8801 2018

What is the IRS Tax Form 8801?

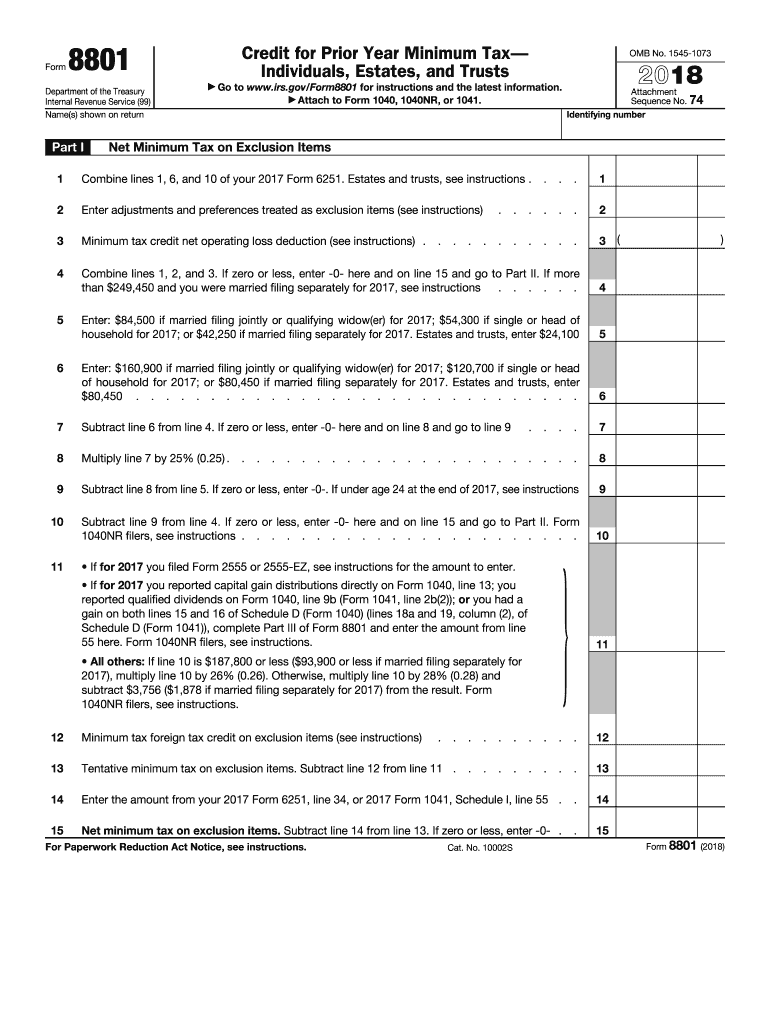

The IRS tax form 8801 is used to calculate and claim the credit for prior year minimum tax. This form is essential for taxpayers who have previously paid alternative minimum tax (AMT) and are eligible to recover some of that amount in subsequent years. The 8801 form helps ensure that taxpayers receive the credit they are entitled to, which can significantly reduce their overall tax liability.

Steps to Complete the 8801

Completing the IRS tax form 8801 involves several key steps:

- Gather necessary financial documents, including previous tax returns and records of any alternative minimum tax paid.

- Fill out the identification section, providing your name, Social Security number, and other relevant information.

- Calculate your allowable credit by following the instructions provided on the form, ensuring all figures are accurate.

- Review the completed form for any errors or omissions before submission.

How to Obtain the 8801

To obtain the IRS tax form 8801, you can visit the official IRS website where the form is available for download. It can be accessed in PDF format, allowing you to print it for completion. Alternatively, you may also find the form at various tax preparation offices or request it directly from the IRS by phone.

Legal Use of the 8801

The legal use of the IRS tax form 8801 is governed by federal tax regulations. Taxpayers must ensure that they meet all eligibility criteria for claiming the credit. Proper completion and submission of the form are crucial for compliance with IRS guidelines. Failure to adhere to these regulations may result in penalties or denial of the credit.

Filing Deadlines / Important Dates

Filing deadlines for the IRS tax form 8801 typically align with the standard tax filing deadlines. For most individual taxpayers, this means the form should be submitted by April 15 of the following tax year. It is important to stay informed about any changes to deadlines or extensions that may apply, particularly in light of special circumstances or federal announcements.

Form Submission Methods

The IRS tax form 8801 can be submitted in several ways:

- Electronically through tax preparation software that supports the form, allowing for faster processing.

- By mail, sending the completed form to the appropriate IRS address as indicated in the form instructions.

- In-person at designated IRS offices, although this method may require an appointment and is less common.

Quick guide on how to complete proposed credit for prior year minimum tax efile

Complete 8801 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents rapidly without interruptions. Handle 8801 on any platform with airSlate SignNow Android or iOS applications and simplify any document-driven process today.

How to edit and eSign 8801 with ease

- Locate 8801 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your updates.

- Select how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign 8801 and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct proposed credit for prior year minimum tax efile

Create this form in 5 minutes!

How to create an eSignature for the proposed credit for prior year minimum tax efile

How to make an eSignature for your Proposed Credit For Prior Year Minimum Tax Efile in the online mode

How to create an electronic signature for your Proposed Credit For Prior Year Minimum Tax Efile in Google Chrome

How to make an eSignature for signing the Proposed Credit For Prior Year Minimum Tax Efile in Gmail

How to create an electronic signature for the Proposed Credit For Prior Year Minimum Tax Efile straight from your smartphone

How to generate an electronic signature for the Proposed Credit For Prior Year Minimum Tax Efile on iOS

How to generate an eSignature for the Proposed Credit For Prior Year Minimum Tax Efile on Android OS

People also ask

-

What is IRS tax form 8801?

IRS tax form 8801 is used to calculate the credit for prior year minimum tax. This form is essential for taxpayers who have previously incurred alternative minimum tax liabilities and want to ensure they receive appropriate credits. Understanding how to complete IRS tax form 8801 can help you maximize your tax benefits.

-

How can airSlate SignNow help with IRS tax form 8801?

AirSlate SignNow simplifies the process of preparing and signing IRS tax form 8801. With our platform, you can electronically sign and send this form securely, allowing for quick submission without the hassle of printing and mailing. Our user-friendly interface makes it easier to manage your tax documents, including IRS tax form 8801.

-

Is there a cost to use airSlate SignNow for IRS tax form 8801?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs when managing IRS tax form 8801 and other documents. We provide affordable subscription options that allow businesses to streamline their document management process. The investment in our service can lead to signNow time savings when dealing with important forms like IRS tax form 8801.

-

What features does airSlate SignNow offer for handling IRS tax form 8801?

AirSlate SignNow provides multiple features tailored for IRS tax form 8801, including electronic signatures, secure document storage, and customizable templates. These tools help facilitate compliance and ensure that your tax documents are accurately completed. Enjoy features such as in-app payments and reminders so you never miss a tax deadline.

-

Can I integrate airSlate SignNow with other applications for IRS tax form 8801?

Absolutely! AirSlate SignNow offers seamless integrations with various applications, enhancing the way you manage IRS tax form 8801. Whether you need to connect with accounting software or project management tools, our platform allows for efficient workflow and data transfer among your essential applications.

-

How secure is airSlate SignNow for handling IRS tax form 8801?

AirSlate SignNow prioritizes security, ensuring that all documents, including IRS tax form 8801, are protected with industry-standard encryption. Your sensitive information is stored securely, with features such as audit trails and user authentication to enhance data safety. Trust in our platform to keep your tax documents safe and confidential.

-

What are the benefits of using airSlate SignNow for IRS tax form 8801?

Using airSlate SignNow for IRS tax form 8801 offers numerous benefits, including increased efficiency, convenience, and compliance. Our platform allows for faster processing and reduces the risk of errors common with paper forms, ultimately leading to smoother tax filing. Benefit from the ability to manage all your signatures and documents in one place.

Get more for 8801

- Power of attorney and declaration of representative rev 677 form

- Form pwh rw

- Ga 110l form

- Dor 4682 application for dealer auction or manufacturer license number plates application for dealer auction or manufacturer form

- Rpd 41260 form

- Form g5b instructions

- Rev 1737 1 form

- Tc 69c notice of change for a tax account form

Find out other 8801

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form