About Form 8801, Credit for Prior Year Minimum TaxInstructions for Form 8801 Internal Revenue ServiceInstructions for Form 8801 2022

Understanding Form 8801: Credit for Prior Year Minimum Tax

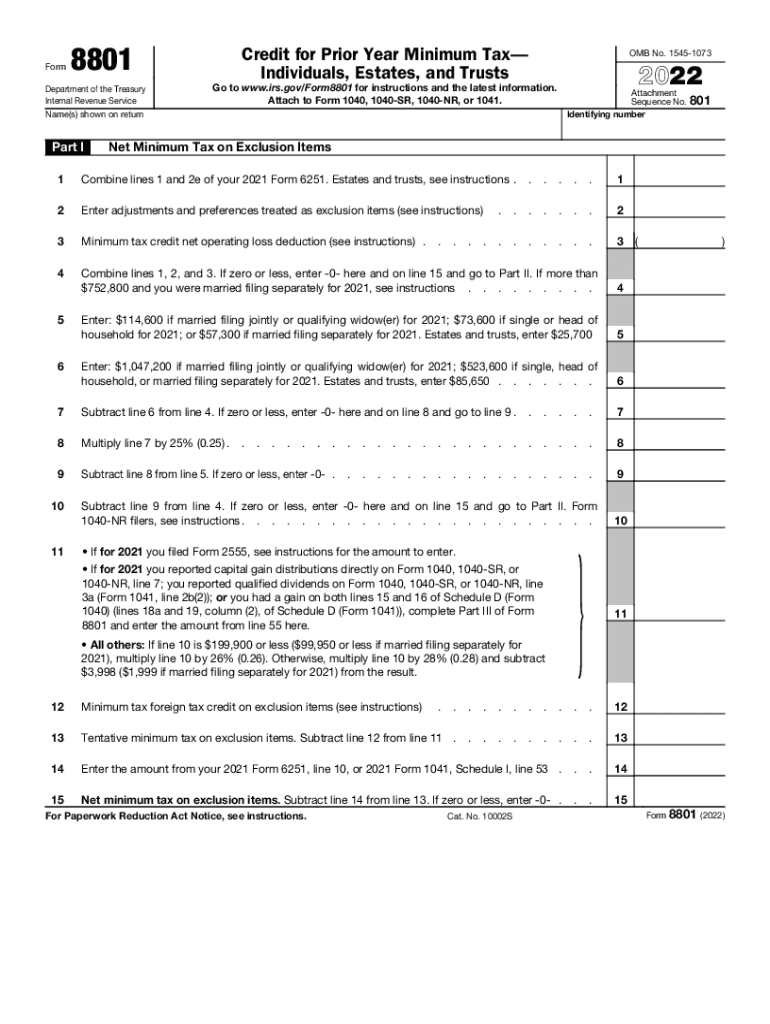

Form 8801 is used to claim a credit for prior year minimum tax. This form is particularly relevant for individuals who have paid alternative minimum tax in previous years and are eligible to recover some of that amount in the current tax year. The credit can help reduce the overall tax liability, making it an important consideration for tax planning.

To qualify for this credit, taxpayers must have paid alternative minimum tax in a prior year and must meet specific eligibility criteria outlined by the IRS. The form requires detailed information about prior year tax calculations and current year tax liabilities.

Steps to Complete Form 8801

Completing Form 8801 involves several key steps to ensure accuracy and compliance with IRS regulations. Here’s a brief overview:

- Gather necessary documentation, including prior year tax returns and records of alternative minimum tax paid.

- Fill out the form accurately, providing all required information regarding prior year minimum tax and current year calculations.

- Review the completed form for accuracy, ensuring all figures are correct and all required fields are filled.

- Submit the form according to IRS guidelines, either electronically or by mail, ensuring to keep a copy for personal records.

Eligibility Criteria for Form 8801

To be eligible to use Form 8801, taxpayers must meet certain criteria set by the IRS. These include:

- Having paid alternative minimum tax in a previous tax year.

- Filing a federal income tax return for the current year.

- Meeting income thresholds as specified by the IRS for the current tax year.

It is important to review these criteria carefully to ensure eligibility before completing the form.

Filing Deadlines for Form 8801

Form 8801 must be filed in accordance with the IRS deadlines for tax returns. Typically, the deadline for individual tax returns is April 15 of the following year. If you are filing for an extension, ensure that Form 8801 is submitted by the extended deadline. Late submissions can result in penalties and interest on any unpaid taxes.

Form Submission Methods for Form 8801

Taxpayers can submit Form 8801 through various methods:

- Online: Many tax software programs support e-filing of Form 8801, allowing for quicker processing.

- Mail: If filing by mail, ensure the form is sent to the correct IRS address as specified in the instructions.

- In-Person: While less common, some taxpayers may choose to deliver their forms directly to an IRS office.

Choosing the right method can impact processing times and overall convenience.

Key Elements of Form 8801

When filling out Form 8801, it is essential to understand its key components:

- Taxpayer Information: Includes name, address, and Social Security number.

- Prior Year Minimum Tax Paid: Detailed reporting of the alternative minimum tax paid in previous years.

- Current Year Tax Calculation: Information on the current year's tax liability and how the credit applies.

Accurate completion of these elements is crucial for a successful claim.

Quick guide on how to complete about form 8801 credit for prior year minimum taxinstructions for form 8801 2020internal revenue serviceinstructions for form

Manage About Form 8801, Credit For Prior Year Minimum TaxInstructions For Form 8801 Internal Revenue ServiceInstructions For Form 8801 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and efficiently. Handle About Form 8801, Credit For Prior Year Minimum TaxInstructions For Form 8801 Internal Revenue ServiceInstructions For Form 8801 on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

Steps to edit and eSign About Form 8801, Credit For Prior Year Minimum TaxInstructions For Form 8801 Internal Revenue ServiceInstructions For Form 8801 effortlessly

- Locate About Form 8801, Credit For Prior Year Minimum TaxInstructions For Form 8801 Internal Revenue ServiceInstructions For Form 8801 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize specific sections of your documents or redact sensitive information with tools offered by airSlate SignNow designed for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and eSign About Form 8801, Credit For Prior Year Minimum TaxInstructions For Form 8801 Internal Revenue ServiceInstructions For Form 8801 to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8801 credit for prior year minimum taxinstructions for form 8801 2020internal revenue serviceinstructions for form

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to 8801?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents efficiently. The reference to 8801 highlights its capability to meet compliance needs for secure digital signatures, ensuring that important documents are processed swiftly and legally.

-

What pricing options are available for airSlate SignNow 8801?

airSlate SignNow offers multiple pricing tiers to accommodate various business needs regarding 8801 compliance. Whether you're a small startup or a large enterprise, you can find a suitable plan that provides the necessary features without breaking the bank.

-

What features does airSlate SignNow provide to support 8801 compliance?

airSlate SignNow includes features like customizable templates, real-time tracking, and advanced security protocols to ensure 8801 compliance. These features empower businesses to manage their document workflows seamlessly while adhering to legal requirements.

-

How can airSlate SignNow help enhance productivity concerning 8801 processes?

By automating the document signing process with airSlate SignNow, businesses can signNowly reduce turnaround times related to 8801 paperwork. This streamlining allows teams to focus on more critical tasks rather than getting bogged down in manual processes.

-

Are there integrations available with airSlate SignNow for 8801 documentation?

Yes, airSlate SignNow seamlessly integrates with numerous third-party applications to facilitate 8801 documentation management. From CRMs to cloud storage services, these integrations help create a more cohesive workflow for your business.

-

Can airSlate SignNow assist businesses in reducing costs associated with 8801 compliance?

Absolutely! Utilizing airSlate SignNow for your 8801 documentation not only saves on paper and printing costs but also minimizes the time spent managing these documents. This efficiency translates into signNow savings for businesses looking to optimize their operations.

-

What are the benefits of choosing airSlate SignNow for 8801 document handling?

The primary benefits of using airSlate SignNow for 8801 document handling include ease of use, enhanced security, and compliance with industry regulations. This ensures that your signing processes are both efficient and legally sound.

Get more for About Form 8801, Credit For Prior Year Minimum TaxInstructions For Form 8801 Internal Revenue ServiceInstructions For Form 8801

- Flood zone statement and authorization new york form

- Name affidavit of buyer new york form

- Name affidavit of seller new york form

- Non foreign affidavit under irc 1445 new york form

- Owners or sellers affidavit of no liens new york form

- New york affidavit form

- Complex will with credit shelter marital trust for large estates new york form

- Assumed name pdf form

Find out other About Form 8801, Credit For Prior Year Minimum TaxInstructions For Form 8801 Internal Revenue ServiceInstructions For Form 8801

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template