Form 8801 Credit for Prior Year Minimum TaxIndividuals, Estates, and Trusts 2020

Understanding the Form 8801 Credit for Prior Year Minimum Tax

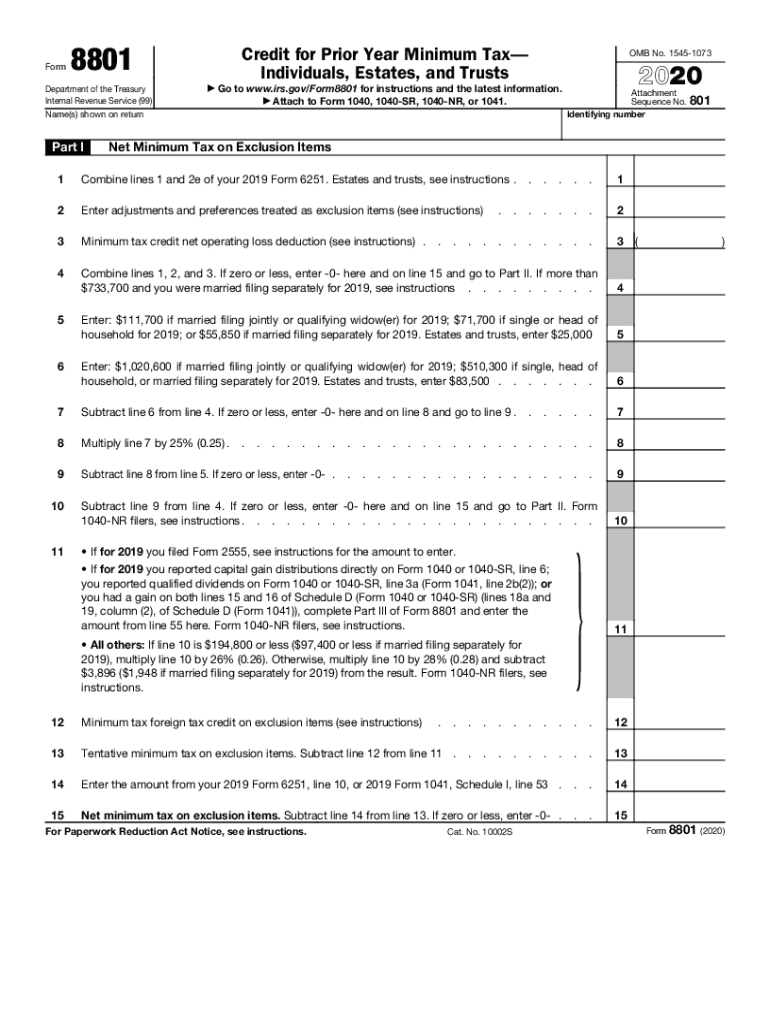

The Form 8801 is designed to help individuals, estates, and trusts claim a credit for prior year minimum tax. This credit is particularly beneficial for taxpayers who may have paid alternative minimum tax (AMT) in previous years and are now eligible to recover some of that amount. The credit can reduce the amount of tax owed in the current year, making it an important form for those who have experienced fluctuations in their tax liabilities.

Steps to Complete the Form 8801

Completing the Form 8801 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including prior year tax returns and any records of AMT paid. Next, follow these steps:

- Enter your personal information, including your name, address, and Social Security number.

- Calculate the amount of minimum tax credit you are eligible for by reviewing your prior tax returns.

- Complete the relevant sections of the form, detailing your calculations and any adjustments.

- Review the form for accuracy, ensuring all figures are correct and all required fields are filled out.

- Sign and date the form before submission.

Legal Use of the Form 8801

The Form 8801 is legally recognized by the IRS as a valid means for claiming a credit for prior year minimum tax. To ensure its legal standing, it is essential to adhere to IRS guidelines regarding eSignature and submission methods. Using a reliable eSignature solution, like signNow, can help maintain the integrity and legality of your submitted form. Compliance with regulations such as the ESIGN Act and UETA is crucial for ensuring that your eSigned documents are recognized in a legal context.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is critical for successfully submitting the Form 8801. Generally, the form must be filed alongside your annual tax return. Key dates to remember include:

- April 15: The standard deadline for individual tax returns.

- Extensions: If you file for an extension, ensure that you submit Form 8801 by the extended deadline.

Missing these deadlines can result in penalties or the inability to claim the credit, so it is advisable to keep track of these important dates each tax year.

Eligibility Criteria for the Form 8801

To qualify for the credit on Form 8801, certain eligibility criteria must be met. Taxpayers must have paid alternative minimum tax in a prior year and have a minimum tax credit available to claim. Additionally, the credit is available to individuals, estates, and trusts that meet specific income thresholds. It is important to review these criteria carefully to determine your eligibility before completing the form.

Examples of Using the Form 8801

Understanding how to effectively use the Form 8801 can provide clarity on its benefits. For instance, a taxpayer who paid AMT in 2020 may find that they are eligible to claim a credit in 2021 if their tax situation has improved. Similarly, estates and trusts that have previously been subject to AMT can utilize this form to recover some of their tax payments. By analyzing past tax situations and current eligibility, individuals and entities can maximize their credits.

Obtaining the Form 8801

The Form 8801 can be easily obtained through the IRS website or directly from tax preparation software. It is essential to ensure that you are using the correct version of the form for the tax year you are filing. Keeping up to date with any changes to the form or its requirements is also important for accurate filing.

Quick guide on how to complete 2020 form 8801 credit for prior year minimum taxindividuals estates and trusts

Complete Form 8801 Credit For Prior Year Minimum TaxIndividuals, Estates, And Trusts easily on any device

Digital document management has gained popularity among organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8801 Credit For Prior Year Minimum TaxIndividuals, Estates, And Trusts on any device using airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The simplest way to alter and electronically sign Form 8801 Credit For Prior Year Minimum TaxIndividuals, Estates, And Trusts effortlessly

- Find Form 8801 Credit For Prior Year Minimum TaxIndividuals, Estates, And Trusts and select Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new copies of documents. airSlate SignNow fulfills your requirements in document management with just a few clicks from any device you choose. Modify and electronically sign Form 8801 Credit For Prior Year Minimum TaxIndividuals, Estates, And Trusts to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 8801 credit for prior year minimum taxindividuals estates and trusts

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 8801 credit for prior year minimum taxindividuals estates and trusts

How to make an electronic signature for your PDF online

How to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is the main feature of airSlate SignNow 8801?

The primary feature of airSlate SignNow 8801 is its ability to provide a seamless eSigning experience for documents. With intuitive design and robust functionality, it allows users to send, sign, and manage documents effortlessly. This makes it an excellent choice for businesses looking for an efficient document management solution.

-

How does pricing work for airSlate SignNow 8801?

Pricing for airSlate SignNow 8801 is designed to be cost-effective, ensuring businesses of all sizes can access eSigning solutions. Various subscription plans are available, providing flexibility based on the number of users or features needed. It's important to evaluate your needs to choose the right plan for maximizing your investment.

-

What are the benefits of using airSlate SignNow 8801?

Using airSlate SignNow 8801 offers several benefits, including enhanced efficiency and improved workflow management. It also ensures document security and compliance, which are crucial for businesses handling sensitive information. Additionally, users enjoy the convenience of accessing and signing documents from anywhere and at any time.

-

Can I integrate airSlate SignNow 8801 with other software?

Yes, airSlate SignNow 8801 supports integrations with various software applications to enhance your business processes. Common integrations include CRM systems, cloud storage solutions, and project management tools. This flexibility allows users to streamline workflows and improve productivity.

-

Is there customer support available for airSlate SignNow 8801 users?

Absolutely! airSlate SignNow 8801 provides dedicated customer support to assist users with any inquiries or issues. The support team is available through various channels, ensuring you receive timely help to make the most of the platform's features. Their commitment to customer satisfaction is a key advantage.

-

What types of documents can be signed using airSlate SignNow 8801?

airSlate SignNow 8801 supports a wide range of document types for eSigning, including contracts, agreements, and forms. Regardless of the industry, users can easily upload and send any document for signature. This versatility makes it a valuable tool for various business applications.

-

Is airSlate SignNow 8801 suitable for small businesses?

Yes, airSlate SignNow 8801 is particularly suitable for small businesses looking for a budget-friendly eSigning solution. Its user-friendly interface and cost-effective pricing plans cater to organizations of all sizes. Small businesses can leverage its features without compromising on quality.

Get more for Form 8801 Credit For Prior Year Minimum TaxIndividuals, Estates, And Trusts

Find out other Form 8801 Credit For Prior Year Minimum TaxIndividuals, Estates, And Trusts

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed