St104 2012

What is the St104

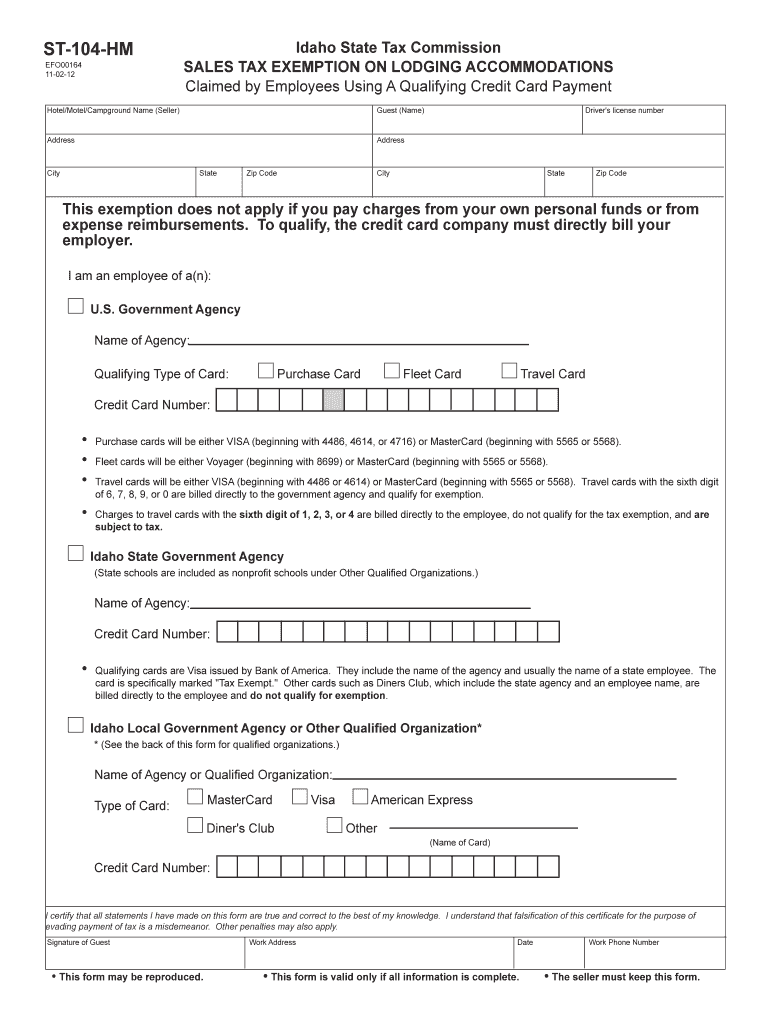

The Idaho ST-104 is a tax exemption form used by businesses and individuals in Idaho to claim sales tax exemptions on certain purchases. This form is particularly relevant for entities that qualify for tax-exempt status, such as non-profit organizations, government agencies, and specific educational institutions. By submitting the ST-104, eligible parties can avoid paying sales tax on qualifying items, which can lead to significant savings.

How to use the St104

To use the Idaho ST-104, individuals or organizations must first ensure they meet the eligibility criteria for tax exemption. Once confirmed, the form should be completed with accurate information regarding the purchaser and the specific items being purchased. It is essential to provide detailed descriptions of the items and the reason for the exemption. After filling out the form, it should be presented to the seller at the time of purchase to validate the tax-exempt status.

Steps to complete the St104

Completing the Idaho ST-104 involves several key steps:

- Gather necessary information, including the purchaser's name, address, and tax identification number.

- Identify the items for which the exemption is being claimed and provide clear descriptions.

- Fill out the form accurately, ensuring all required fields are completed.

- Sign and date the form to certify that the information provided is true and correct.

- Present the completed ST-104 to the seller at the time of purchase.

Legal use of the St104

The Idaho ST-104 is legally recognized under state tax laws for claiming sales tax exemptions. To ensure compliance, it is crucial that the form is used only for eligible purchases and that all information is accurate. Misuse of the ST-104 can lead to penalties, including the obligation to pay the sales tax that was avoided, along with potential fines. Understanding the legal implications of using this form helps maintain compliance with Idaho tax regulations.

Key elements of the St104

Several key elements define the Idaho ST-104, making it a vital document for tax-exempt purchases:

- Purchaser Information: Details about the entity or individual claiming the exemption.

- Seller Information: The name and address of the seller from whom the items are being purchased.

- Description of Items: Clear and specific descriptions of the items eligible for tax exemption.

- Reason for Exemption: A statement explaining why the exemption is being claimed.

- Signature: The signature of the purchaser or an authorized representative to validate the form.

Eligibility Criteria

To qualify for using the Idaho ST-104, purchasers must meet specific eligibility criteria. Typically, this includes being a non-profit organization, a governmental entity, or an educational institution that is exempt from sales tax under Idaho law. It is important for applicants to verify their status and ensure they have the necessary documentation to support their exemption claim. Failure to meet these criteria can result in the denial of the exemption and potential tax liabilities.

Quick guide on how to complete st 104 hm idaho state tax commission tax idaho

Effortlessly Prepare St104 on Any Device

The management of online documents has become increasingly favored by both businesses and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed materials, as it allows you to obtain the correct format and securely store it online. airSlate SignNow equips you with every tool necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage St104 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Step-by-Step: Alter and eSign St104 with Ease

- Find St104 and click on Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with the tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tiring searches for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign St104 to ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st 104 hm idaho state tax commission tax idaho

Create this form in 5 minutes!

How to create an eSignature for the st 104 hm idaho state tax commission tax idaho

How to generate an electronic signature for the St 104 Hm Idaho State Tax Commission Tax Idaho in the online mode

How to make an electronic signature for your St 104 Hm Idaho State Tax Commission Tax Idaho in Chrome

How to generate an electronic signature for signing the St 104 Hm Idaho State Tax Commission Tax Idaho in Gmail

How to make an eSignature for the St 104 Hm Idaho State Tax Commission Tax Idaho right from your smartphone

How to generate an eSignature for the St 104 Hm Idaho State Tax Commission Tax Idaho on iOS

How to make an eSignature for the St 104 Hm Idaho State Tax Commission Tax Idaho on Android OS

People also ask

-

What is the Idaho ST104 and how does it benefit my business?

The Idaho ST104 is a specific form used for tax reporting in the state of Idaho. Using airSlate SignNow, businesses can easily send and eSign the Idaho ST104, ensuring compliance and timely submission. This streamlines the tax filing process, saving you valuable time and reducing errors associated with manual completion.

-

How can I integrate Idaho ST104 into my existing workflow?

Integrating the Idaho ST104 into your workflow with airSlate SignNow is seamless. The platform allows you to upload the form, customize it as needed, and send it for signatures. This integration enhances productivity by eliminating paper-based processes and facilitating faster approvals.

-

What are the pricing options for using airSlate SignNow to handle Idaho ST104?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes looking to manage their Idaho ST104 efficiently. You can choose from various subscription levels based on your needs, and there’s often a free trial available to test the service. This cost-effective solution ensures you only pay for the features you truly need.

-

What key features does airSlate SignNow offer for managing Idaho ST104?

airSlate SignNow provides essential features like eSigning, document templates, and automated reminders, specifically designed to help with Idaho ST104 management. These features accelerate the signing process and improve overall document handling efficiency. Additionally, you can track document status in real-time, ensuring that your Idaho ST104 is processed promptly.

-

Is my data secure when using airSlate SignNow for Idaho ST104?

Yes, airSlate SignNow prioritizes data security, especially when handling sensitive forms like the Idaho ST104. The platform employs encryption and compliance with industry standards to protect your documents. This commitment to security enables you to confidently manage sensitive information without fearing data bsignNowes.

-

Can airSlate SignNow store my completed Idaho ST104 forms?

Absolutely! airSlate SignNow allows you to securely store completed Idaho ST104 forms within the platform. You can easily access these documents whenever needed, providing a centralized location for all your important tax forms. This feature simplifies retrieval and keeps your records organized.

-

How does airSlate SignNow improve the turnaround time for Idaho ST104 submissions?

Using airSlate SignNow signNowly shortens the turnaround time for Idaho ST104 submissions by enabling quick eSigning and document delivery. This eliminates the delays associated with traditional mailing or in-person approvals. Consequently, you can submit the Idaho ST104 faster and ensure tax compliance in a timely manner.

Get more for St104

- Customer identification program quotcipquot disclosure union bank form

- Application of new jersey construction classification premium form

- Resp educational assistance payment withdrawal form owly

- Call audit form

- Longhorn foundation patron membership application ufcu form

- New accounts morgan form

- Morgan stanley durable power of attorney form

- Fill in the blank domicile form

Find out other St104

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney