Alaska Fishery Resource Landing Tax Return 2022

What is the Alaska Fishery Resource Landing Tax Return

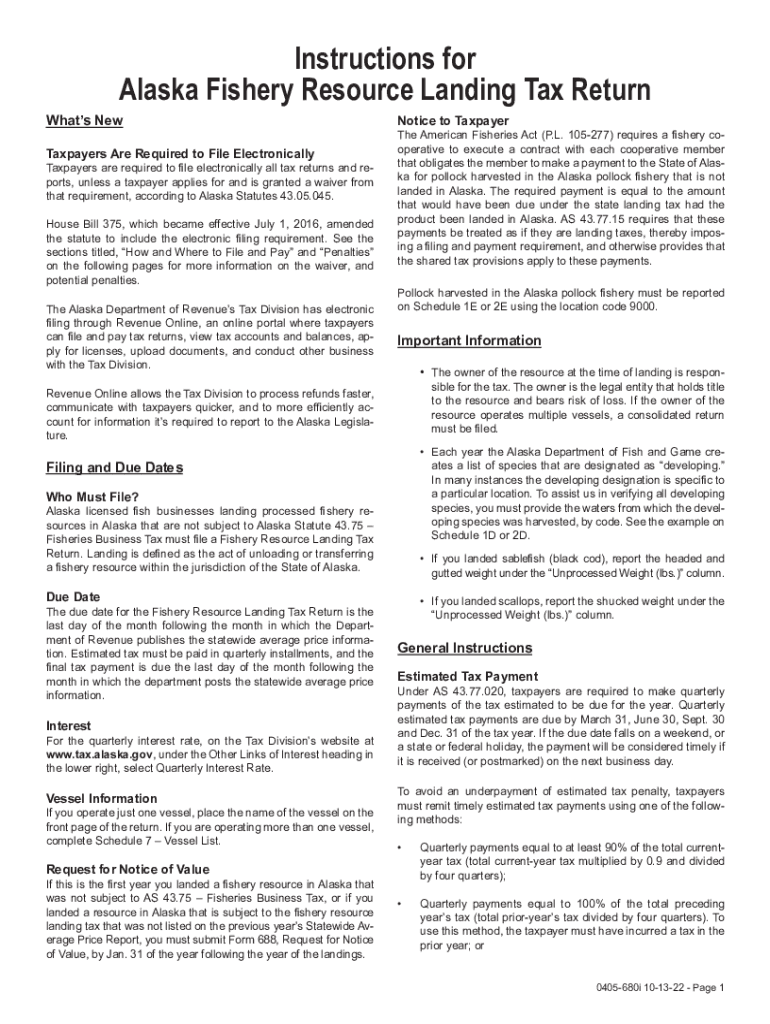

The Alaska Fishery Resource Landing Tax Return is a specific tax form used by individuals and businesses engaged in commercial fishing activities within Alaska. This form is essential for reporting landings of fish and shellfish, ensuring compliance with state tax regulations. It helps the state of Alaska track the volume of fish harvested and assess the appropriate tax on these resources. Proper completion of this form is crucial for maintaining transparency and accountability in the fishing industry.

How to use the Alaska Fishery Resource Landing Tax Return

Using the Alaska Fishery Resource Landing Tax Return involves several steps to ensure accurate reporting. First, gather all relevant data regarding your fishing activities, including the types and quantities of fish landed. Next, fill out the form with the required information, ensuring that all figures are accurate and reflect your actual landings. Once completed, review the form for any errors before submission. Utilizing digital tools can streamline this process, allowing for easy corrections and secure eSigning.

Steps to complete the Alaska Fishery Resource Landing Tax Return

Completing the Alaska Fishery Resource Landing Tax Return involves a systematic approach:

- Collect necessary documentation, including records of fish landings and sales.

- Access the official tax return form, either online or through local tax offices.

- Fill out the form by entering your personal and business information, along with details about your fish landings.

- Double-check all entries for accuracy, ensuring compliance with state regulations.

- Submit the completed form electronically or by mail, depending on your preference.

Legal use of the Alaska Fishery Resource Landing Tax Return

The legal use of the Alaska Fishery Resource Landing Tax Return is governed by state tax laws. It is crucial for taxpayers to understand that this form must be filled out accurately to avoid penalties. The information provided on this form is subject to verification by state authorities, and any discrepancies could lead to legal consequences. Utilizing secure digital platforms for submission can enhance compliance and ensure that the form is legally binding.

Filing Deadlines / Important Dates

Filing deadlines for the Alaska Fishery Resource Landing Tax Return are typically set by the state tax authority. It is important for filers to be aware of these dates to avoid late fees or penalties. Generally, the form must be submitted annually, with specific deadlines announced each year. Keeping track of these important dates ensures that you remain compliant with state regulations and can avoid unnecessary complications.

Required Documents

To complete the Alaska Fishery Resource Landing Tax Return, certain documents are required. These typically include:

- Records of fish landings, including species and quantities.

- Sales receipts or invoices related to fish sales.

- Any previous tax returns related to fishing activities.

Having these documents on hand streamlines the completion process and ensures accuracy in reporting.

Quick guide on how to complete alaska fishery resource landing tax return

Finalize Alaska Fishery Resource Landing Tax Return effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Handle Alaska Fishery Resource Landing Tax Return on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest method to modify and electronically sign Alaska Fishery Resource Landing Tax Return without hassle

- Obtain Alaska Fishery Resource Landing Tax Return and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure private details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Alter and electronically sign Alaska Fishery Resource Landing Tax Return and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska fishery resource landing tax return

Create this form in 5 minutes!

How to create an eSignature for the alaska fishery resource landing tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alaska Fishery Resource Landing Tax Return and why is it important?

The Alaska Fishery Resource Landing Tax Return is a critical document that fishers must file to report their landing taxes. This return is essential for ensuring compliance with state regulations and for contributing to the management of Alaska's fishery resources. Proper submission of this return helps avoid penalties and supports sustainable fishing practices.

-

How can airSlate SignNow help with filing the Alaska Fishery Resource Landing Tax Return?

airSlate SignNow offers a user-friendly platform that simplifies the process of preparing and submitting your Alaska Fishery Resource Landing Tax Return. With its electronic signature capabilities, you can easily sign and send your documents securely, reducing the risk of errors and increasing efficiency in your filing process.

-

What features does airSlate SignNow offer for managing tax returns?

airSlate SignNow includes a range of features tailored for managing tax returns such as customizable templates, automated workflows, and secure document storage. These features streamline the preparation of your Alaska Fishery Resource Landing Tax Return, ensuring that all necessary information is accurately captured and easily accessible.

-

Is airSlate SignNow cost-effective for someone needing to file the Alaska Fishery Resource Landing Tax Return?

Yes, airSlate SignNow is designed to be a cost-effective solution for individuals and businesses alike. By reducing the time spent on paperwork and providing efficient eSigning options, users find that the investment in airSlate SignNow pays off quickly, especially when filing the Alaska Fishery Resource Landing Tax Return.

-

Can I integrate airSlate SignNow with my existing accounting software for my tax returns?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software, allowing for a more streamlined process when filing your Alaska Fishery Resource Landing Tax Return. This integration helps ensure that your financial data and documents are synchronized, reducing manual entry and potential errors.

-

What are the security measures in place for documents filed through airSlate SignNow?

airSlate SignNow takes security seriously, employing advanced encryption both in transit and at rest to protect your sensitive documents. When you file your Alaska Fishery Resource Landing Tax Return, you can rest assured that your data is secure and compliant with industry standards.

-

How does airSlate SignNow support group collaboration for tax return preparation?

With airSlate SignNow, team collaboration is streamlined, making it easy for multiple users to access, review, and sign the necessary documents for your Alaska Fishery Resource Landing Tax Return. The platform allows for real-time updates and communication, ensuring everyone involved can stay aligned and informed.

Get more for Alaska Fishery Resource Landing Tax Return

Find out other Alaska Fishery Resource Landing Tax Return

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter