Form 8801 Entering Credit for Prior Year Minimum Tax in 2023-2026

Understanding the 2018 IRS Form 8801

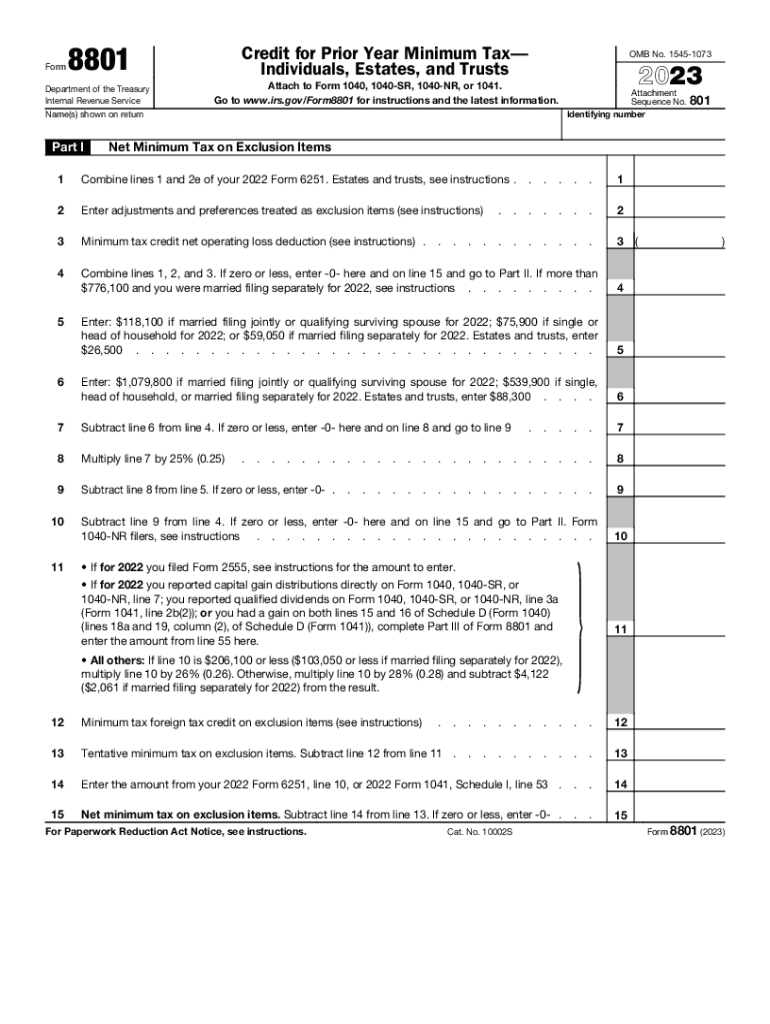

The 2018 IRS Form 8801 is used to claim a credit for prior year minimum tax. This form is essential for taxpayers who have paid alternative minimum tax (AMT) in previous years and are eligible to recover some of that amount in the current tax year. By filing this form, individuals can reduce their overall tax liability, making it an important tool for tax planning and management.

Steps to Complete the 2018 Form 8801

Completing the 2018 Form 8801 involves several key steps:

- Gather necessary documentation, including prior year tax returns and records of any AMT paid.

- Fill out the identification section with your name, Social Security number, and other relevant information.

- Calculate the credit for prior year minimum tax using the provided worksheets in the form.

- Transfer the calculated credit amount to your main tax return.

- Review the completed form for accuracy before submission.

How to Obtain the 2018 Form 8801

The 2018 IRS Form 8801 can be obtained through several methods:

- Visit the IRS website and navigate to the forms section to download the PDF version.

- Request a physical copy by calling the IRS directly or visiting a local IRS office.

- Access the form through tax preparation software that supports IRS forms.

Filing Deadlines for Form 8801

It is crucial to be aware of the filing deadlines associated with the 2018 Form 8801. Generally, this form should be filed along with your annual tax return by the due date, which is typically April 15 for most taxpayers. If you are unable to file by this date, you may request an extension, but ensure that you still pay any taxes owed to avoid penalties.

Eligibility Criteria for Using Form 8801

To qualify for claiming a credit using the 2018 Form 8801, taxpayers must meet specific criteria:

- You must have paid alternative minimum tax in a prior year.

- Your current tax situation must allow for a credit to be claimed based on previous AMT payments.

- You should have all necessary documentation to support your claim, including prior year tax returns.

Legal Use of Form 8801

The legal use of the 2018 Form 8801 is defined by IRS regulations. Taxpayers are required to use this form to accurately claim credits for prior year minimum tax. Misuse or incorrect filing can lead to penalties or delays in processing. It is advisable to consult tax professionals if there are uncertainties regarding eligibility or filing procedures.

Quick guide on how to complete form 8801 entering credit for prior year minimum tax in

Effortlessly prepare Form 8801 Entering Credit For Prior Year Minimum Tax In on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and without hurdles. Manage Form 8801 Entering Credit For Prior Year Minimum Tax In on any device with the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to alter and eSign Form 8801 Entering Credit For Prior Year Minimum Tax In effortlessly

- Find Form 8801 Entering Credit For Prior Year Minimum Tax In and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Verify the information and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choice. Edit and eSign Form 8801 Entering Credit For Prior Year Minimum Tax In and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8801 entering credit for prior year minimum tax in

Create this form in 5 minutes!

How to create an eSignature for the form 8801 entering credit for prior year minimum tax in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the primary function of 8801?

8801 is designed to empower businesses by allowing them to send and eSign documents efficiently. With its user-friendly interface, 8801 simplifies the process of document management and electronic signatures, ensuring that business transactions are both secure and streamlined.

-

How does pricing for 8801 work?

The pricing for 8801 is structured to accommodate businesses of all sizes, offering flexible plans based on features needed. By providing a cost-effective solution, 8801 ensures that businesses can choose a pricing tier that aligns with their needs without compromising on functionality.

-

What are the key features of 8801?

8801 includes essential features such as document templates, customizable workflows, and secure cloud storage. Additionally, 8801 offers real-time notifications and analytics to track document status, enhancing overall productivity and efficiency in document management.

-

What benefits does 8801 offer to businesses?

Businesses utilizing 8801 can enjoy signNow time savings and reduced costs associated with traditional printing and mailing processes. By digitizing document workflows, 8801 increases efficiency and accelerates transaction times, ultimately enhancing customer satisfaction.

-

Can 8801 integrate with other software solutions?

Yes, 8801 seamlessly integrates with various software solutions including CRM systems and cloud storage services. This flexibility allows businesses to enhance their existing workflows without disruption, making 8801 a versatile addition to any digital toolkit.

-

Is 8801 secure for sensitive documents?

8801 employs advanced encryption and security protocols to ensure that sensitive documents are protected. This commitment to security allows businesses to confidently use 8801 for eSigning contracts and other important documents without risking data bsignNowes.

-

How user-friendly is the 8801 platform?

8801 is designed with user experience in mind, featuring an intuitive interface that enables users to navigate easily. This focus on usability means that even those with minimal technical knowledge can quickly adapt to using 8801 for their document needs.

Get more for Form 8801 Entering Credit For Prior Year Minimum Tax In

Find out other Form 8801 Entering Credit For Prior Year Minimum Tax In

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors