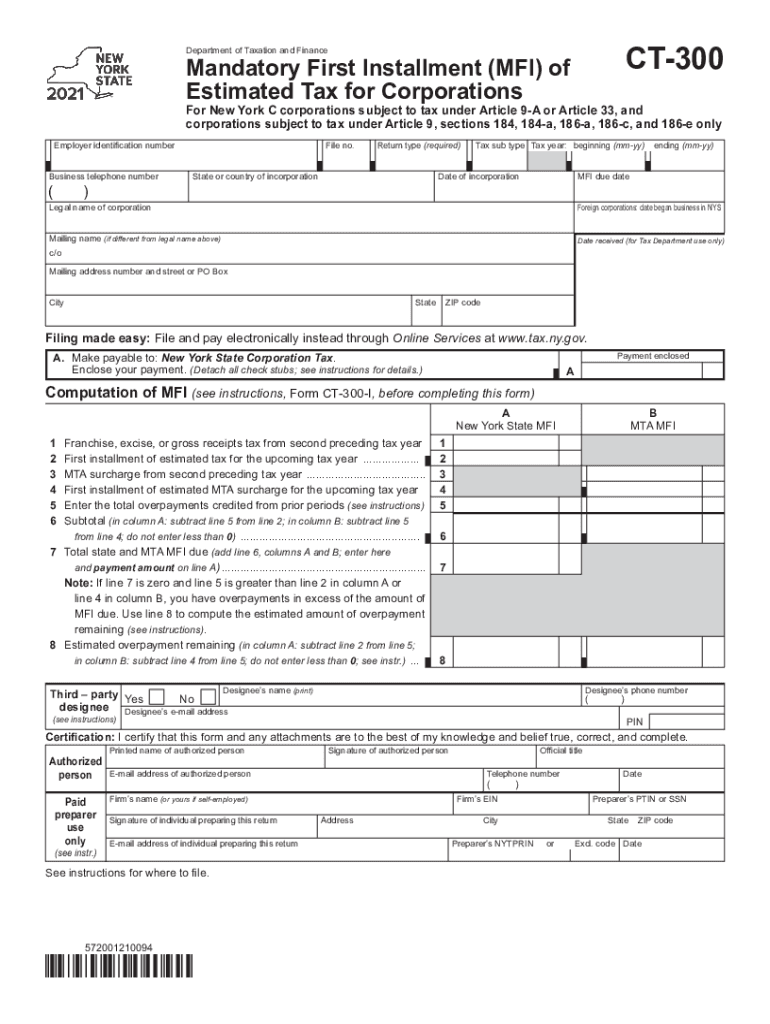

The Form CT-300, known as the Mandatory First Installment of Estimated Tax for Corporations, is a crucial document for businesses in New York City. This form is used to report and pay the first installment of estimated tax for the current tax year. Corporations, including limited liability companies (LLCs) treated as corporations, must file this form if they expect to owe tax of five hundred dollars or more for the year. The CT-300 ensures that businesses comply with tax obligations and helps prevent penalties for underpayment.

Steps to Complete the Form CT-300, Mandatory First Installment MFI Of Estimated

Completing the Form CT-300 involves several key steps to ensure accuracy and compliance. First, gather necessary financial information, including prior year tax returns and estimated income for the current year. Next, fill out the form by entering your business name, address, and federal employer identification number (EIN). Calculate the estimated tax liability based on projected income, and determine the amount due for the first installment. Finally, review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Timely filing of the Form CT-300 is essential to avoid penalties. The first installment is generally due on the fifteenth day of the fourth month following the end of the corporation’s tax year. For most businesses operating on a calendar year, this means the form must be filed by April 15. It is important to stay informed about any changes to deadlines, as they may vary based on specific circumstances or updates from the New York State Department of Taxation and Finance.

Form Submission Methods (Online / Mail / In-Person)

The Form CT-300 can be submitted through various methods to accommodate different preferences. Businesses may file the form online using the New York State Department of Taxation and Finance's e-file system, which offers a secure and efficient submission process. Alternatively, the form can be mailed to the appropriate address listed on the form instructions. In-person submissions are also accepted at designated tax offices, providing another option for those who prefer face-to-face interactions.

Key Elements of the Form CT-300, Mandatory First Installment MFI Of Estimated

Several key elements must be included when completing the Form CT-300. These include the corporation's name and address, federal employer identification number (EIN), and the estimated tax liability for the current year. Additionally, businesses must indicate the amount of the first installment due. Accurate reporting of these elements is crucial for compliance with tax regulations and to avoid potential penalties.

Legal Use of the Form CT-300, Mandatory First Installment MFI Of Estimated

The Form CT-300 is legally binding when properly completed and submitted. It is essential for businesses to understand that submitting this form signifies their commitment to fulfilling tax obligations. The form must be filed in accordance with the New York State tax laws, and any discrepancies or inaccuracies can lead to legal consequences, including fines or audits. Therefore, ensuring that the form is filled out correctly and submitted on time is vital for maintaining compliance.

Quick guide on how to complete form ct 300 mandatory first installment mfi of estimated 541624132

Complete Form CT 300, Mandatory First Installment MFI Of Estimated effortlessly on any device

Digital document management has become widely adopted by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly and without hold-ups. Manage Form CT 300, Mandatory First Installment MFI Of Estimated on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form CT 300, Mandatory First Installment MFI Of Estimated with ease

- Obtain Form CT 300, Mandatory First Installment MFI Of Estimated and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form searches, or mistakes that necessitate reprinting documents. airSlate SignNow addresses your document management needs in a few clicks from any device you prefer. Alter and eSign Form CT 300, Mandatory First Installment MFI Of Estimated and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 300 mandatory first installment mfi of estimated 541624132

Create this form in 5 minutes!

How to create an eSignature for the form ct 300 mandatory first installment mfi of estimated 541624132

The best way to make an electronic signature for a PDF document online

The best way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What are the NYC MFI instructions 2025?

The NYC MFI instructions 2025 provide guidelines for businesses and individuals in New York City to comply with financial reporting requirements. These instructions set forth the necessary documentation and procedures for filing, ensuring clarity and transparency in financial transactions. Understanding these guidelines is crucial for effective compliance in your business operations.

-

How can airSlate SignNow help with NYC MFI instructions 2025?

airSlate SignNow simplifies the process of signing and sending documents necessary for adhering to the NYC MFI instructions 2025. Our platform allows users to create, track, and manage documents securely, ensuring all required financial disclosures are correctly completed and submitted. With eSign capabilities, compliance becomes efficient and manageable.

-

What features should I look for to comply with NYC MFI instructions 2025?

When looking to comply with NYC MFI instructions 2025, features such as eSignature, document templates, and secure storage are essential. Additionally, tracking capabilities to monitor document status and audit trails for accountability are crucial to meet compliance standards. airSlate SignNow offers these features, making it a reliable choice.

-

What is the pricing structure for using airSlate SignNow for NYC MFI instructions 2025?

The pricing for airSlate SignNow is designed to be cost-effective, especially for businesses needing to comply with NYC MFI instructions 2025. We offer various plans based on the number of users and features required, ensuring flexibility to suit different business sizes. Visit our pricing page to find the best plan for your specific needs.

-

Are there any integrations available with airSlate SignNow for NYC MFI instructions 2025?

Yes, airSlate SignNow integrates seamlessly with various platforms, allowing users to streamline their compliance processes for NYC MFI instructions 2025. Whether you use accounting software or document management systems, our integrations facilitate data transfer and workflow efficiency. This enhances your ability to meet deadlines and compliance mandates effortlessly.

-

What benefits does airSlate SignNow offer for businesses adhering to NYC MFI instructions 2025?

By using airSlate SignNow, businesses can benefit from enhanced document security, reduced processing times, and improved compliance with NYC MFI instructions 2025. The ease of use empowers teams to manage their paperwork efficiently, leading to better productivity. Additionally, the ability to access documents anytime, anywhere supports flexible work environments.

-

How does airSlate SignNow ensure compliance with NYC MFI instructions 2025?

airSlate SignNow keeps your business compliant with NYC MFI instructions 2025 through advanced security measures, legally binding eSignatures, and audit trails. Our platform is built with compliance in mind, ensuring that every signature and document transaction is tracked and secure. This approach minimizes the risk of non-compliance and fosters trust in your processes.

Get more for Form CT 300, Mandatory First Installment MFI Of Estimated

- List of all pokmon pdf download form

- Dxn registration form

- Crossword irregular verbs resuelto form

- Radical forgiveness worksheet 350817051 form

- Advance form

- Nyc doe test security form

- Field trip permission form 091312 lakota middle school schools fwps

- Cottage food operation permit application packet form

Find out other Form CT 300, Mandatory First Installment MFI Of Estimated

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form

- Can I Sign Pennsylvania Church Donation Giving Form

- Sign Oklahoma Life-Insurance Quote Form Later

- Can I Sign Texas Life-Insurance Quote Form

- Sign Texas Life-Insurance Quote Form Fast

- How To Sign Washington Life-Insurance Quote Form

- Can I Sign Wisconsin Life-Insurance Quote Form

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free