Form CT 300 Mandatory First Installment MFI of Estimated 2020

What is the Form CT 300 Mandatory First Installment MFI Of Estimated

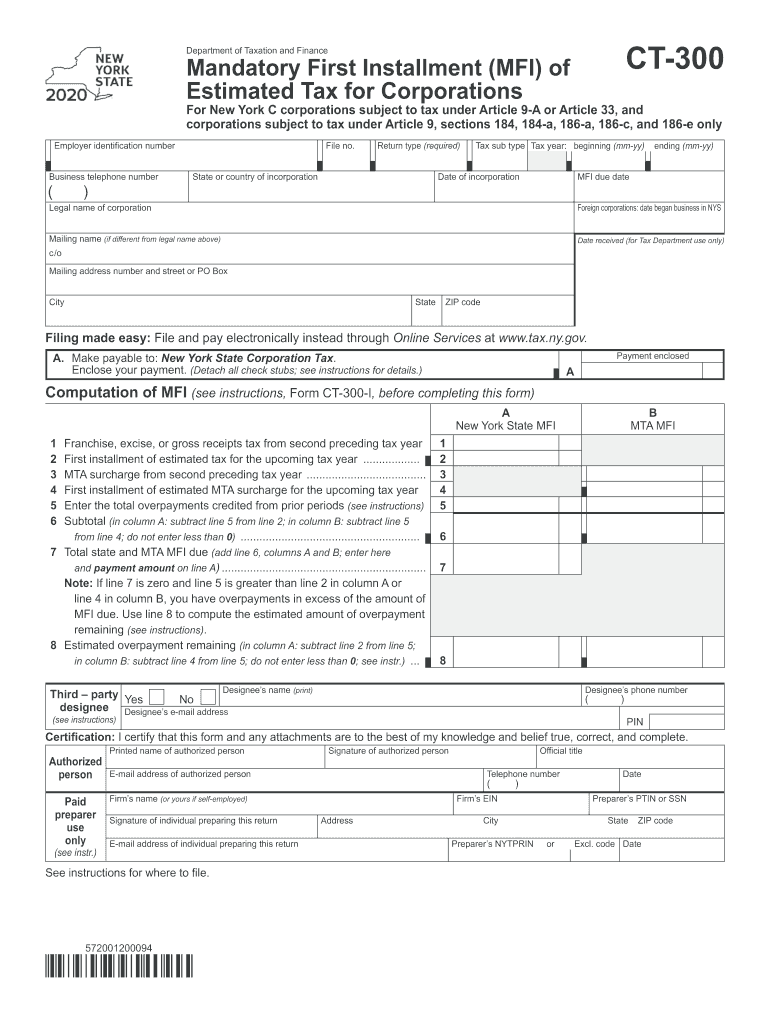

The Form CT 300, also known as the Mandatory First Installment (MFI) of Estimated Tax, is a tax form used in New York to report and pay estimated income taxes. This form is essential for individuals and businesses that expect to owe tax of a certain amount when filing their annual tax returns. The CT 300 allows taxpayers to make a payment that helps to avoid penalties and interest associated with underpayment of taxes. It is particularly relevant for self-employed individuals, corporations, and partnerships that anticipate significant tax liabilities.

Steps to complete the Form CT 300 Mandatory First Installment MFI Of Estimated

Completing the Form CT 300 involves several key steps to ensure accuracy and compliance with state tax regulations. Begin by gathering necessary financial information, including your expected income for the year and any deductions applicable to your situation. Next, calculate your estimated tax liability based on the current tax rates. Once you have this figure, fill out the form with your personal details, including your name, address, and taxpayer identification number. Finally, submit the form along with your payment, either electronically or via mail, before the specified deadline to avoid penalties.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form CT 300 to avoid late fees and penalties. Generally, the form is due on or before the 15th day of the fourth month following the end of your tax year. For individuals and most businesses operating on a calendar year, this means the form is typically due by April 15. Taxpayers should also be mindful of any additional deadlines for estimated payments throughout the year, which may occur quarterly.

Legal use of the Form CT 300 Mandatory First Installment MFI Of Estimated

The legal use of the Form CT 300 is governed by New York state tax laws, which require taxpayers to pay estimated taxes if they expect to owe a certain amount. The form serves as a declaration of anticipated tax liability and a mechanism for making timely payments. To be considered valid, the form must be completed accurately and submitted on time. Failure to comply with these requirements can result in penalties, including interest on unpaid taxes and potential legal action from tax authorities.

Key elements of the Form CT 300 Mandatory First Installment MFI Of Estimated

The Form CT 300 includes several key elements that are essential for proper completion. These elements typically consist of the taxpayer's identification information, estimated income, deductions, and the total estimated tax liability. Additionally, the form requires a declaration of the amount being paid with the submission. It is important to review all sections carefully to ensure that all information is accurate and complete, as errors can lead to complications with tax authorities.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have various options for submitting the Form CT 300. The form can be filed online through the New York State Department of Taxation and Finance website, which offers a secure and efficient method for submission. Alternatively, taxpayers may choose to mail the completed form along with their payment to the appropriate address specified by the state. In-person submissions may also be possible at designated tax offices, although this option may vary based on local regulations and availability.

Quick guide on how to complete form ct 300 mandatory first installment mfi of estimated

Complete Form CT 300 Mandatory First Installment MFI Of Estimated effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without any hold-ups. Manage Form CT 300 Mandatory First Installment MFI Of Estimated on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to edit and eSign Form CT 300 Mandatory First Installment MFI Of Estimated with ease

- Locate Form CT 300 Mandatory First Installment MFI Of Estimated and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign Form CT 300 Mandatory First Installment MFI Of Estimated and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 300 mandatory first installment mfi of estimated

Create this form in 5 minutes!

How to create an eSignature for the form ct 300 mandatory first installment mfi of estimated

How to create an eSignature for a PDF in the online mode

How to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

How to generate an eSignature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the airSlate SignNow solution for New York CT 300?

The airSlate SignNow solution for New York CT 300 is a user-friendly platform designed to streamline the signing process for businesses. It enables users to send and eSign documents easily, ensuring efficient workflow management. This solution is particularly beneficial for companies seeking a reliable and cost-effective electronic signature solution.

-

How much does airSlate SignNow cost in relation to New York CT 300?

Pricing for airSlate SignNow related to New York CT 300 varies based on the subscription tier chosen. The platform offers flexible pricing plans designed to accommodate the needs of diverse businesses, making it both affordable and scalable. Interested users can explore the pricing options on the airSlate SignNow website.

-

What key features does airSlate SignNow offer for New York CT 300 users?

For New York CT 300 users, airSlate SignNow includes features such as customizable templates, automated workflows, and robust document management tools. These features enhance efficiency by allowing users to create, send, and manage documents seamlessly. The platform also ensures secure transactions, making it ideal for businesses.

-

How can airSlate SignNow benefit businesses in New York CT 300?

AirSlate SignNow benefits businesses in New York CT 300 by reducing paperwork and speeding up the signing process. This increases operational efficiency and allows teams to focus on core tasks rather than manual document management. Additionally, the platform provides a compliant solution that meets legal requirements for electronic signatures.

-

What integrations does airSlate SignNow offer for New York CT 300 users?

AirSlate SignNow provides various integrations that cater to the needs of New York CT 300 users, including popular applications such as Google Drive, Salesforce, and Microsoft Office. These integrations help create a cohesive digital workspace, making document management even more streamlined. Users can easily connect their existing tools with airSlate SignNow for enhanced productivity.

-

Is airSlate SignNow secure for handling documents in New York CT 300?

Yes, airSlate SignNow is fully secure for handling documents in New York CT 300. The platform employs advanced encryption methods and follows compliance standards to protect sensitive information. Users can confidently send and eSign documents knowing that their data is secure.

-

Can I customize my documents in airSlate SignNow for New York CT 300?

Absolutely! AirSlate SignNow allows users in New York CT 300 to customize their documents easily. Users can create templates tailored to their needs, ensuring consistency and professionalism in all communications. This customization enhances the user experience and supports brand identity.

Get more for Form CT 300 Mandatory First Installment MFI Of Estimated

Find out other Form CT 300 Mandatory First Installment MFI Of Estimated

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe